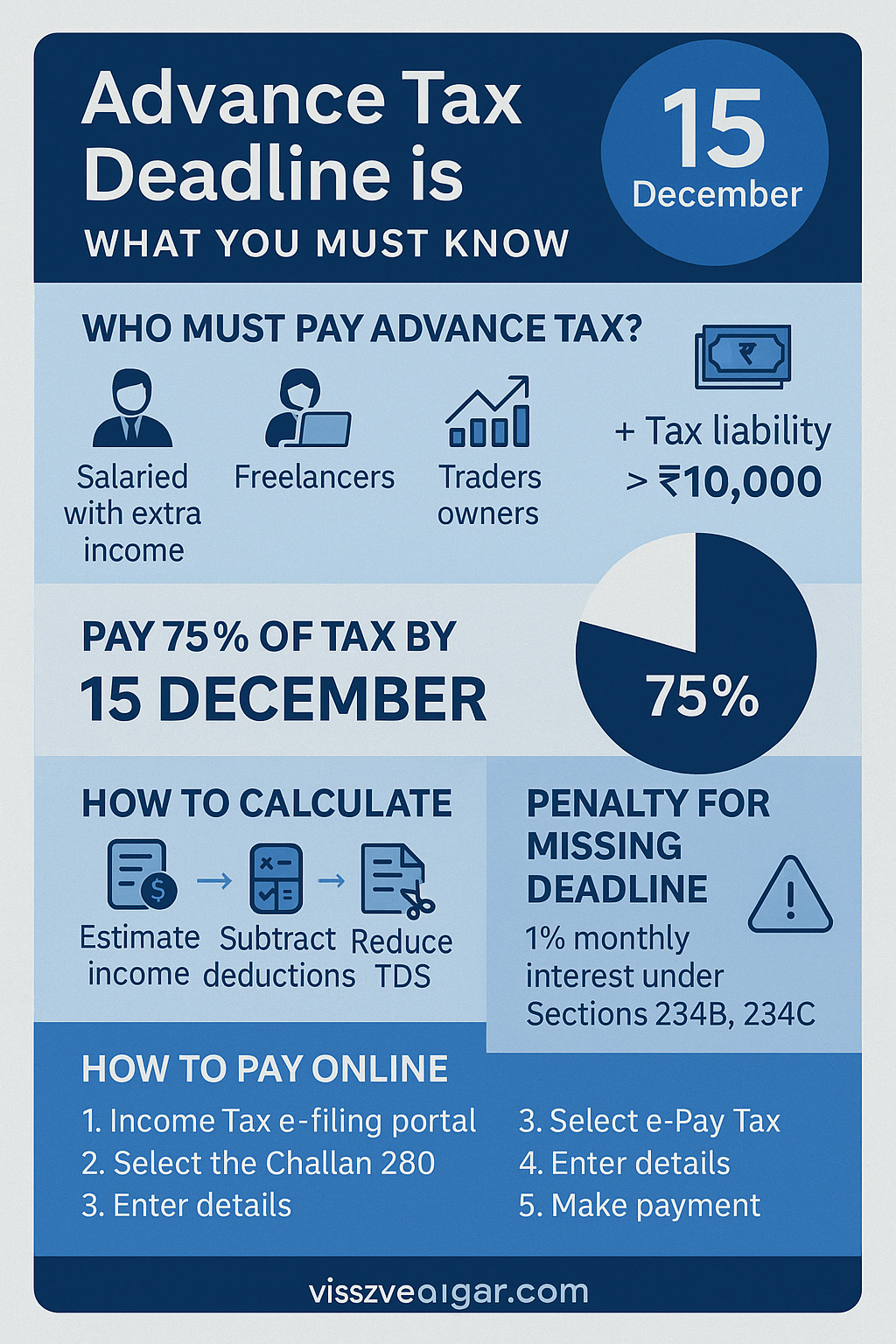

The advance tax deadline of 15 December requires taxpayers to pay 75% of their total advance tax for FY 2025–26. Anyone with tax liability over ₹10,000 (after TDS) must pay advance tax—salaried, freelancers, business owners, and traders. Missing the deadline leads to interest penalties under Sections 234B and 234C.

What Is Advance Tax? (Simple Explanation)

Advance tax is “pay-as-you-earn” income tax.

Instead of paying tax only at the end of the year, you pay it in four instalments.

It applies to all individuals whose estimated tax liability is more than ₹10,000 after TDS.

Advance Tax Due Dates (FY 2025–26)

| Due Date | Percentage of Tax Payable | Remarks |

|---|---|---|

| 15 June | 15% | 1st instalment |

| 15 September | 45% | 2nd instalment cumulative |

| 15 December | 75% | Major instalment |

| 15 March | 100% | Final instalment |

Who Must Pay Advance Tax?

✔ Required for:

Salaried employees with extra income:

Rent, interest, capital gains, freelancing

Freelancers

Small business owners

Shop owners

Consultants

Traders (stock, intraday, F&O, crypto)

Professionals: doctors, lawyers, designers, CA, etc.

❌ Not required for:

Senior citizens (60+) with no business income

Individuals whose tax liability after TDS is less than ₹10,000

How to Calculate Advance Tax (Step-by-Step)

Step 1: Estimate total income

Include:

Salary

Rent

Interest

Freelance income

Trading profit

Capital gains

Business income

Step 2: Subtract deductions (80C, 80D, HRA, etc.)

Step 3: Calculate total tax payable

Step 4: Subtract TDS already deducted

Step 5: If tax > ₹10,000 → You must pay advance tax

Step 6: Pay 75% of that amount by 15 December

Example: Advance Tax Calculation

Suppose:

Total estimated income = ₹12,00,000

Tax payable = ₹1,48,200

TDS deducted = ₹75,000

Tax left to pay = ₹73,200

By 15 December, you must have paid:

75% of ₹73,200 = ₹54,900

If you paid less earlier, pay the difference now.

Penalties for Missing 15 December Deadline

Missing advance tax instalments leads to:

Section 234C – Interest for Late Payment of Instalments

Interest = 1% per month on shortfall.

Section 234B – Interest for Not Paying 90% Total Tax by March

If you don’t pay 90%+ of final tax by 15 March → 1% monthly interest until paid.

How to Pay Advance Tax Online (Step-by-Step Guide)

Visit: https://eportal.incometax.gov.in

Login → “e-Pay Tax”

Select “Pay Tax”

Choose Challan 280 (Income Tax – Regular Assessment)

Select Advance Tax

Enter amount

Pay via UPI / Net banking / Debit card

Download challan receipt

Keep this for ITR filing.

What Happens If You Overpay?

Overpaid amount is:

Adjusted during ITR filing

Refunded by Income Tax Department (with interest in some cases)

Special Cases: Advance Tax Rules

1. Capital Gains & Advance Tax

Gains from:

Stocks

Mutual funds

Property

Crypto

Pay advance tax in the same quarter when gain occurs.

2. Intraday & F&O Traders

Trading income is business income → Advance tax mandatory.

3. Salaried Employees with Side Income

Even salaried people must pay if:

Rent income

Freelancing

Consulting

Trading income

push tax liability above ₹10,000.

Internal & External Linking Suggestions

Internal Links:

Credit utilization impact on loan approval

Best money habits for 2026

How to file income tax return correctly

External Links:

Income Tax Portal

CBDT Advance Tax Guidelines

Section 234B & 234C documentation

Key Takeaways

Advance tax is mandatory if tax liability > ₹10,000.

15 December is the most important instalment → 75% of tax must be paid.

Missing deadlines results in 1% monthly penalty.

Salaried people with extra income must also pay advance tax.

Paying on time helps avoid large penalties during ITR season.

FAQs

1. Who needs to pay advance tax by 15 December?

Anyone with tax liability > ₹10,000 after TDS.

2. How much do I need to pay on 15 December?

75% of total advance tax.

3. Is advance tax only for business owners?

No—salaried with extra income must also pay.

4. What if I miss the deadline?

Interest under Sections 234B & 234C.

5. Can I pay advance tax through UPI?

Yes.

6. Does capital gains require advance tax?

Yes—pay in the same quarter.

7. Are senior citizens exempt?

Yes, if they have no business income.

8. Is advance tax compulsory for freelancers?

Yes.

9. Does TDS reduce advance tax?

Yes—subtract TDS first.

10. Can I revise advance tax calculations?

Yes—pay the difference in the next instalment.

11. What if I overpay?

You get a refund.

12. Is interest charged daily?

Monthly at 1%.

13. Should traders pay advance tax?

Yes—F&O and intraday earnings are taxable quarterly.

14. Can I pay advance tax on mobile?

Yes via the Income Tax portal.

15. What documents are needed?

None—just PAN and login.

Conclusion

The 15 December advance tax deadline is crucial for avoiding penalties and keeping your tax obligations on track. If your tax liability after TDS is above ₹10,000, paying advance tax is not optional—it’s mandatory.

If you need funds for tax payments, emergencies, or smart planning,

Vizzve Financial offers quick personal loans, easy approval, and low documentation.

👉 Apply now at www.vizzve.com

Published on : 2nd December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed