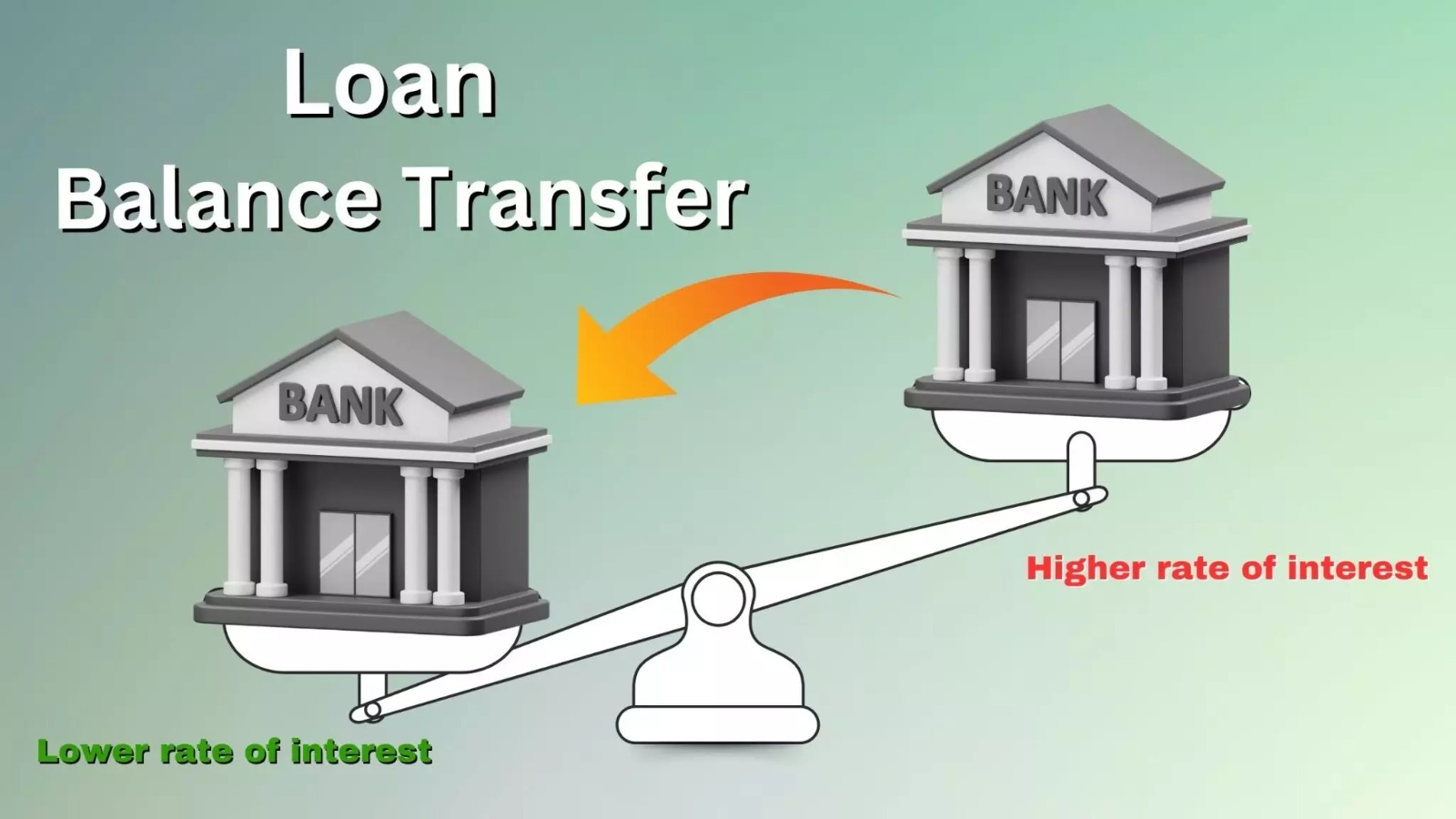

If you’re stuck with a high-interest loan, you may have come across the option of a balance transfer loan. It allows you to transfer your outstanding loan balance to another lender offering a lower interest rate or better repayment terms.

But is it always a smart move? Let’s explore when a balance transfer actually makes sense—and when it doesn’t.

What is a Balance Transfer Loan?

A balance transfer loan is when you shift your existing loan (home, car, or personal loan) from one lender to another to enjoy reduced interest rates, lower EMIs, or additional benefits.

When Does a Balance Transfer Loan Make Sense?

✅ 1. When Interest Rate Difference is Significant

If your current lender charges 12% interest and another lender offers 9%, transferring can save you thousands over the tenure.

✅ 2. When You Have a Long Tenure Left

The longer your repayment period, the more you save by lowering interest costs. If you’re near the end of the loan, the benefit may be minimal.

✅ 3. When You Want to Lower EMIs

Switching can reduce your monthly repayment burden, freeing up cash for savings or investments.

✅ 4. When You Want Better Features

Some lenders offer top-up loans, flexible prepayment options, or zero hidden charges with balance transfers.

✅ 5. When Your Credit Score Has Improved

If your financial profile is stronger now, you may qualify for better terms than when you took the original loan.

When Does a Balance Transfer Loan NOT Make Sense?

❌ If the processing fees, transfer charges, or hidden costs outweigh your savings.

❌ If you’re close to completing the loan—savings will be negligible.

❌ If the new lender doesn’t offer significantly better terms.

Benefits of Balance Transfer Loans

Lower interest rate → lower overall cost.

Reduced EMI → improved monthly cash flow.

Possibility of top-up loan for extra funds.

Better customer service and repayment flexibility.

Risks and Considerations

High processing and transfer fees.

Longer tenure might lower EMIs but increase total interest paid.

Frequent transfers can affect your credit score.

Always read the fine print before signing.

Conclusion

A balance transfer loan can be a powerful tool to save money and ease repayment—but only if used wisely. It makes sense when there’s a big interest rate difference, plenty of tenure left, or better features with the new lender. Always calculate net savings after fees before making the switch.

FAQs

Q1: Can I transfer my loan anytime?

Yes, but it’s best done in the early or mid-tenure when interest payments are highest.

Q2: Does balance transfer affect my credit score?

A new loan application may cause a minor dip, but consistent repayments will improve your score.

Q3: What types of loans can be transferred?

Home loans, car loans, and personal loans are most commonly transferred.

Q4: Are there hidden charges in balance transfers?

Yes, watch for processing fees, legal charges, and foreclosure penalties.

Q5: Is it better to negotiate with my current lender instead?

Sometimes yes—if you have a good repayment history, your current lender may match competitor rates.

Published on : 12th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share