🏦 Axis Bank: A Brief History

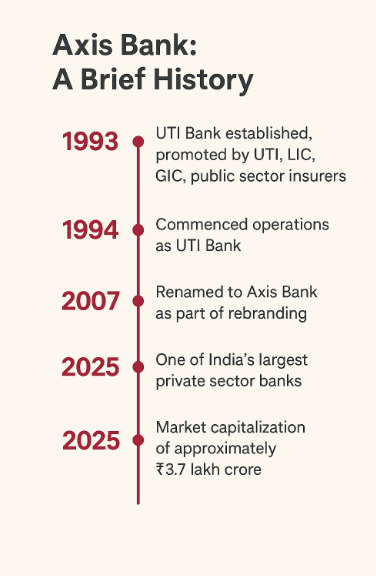

Axis Bank, originally known as UTI Bank, was established in 1993 and started its operations in 1994. It was promoted jointly by Unit Trust of India (UTI), Life Insurance Corporation of India (LIC), General Insurance Corporation (GIC), and four public sector insurance companies.

In 2007, UTI Bank was officially renamed to Axis Bank as part of a rebranding strategy to differentiate itself and expand internationally.

Over the years, Axis Bank has emerged as one of India's largest private sector banks, offering a comprehensive range of financial products and services to retail, MSME, and corporate customers.

💰 Net Worth of Axis Bank (2025)

As of March 2025, Axis Bank’s market capitalization is estimated at ₹3.7 lakh crore (approx).

Key Financials (FY 2024-25):

-

Revenue: ₹1.22 lakh crore

-

Net Profit: ₹22,000+ crore

-

Assets Under Management (AUM): Over ₹12 lakh crore

-

Branches: 5,000+ across India

-

Employees: Over 95,000

Axis Bank has grown both organically and through acquisitions, including the acquisition of Citibank India’s retail business, which significantly boosted its customer base.

💼 Types of Loans Offered by Axis Bank

Axis Bank provides a wide range of loan products tailored to different segments:

-

Personal Loans

-

Instant approvals

-

Loan amount up to ₹40 lakh

-

Tenure: Up to 60 months

-

Competitive interest rates

-

-

Home Loans

-

Up to ₹5 crore based on eligibility

-

Flexible tenure up to 30 years

-

Balance transfer facility

-

-

Car Loans

-

Finance for new and used cars

-

Up to 100% on-road funding

-

Quick approvals

-

-

Education Loans

-

For higher education in India and abroad

-

Moratorium period available

-

Covers tuition, travel, and accommodation

-

-

Business Loans / MSME Loans

-

Working capital finance

-

Machinery loans

-

Collateral-free options available

-

-

Gold Loans

-

Loan against gold ornaments

-

Quick disbursement

-

Low interest rate options

-

⚠️ Issues Faced by Axis Bank

Like any large financial institution, Axis Bank has also experienced several challenges:

-

NPAs (Non-Performing Assets):

-

Faced a rise in bad loans during the 2016–2019 period.

-

Took significant write-offs due to stressed corporate accounts.

-

-

Leadership Changes:

-

In 2018, MD & CEO Shikha Sharma stepped down amid regulatory concerns.

-

Amitabh Chaudhry took over and brought reforms.

-

-

Competition:

-

Strong competition from HDFC Bank, ICICI Bank, and new-age digital banks.

-

-

Data Breach Incidents:

-

Faced phishing and cyber fraud cases affecting customer trust temporarily.

-

📈 Current Situation (2025)

Axis Bank has rebounded strongly from past setbacks:

-

Focused heavily on digital transformation and customer experience.

-

Strong loan book growth, especially in retail and MSME segments.

-

Diversified portfolio with low credit risk.

-

Recognized for sustainable banking practices and ESG initiatives.

-

Expansion into semi-urban and rural areas for greater financial inclusion.

Axis Bank is currently among the top 3 private sector banks in India, known for its innovation, customer-centric approach, and robust infrastructure.

🔐 Cybersecurity and Fraud Incidents

In a notable case from late 2023, a customer lost approximately ₹41 lakh after fraudsters managed to change her registered contact details and break her fixed deposits. The incident raised concerns about the bank's fraud monitoring systems and the responsiveness of its relationship managers. ETBFSI.com

💸 Unauthorized Deductions and Charges

Numerous customers have reported unexpected deductions from their accounts, including:fintech-start-up.com

-

Non-maintenance of minimum balance fees, even when balances were maintained.fintech-start-up.com+1Live Law+1

-

SMS and service charges applied without prior notification.fintech-start-up.com

-

Duplicate charges for services like ATM withdrawals.fintech-start-up.com

-

Deductions for insurance policies not opted for by the customers. fintech-start-up.com

🏦 Service Delays and Deficiencies

In 2023, the Panipat District Consumer Disputes Redressal Commission held Axis Bank liable for delaying the release of a fixed deposit after its maturity date, highlighting service deficiencies. Live Law

📉 High Volume of Customer Complaints

Axis Bank has faced a significant number of customer complaints, with over 12,000 reported on consumer forums. Issues range from unauthorized deductions to poor customer service and unresolved grievances. Consumer Complaintsfintech-start-up.com

👥 Employee Attrition and Its Impact

The bank experienced a high attrition rate, with over a third of its staff leaving in FY2023. Such turnover can disrupt customer service continuity and affect overall satisfaction. The Wire

📊 Complaint Resolution Rates

On platforms like ComplaintsBoard, Axis Bank has a resolution rate of approximately 14%, indicating a need for improved responsiveness to customer issues. Complaints Board

🤝 Need Instant Loan Help? Try Vizzve Financial!

While Axis Bank is a trusted name in the financial industry, sometimes bank processes can be lengthy or eligibility may be an issue. That’s where Vizzve Financial comes in!

Why Choose Vizzve?

Get personal loans up to ₹10 Lakhs

No income proof? No worries! We specialize in flexible eligibility

Same-day approval & disbursement

100% paperless, fast and secure process

Friendly support and guidance throughout your loan journey

✅ Apply online now at www.vizzve.com

✍️ Conclusion

Axis Bank has played a pivotal role in shaping India’s banking ecosystem over the past three decades. With its expansive services, innovation-driven approach, and growing net worth, it remains a solid choice for financial needs. But if you're looking for a faster, easier, and more flexible alternative for personal loans, Vizzve Financial is your trusted partner.