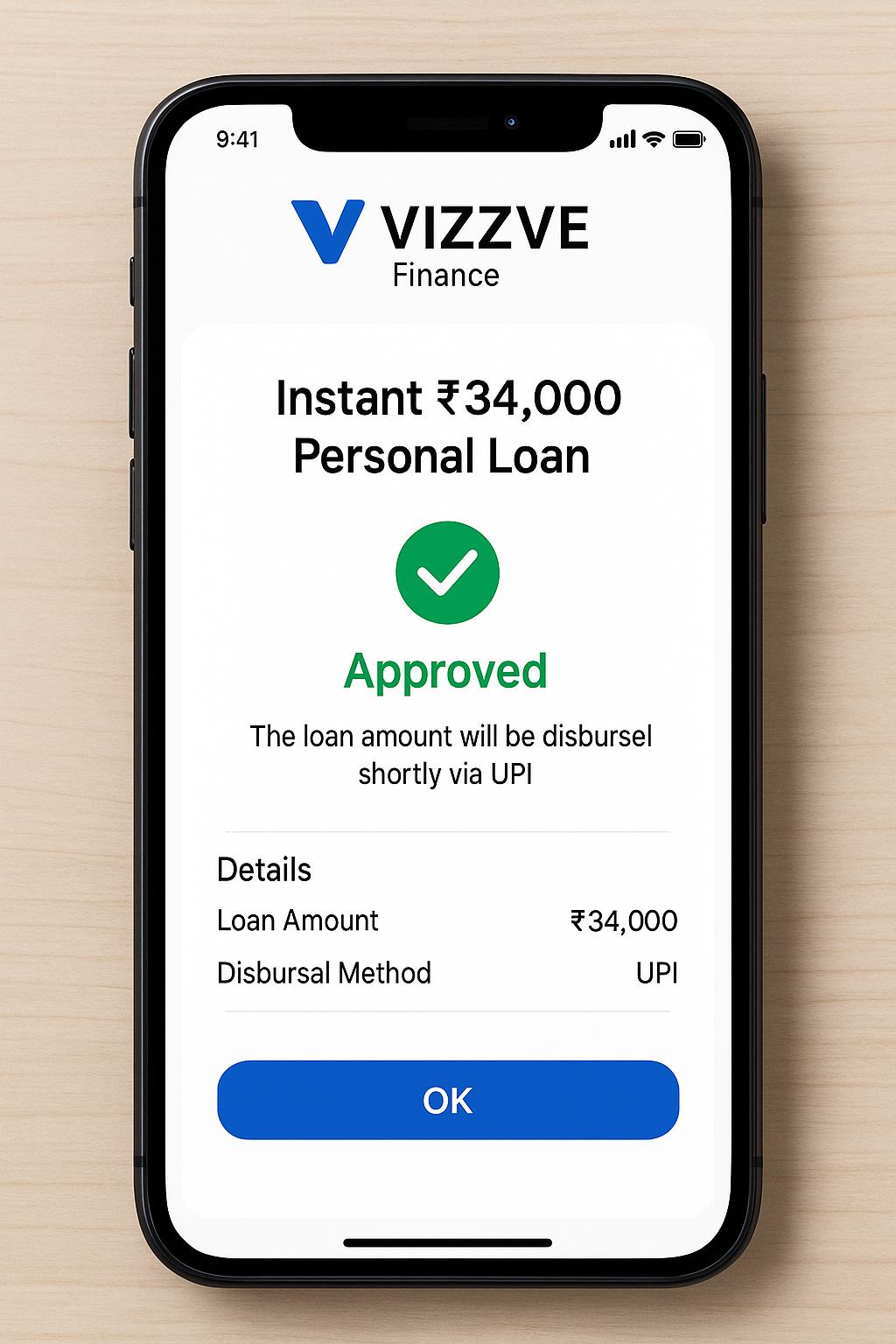

Apply for Instant ₹34,000 Personal Loan Online – Quick Approval on Vizzve App

Are you facing a sudden financial crunch and need ₹34,000 instantly? The Vizzve App offers a smart and hassle-free solution with instant personal loans. Whether it’s a medical emergency, education fees, travel bookings, or urgent home repairs – Vizzve ensures that your loan is processed within minutes and disbursed directly to your UPI-linked bank account.

With a simple digital application, no hidden charges, and minimal paperwork, Vizzve makes borrowing easier for salaried individuals, gig workers, and self-employed professionals. The best part? You don’t need to visit a bank or fill out long forms. Just download the app, complete the KYC, choose your loan amount (like ₹34,000), and get instant approval.

Why Choose Vizzve for Your ₹34,000 Instant Loan?

100% digital application process

Fast approvals within minutes

Direct UPI disbursal to your bank account

PAN & Aadhaar-based e-KYC

Transparent terms and flexible EMIs

Steps to Apply for ₹34,000 Personal Loan on Vizzve Finance

1. Download the App

Get the Vizzve Microseva app from Google Play Store.

2. Complete KYC

Upload Aadhaar, PAN, and a selfie.

3. Select ₹34,000 as Loan Amount

Choose your loan amount and EMI tenure.

4. Get Instant Approval

Loan processed within minutes after document verification.

5. Receive Funds via UPI

Money is transferred directly to your bank account using UPI.

FAQs:

Q1: How do I apply for an instant ₹34,000 personal loan via Vizzve?

A: Simply download the Vizzve app, complete your digital KYC using PAN and Aadhaar, select ₹34,000 as your loan amount, and submit. You’ll get approval within minutes.

Q2: Who is eligible for the ₹34,000 loan?

A: Salaried employees, freelancers, and self-employed individuals aged 21–58 years with a stable income source are eligible.

Q3: How quickly will I receive the ₹34,000 after approval?

A: Disbursal is done instantly to your UPI-linked bank account, typically within a few minutes after approval.

Q4: Is the Vizzve loan safe and regulated?

A: Yes, Vizzve operates under RBI-compliant NBFC partners and follows strict data privacy protocols.

Q5: What documents are required?

A: You only need your Aadhaar, PAN, and a selfie. No physical documents required.

Published on 16th june

publisher : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram