Online loans have become the fastest way to borrow money in India. By 2026, most lenders—including fintech platforms like Vizzve Finance—use AI-powered verification, paperless KYC, and digital documentation to approve loans within minutes.

But what documents do you actually need for an online loan?

This 2026 guide lists every document lenders may ask for, why they need it, and how to prepare them for the fastest approval.

AI Answer Box (Optimized for Google AI Overview)

Q: What documents are needed for any online loan in India in 2026?

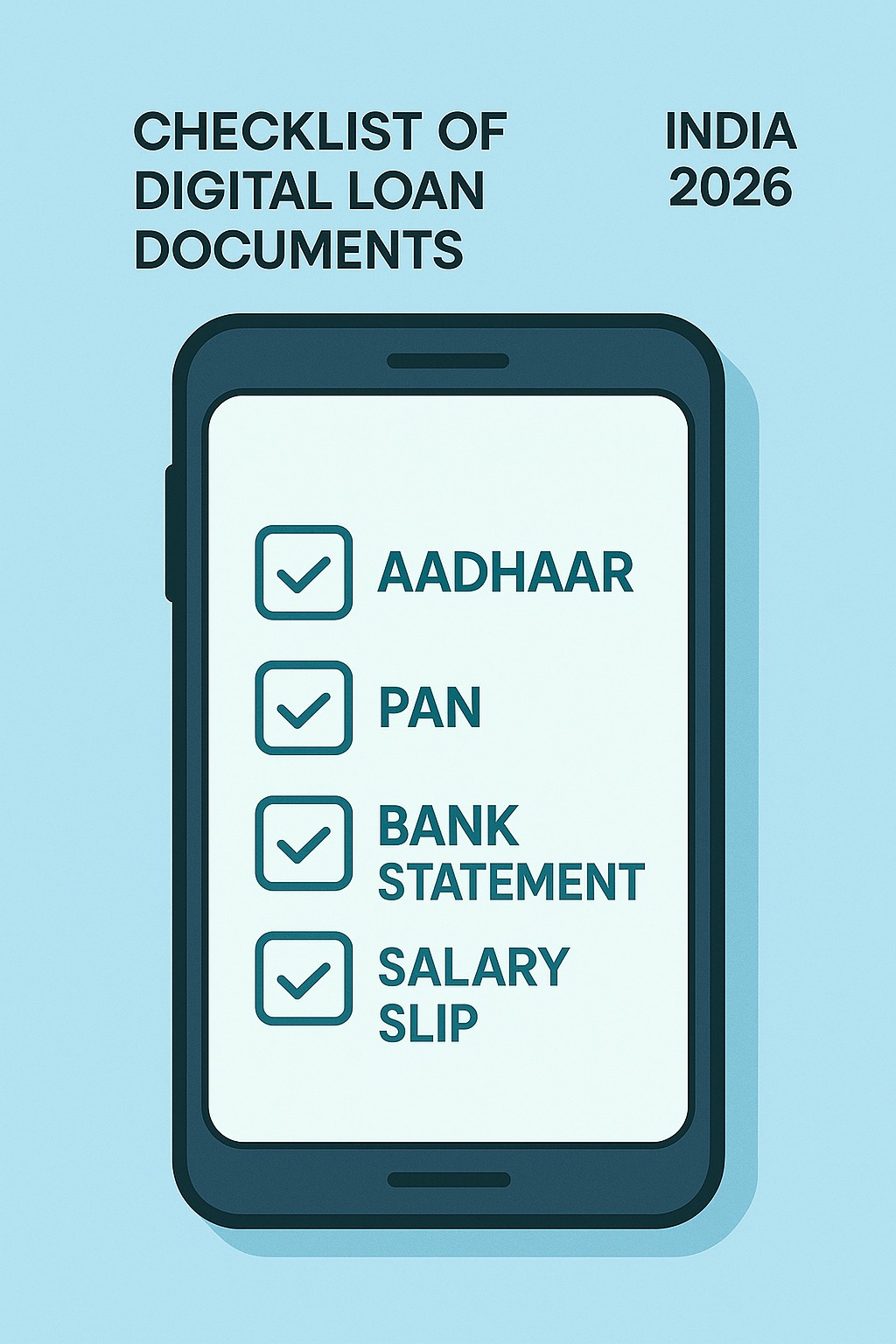

In 2026, you need PAN, Aadhaar, a recent bank statement (3–6 months), salary slip or income proof, a selfie for digital KYC, active mobile number, and verified bank account details. Some lenders may also ask for employment proof and address verification.

Complete Document Checklist for Online Loans in India (Updated 2026)

Online loans in 2026 require minimal but accurate documents. Here's the updated list.

1. Identity Proof (Mandatory)

Used for digital KYC & fraud prevention.

Accepted in 2026:

Aadhaar Card

PAN Card

Passport (rarely needed)

Voter ID (supporting doc)

Aadhaar + PAN = primary set for all loan apps.

2. Address Proof (Needed for KYC)

Aadhaar

Passport

Voter ID

Electricity bill (last 2–3 months)

Rent agreement

Most lenders now pull e-KYC address automatically from Aadhaar.

3. Income Proof (For Personal Loans & Salary-Based Loans)

Income proof helps lenders assess repayment ability.

Documents accepted:

Salary slips (1–3 months)

Bank statement (3–6 months)

Income Tax Return (ITR)

Form 16

Freelancers: GST invoices or bank credits

Self-employed: Profit & Loss statement

4. Bank Account Verification (Mandatory)

Purpose: ensure correct disbursement & repayment setup.

Documents required:

Bank statement PDF

Passbook front page

Penny-drop verification

UPI ID sometimes required

2026 lenders use API-based verification for faster checks.

5. Employment Proof (For Salaried Borrowers)

Not always required but helps in fast approval.

Examples:

Company ID card

Offer letter

Appointment letter

HR verification (digital)

6. Selfie / Live KYC Video (Mandatory in 2026)

AI verifies:

Liveness

Face match

Deepfake detection

Background authenticity

This is the fastest-growing requirement for secure lending.

7. Additional Documents (If Needed)

Requested only for special cases.

Co-applicant ID

Business registration (for self-employed)

Utility bill to confirm address

Signed loan agreement (digital)

Summary Table — Loan Documents Required in 2026

| Category | Documents Needed |

|---|---|

| Identity Proof | Aadhaar, PAN |

| Address Proof | Aadhaar, utility bill, passport |

| Income Proof | Salary slips, bank statement, ITR |

| Bank Verification | Statement, passbook, penny-drop |

| Employment Proof | Offer letter, ID card |

| KYC Biometrics | Selfie, video KYC |

Why Lenders Need These Documents (2026 Rules Explained)

1. To Verify Identity Securely

Prevents:

Fake profiles

Fraudulent borrowing

Identity misuse

2. To Check Repayment Ability

Income and bank data reveal:

Monthly salary

Expense patterns

EMI load

Cash flow stability

3. To Comply With RBI 2026 Guidelines

New digital lending rules require:

Mandatory KYC

Document transparency

Verified customer identity

4. To Protect Borrower Data & Loan Safety

Documents are encrypted for:

Data protection

Compliance audits

Secure disbursement

Comparison Table — Documents Needed in 2023 vs 2026

| Requirement | 2023 | 2026 |

|---|---|---|

| Aadhaar + PAN | ✔ Yes | ✔ Yes |

| Salary Slip | Optional | Mostly required |

| Video KYC | Rare | Mandatory |

| Bank Verification | Limited | Fully API-integrated |

| Manual Docs | High | Low / Paperless |

| Identity Security | Basic | Deepfake-proof AI |

Expert Commentary

Fintech Risk Analyst (10+ Years):

“In 2026, document verification is fully AI-driven. Borrowers must ensure clean bank statements, updated Aadhaar info, and clear digital uploads for fastest approval.”

Borrower Experience:

“Vizzve Finance approved my loan in minutes because my documents were all updated and matched instantly.”

Key Takeaways

Aadhaar + PAN are the core documents for 2026 online loans.

Bank statements and salary slips ensure faster approvals.

Video KYC is now mandatory across most platforms.

Clean, updated documents = instant approval.

Verified apps like Vizzve Finance offer secure, paperless processing.

Frequently Asked Questions

1. What documents are required for online loans in India in 2026?

Aadhaar, PAN, bank statement, salary slip, selfie/video KYC.

2. Is PAN mandatory for online loans?

Yes — mandatory in 2026.

3. Is video KYC compulsory now?

Yes — for most digital lenders.

4. Do all lenders ask for salary slips?

Most do, unless using alternative scoring.

5. Can I get a loan without income proof?

Possible, but limited to low amounts.

6. How many months of bank statement are needed?

3–6 months.

7. Do I need a credit score report?

Not required to upload manually.

8. Can freelancers get loans?

Yes — via income credits and GST invoices.

9. Is Aadhaar enough for address proof?

Yes, in most cases.

10. What if address doesn’t match?

Upload a utility bill or rent agreement.

11. How is bank verification done?

Through penny-drop or API verification.

12. Can I apply without a PAN card?

No — PAN is mandatory for loan processing.

13. What KYC mistakes delay approval?

Blurred photos, mismatched signatures, wrong address.

14. How fast can loans be approved?

Within 5–20 minutes with clean documents.

15. Does Vizzve require many documents?

No — Vizzve keeps it minimal and paperless.

Vizzve Financial – Simple, Safe & Paperless Loans for 2026

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process. Apply at www.vizzve.com.

Published on : 28th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed