CIBIL scores have always been a major factor in loan approvals. But 2026 brings new benchmark ranges, stricter scoring checks, and updated credit evaluation methods. Digital lenders and banks are now using deeper analytics, making credit discipline more important than ever.

This guide breaks down the new CIBIL score requirements for 2026, what each score range means, how it affects your loan approval chances, and how you can improve your score quickly.

⚡ AI Answer Box (Quick Summary)

Q: What is the new CIBIL score requirement for loans in 2026?

Most lenders prefer 700+ for instant approval. Scores between 650–699 may require more checks. Scores below 649 face strict scrutiny and may get lower loan amounts or higher interest rates. Digital lenders use additional behavioral and income analytics alongside CIBIL.

New CIBIL Score Requirements for 2026

CIBIL has not “changed” the scoring scale (300–900), but lender expectations and approval thresholds have become stricter due to rising unsecured loans and risk controls.

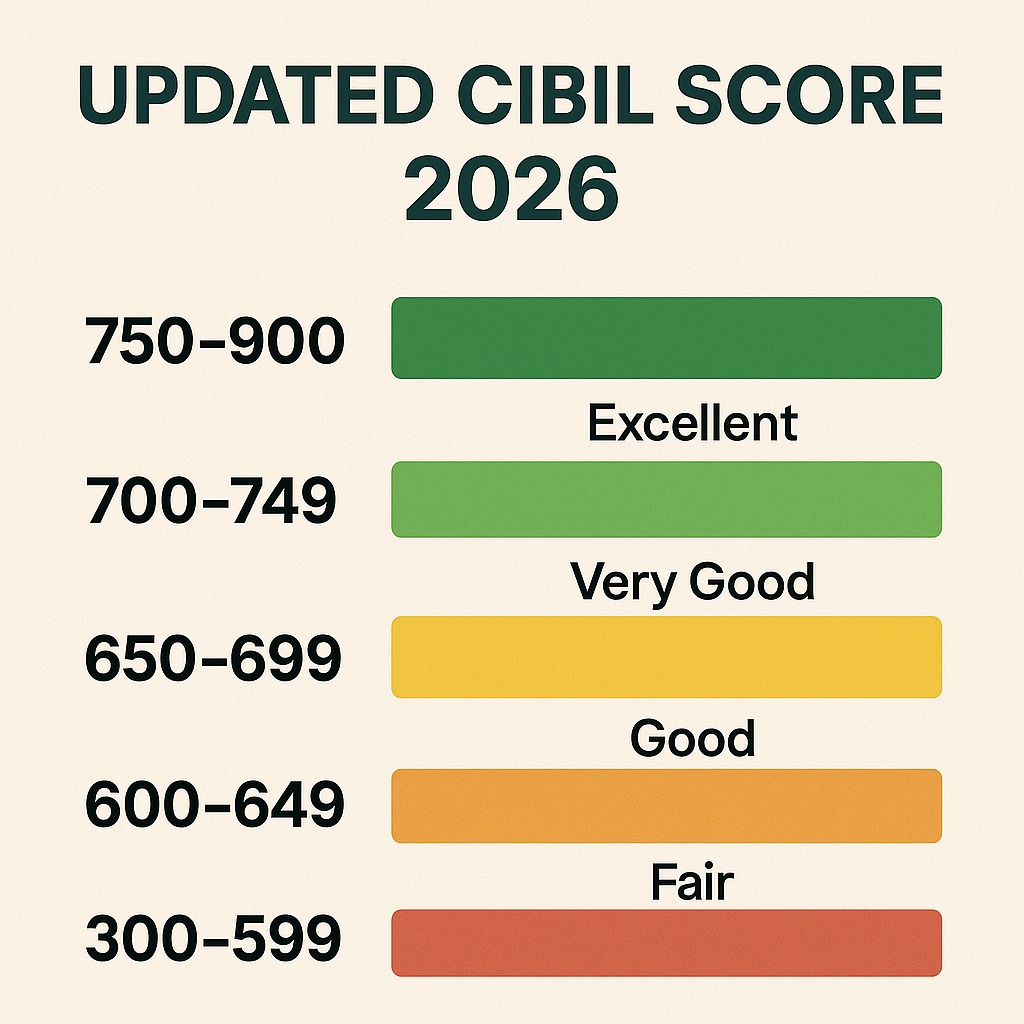

Here’s the updated 2026 breakdown:

1. Score 750–900 — Excellent (High Eligibility)

Approval Chance: Very High

Interest Rate: Lowest

Loan Amount: Highest

Processing Speed: Instant to same day

Borrowers in this range get:

Best loan offers

Highest credit limit

Pre-approved offers

Faster processing

2. Score 700–749 — Good (Safe Zone)

Approval Chance: High

Interest Rate: Competitive

Loan Amount: Moderate to High

This is the minimum preferred score for:

Personal loans

Home loans

Car loans

Credit cards

Most digital lenders consider 700+ as the ideal threshold in 2026.

3.Score 650–699 — Fair (Conditional Approval)

Approval Chance: Medium

Interest Rate: Slightly High

Loan Amount: Limited

Borrowers may need:

Additional income proof

Stable employment history

Low EMI-to-income ratio

Some lenders may offer loans but with tighter conditions.

4. Score 600–649 — Weak (High Risk Zone)

Approval Chance: Low

Interest Rate: High

Loan Amount: Very Limited

Lenders will check:

Salary stability

Existing EMIs

Bank statement health

Late payments history

Approval possible but not guaranteed.

5. Score Below 600 — Very Poor (Rejection Zone)

Approval Chance: Very Low

Interest Rate: Highest

Loan Amount: Mostly Denied

Borrowers must improve score before applying.

2026 Credit Evaluation: Beyond Just CIBIL

Lenders now use multi-layered scoring systems:

✔ Bank statement analysis

Salary inflow, spending pattern, EMI behavior.

✔ Employment stability

Minimum 6–12 months preferred.

✔ UPI & digital payment history

Shows spending consistency.

✔ Income-to-EMI ratio

Should ideally be below 40–50%.

✔ Behavioral analytics

Device behavior, repayment patterns, cash withdrawals, etc.

✔ Alternative data scoring

Especially useful for new-to-credit borrowers.

Conclusion:

In 2026, even if your CIBIL is average, a strong financial profile can still get you a loan.

Comparison Table — Old vs New CIBIL Requirements

| Year | Ideal Score | Minimum Score for Approval | Risk Check Level |

|---|---|---|---|

| 2024 | 700+ | 650+ | Moderate |

| 2025 | 720+ | 660+ | High |

| 2026 | 750+ | 700+ | Very High |

How Your CIBIL Score Impacts Loan Approval in 2026

High Score = Low Risk

Lenders reward borrowers with good discipline.

Low Score = Extra Scrutiny

Banks and NBFCs use tighter risk filters.

Income Stability Helps

Even with moderate CIBIL, high income boosts approval chances.

Multiple Recent Loan Applications Hurt Score

Avoid applying everywhere.

Quick Tips to Improve CIBIL Score in 2026

✔ Pay EMIs & credit card bills on time

The biggest factor in credit score.

✔ Keep credit card utilization below 40%

Shows responsible spending.

✔ Avoid multiple loan applications

Protects your score from hard inquiries.

✔ Maintain older credit accounts

Longer credit history = higher score.

✔ Check your credit report for errors

Dispute wrong entries.

✔ Keep EMI-to-income ratio low

Avoid taking too many loans at once.

Score vs Approval Likelihood Chart (2026)

| CIBIL Score | Approval Chance | Interest Rate | Loan Amount |

|---|---|---|---|

| 800–900 | Very High | Lowest | High |

| 750–799 | High | Low | High |

| 700–749 | Good | Moderate | Medium |

| 650–699 | Fair | High | Limited |

| 600–649 | Low | Very High | Very Limited |

| <600 | Very Low | Highest | Denied |

Key Takeaways

750+ is the new benchmark for best loan offers in 2026.

Scores below 699 face deeper scrutiny and often limited eligibility.

Income, bank behavior, and stability now matter as much as CIBIL.

Improving score is easier with disciplined payments and low credit usage.

Borrow responsibly to maintain long-term credit health.

Expert Commentary

“CIBIL score expectations in 2026 are significantly higher due to rising unsecured lending. Borrowers must maintain disciplined financial behavior to access the best loan terms.”

— Senior Credit Risk Analyst

Frequently Asked Questions (FAQs)

1. What is the ideal CIBIL score for 2026?

A score of 750+ is ideal for best loan offers.

2. Is 700 enough for loan approval in 2026?

Yes, but interest may be slightly higher.

3. Can I get a loan with CIBIL below 650?

Possible, but with strict terms and higher interest.

4. Does salary matter if CIBIL is low?

Yes, high income may still help with approval.

5. How long does it take to improve CIBIL?

Normally 3–6 months with disciplined repayment.

6. Do digital lenders have different CIBIL rules?

They use additional behavioral and income analysis.

7. Does checking your score reduce CIBIL?

No — soft inquiries do not affect score.

8. Will missing one EMI reduce my CIBIL?

Yes — even one missed payment can affect it.

9. Does closing old credit cards reduce score?

Yes — reduces credit history length.

10. Can new borrowers get loans without CIBIL?

Yes — through alternative scoring models.

Vizzve Financial — Smart Loans for Strong CIBIL Profiles

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process. Apply at www.vizzve.com.

Published on : 28th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed