India’s financial sector offers a wide variety of loans to meet different needs—from buying a home to funding education or managing emergencies. Choosing the right loan depends on your requirement, repayment capacity, and eligibility.

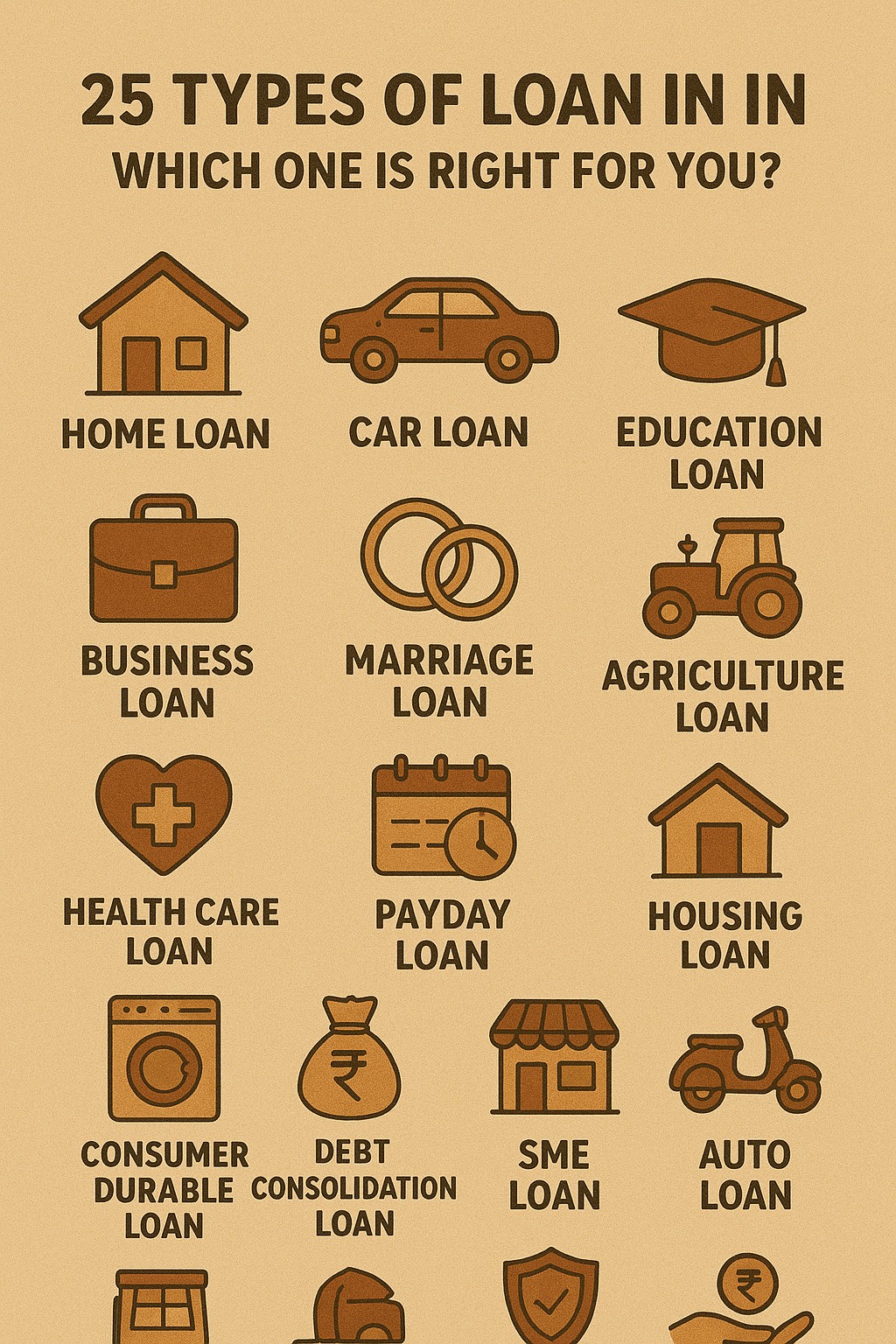

Here’s a detailed guide to 25 types of loans available in India and how they work.

🏠 1. Home Loan

For buying or constructing a house.

Long tenure, low interest rates.

🚗 2. Car Loan

Financing purchase of new/used vehicles.

🎓 3. Education Loan

For higher studies in India or abroad.

Secured and unsecured options available.

💳 4. Personal Loan

No collateral, multipurpose loan for urgent needs.

💍 5. Gold Loan

Loan against pledged gold ornaments.

Quick disbursal, higher LTV when gold prices rise.

🧓 6. Pension Loan

Offered to retired individuals against monthly pension.

📈 7. Business Loan

For expanding business, working capital, or equipment purchase.

🛠️ 8. MSME Loan

Special loans for small and medium enterprises.

📊 9. Loan Against Property (LAP)

Secured loan by pledging residential/commercial property.

📱 10. Digital/Instant Loan

App-based loans with quick approval.

🏢 11. Commercial Vehicle Loan

For purchasing trucks, buses, and commercial vehicles.

⚡ 12. Top-Up Loan

Extra loan amount on an existing home loan.

🏦 13. Balance Transfer Loan

Shifting loan to another lender for lower rates.

🧾 14. Consumer Durable Loan

For buying electronics, furniture, and appliances.

💡 15. Two-Wheeler Loan

For purchasing bikes and scooters.

🌾 16. Agricultural Loan

For farmers to buy seeds, fertilizers, and machinery.

🌍 17. NRI Loan

Designed for Non-Resident Indians for property or personal needs.

👨👩👧 18. Family Loan (Co-operative)

Loans offered by co-operative societies to members.

🏥 19. Medical Loan

For meeting urgent healthcare expenses.

👩💼 20. Working Capital Loan

Helps businesses manage short-term operational expenses.

🔄 21. Overdraft Facility

Flexible borrowing linked to savings/current accounts.

📃 22. Loan Against Fixed Deposit (FD)

Borrow money by pledging fixed deposits without breaking them.

🪙 23. Loan Against Mutual Funds/Shares

Raise funds against your investments.

🏘️ 24. Home Improvement Loan

For renovation, repairs, or interior work.

✈️ 25. Travel Loan

Finance your domestic or international holidays.

How to Choose the Right Loan?

Identify Your Need: Emergency, education, housing, or business.

Check Collateral Requirement: Secured vs. unsecured.

Compare Interest Rates: Choose the lowest rate for your credit profile.

Understand Repayment Capacity: Avoid over-borrowing.

Consider Processing Speed: Some loans take longer to approve.

FAQs

Q1: Which loan is best for emergencies?

Personal loans, gold loans, and digital loans are best for quick cash needs.

Q2: Which loan has the lowest interest rates?

Home loans and education loans usually have the lowest rates.

Q3: Can I take multiple loans at the same time?

Yes, but approval depends on your repayment capacity and credit score.

Q4: Which loans are tax-deductible?

Home loan (principal + interest) and education loan (interest) offer tax benefits.

Q5: Are instant loan apps safe?

Only borrow from RBI-registered NBFC-backed apps to avoid scams.

Published on : 2nd September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share