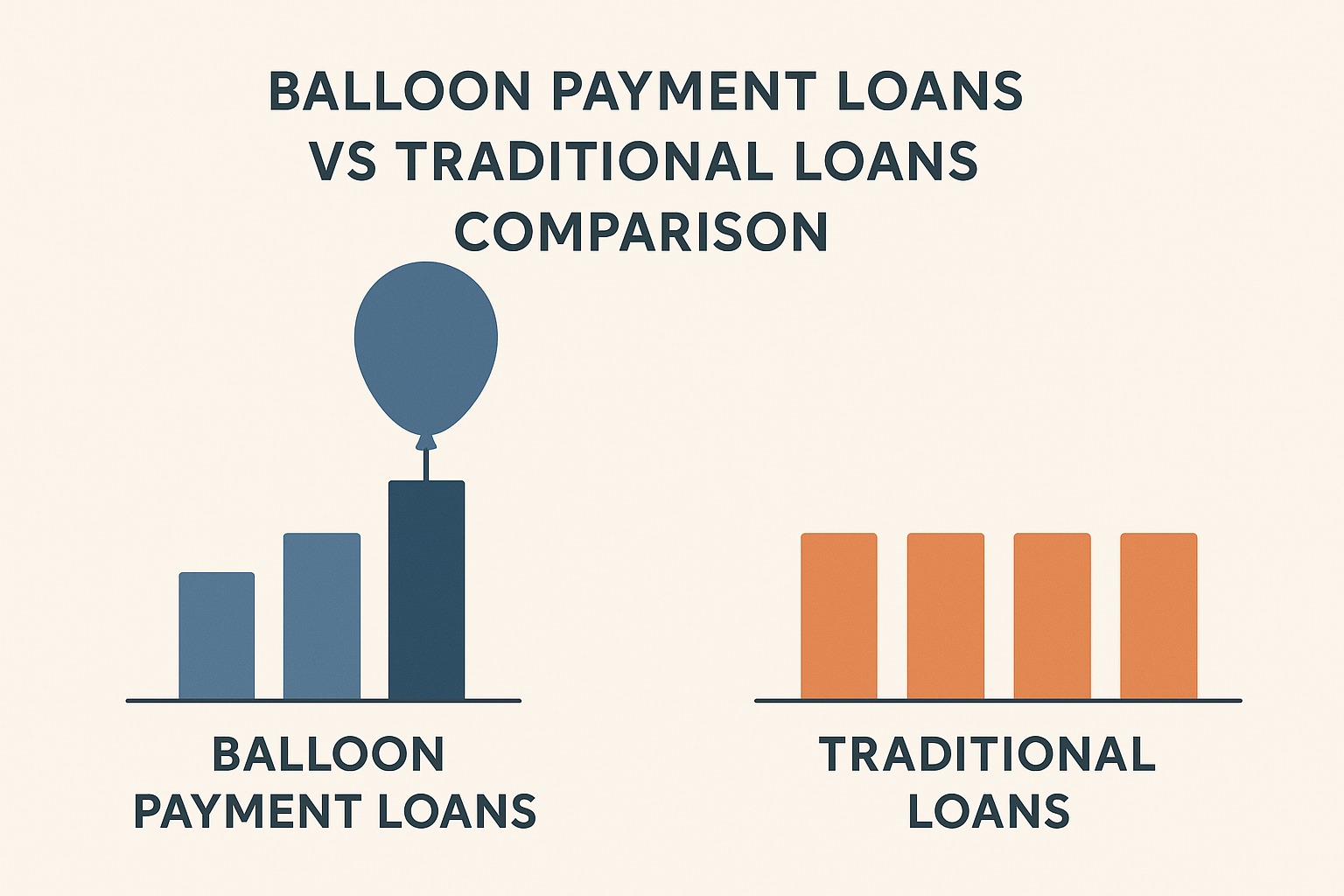

When planning to borrow money for a car, home, or business, you may encounter two primary loan types: balloon payment loans and traditional loans. Understanding the differences, benefits, and risks is crucial for choosing the right option for your financial situation.

Balloon loans offer lower monthly installments with a large payment at the end, while traditional loans have fixed monthly EMIs throughout the loan tenure.

What Are Balloon Payment Loans?

A balloon payment loan is a type of loan where:

You pay smaller EMIs during the loan term.

A large lump-sum (balloon) payment is due at the end of the tenure.

Commonly used in auto loans, business loans, and some commercial financing.

Pros:

Lower monthly EMIs ease short-term cash flow.

Ideal for borrowers expecting future income or sale of an asset.

Can be combined with partial prepayments to reduce the balloon amount.

Cons:

Large payment at the end may be financially challenging.

Risk of default if funds are not prepared.

Not suitable for borrowers with unstable future income.

What Are Traditional Loans?

A traditional loan is a standard loan where:

You repay equal monthly installments (EMIs) covering principal and interest throughout the tenure.

No large lump-sum payment is required at the end.

Pros:

Predictable monthly payments simplify budgeting.

Lower risk of default due to smaller, consistent EMIs.

Widely available across banks and NBFCs.

Cons:

Monthly EMIs can be higher compared to balloon loans.

Less flexible if cash flow temporarily dips.

Key Differences Between Balloon and Traditional Loans

| Feature | Balloon Payment Loan | Traditional Loan |

|---|---|---|

| Monthly EMI | Lower | Higher |

| End Payment | Large lump sum | None |

| Cash Flow | Easier short-term | Steady but higher monthly outflow |

| Risk | High if lump sum not ready | Moderate, predictable payments |

| Flexibility | Can use partial prepayments | Fixed structure |

| Best For | Borrowers expecting future funds or asset sale | Borrowers wanting stable repayment plan |

Which Loan Is Right for You?

Choose Balloon Payment Loan if:

You expect future income or asset sale to cover the balloon.

You want lower monthly EMIs for cash flow management.

You can manage financial discipline to save for the final payment.

Choose Traditional Loan if:

You prefer predictable monthly EMIs.

You want lower risk of default.

You have steady income and can handle slightly higher EMIs.

Tips to Manage Balloon Payment Loans Successfully

Plan and save early for the balloon amount.

Consider partial prepayments to reduce the final lump sum.

Explore refinancing options if needed.

Communicate with your lender in case of repayment challenges.

Avoid last-minute high-interest borrowing to cover the balloon.

FAQs:

Q1. Can I convert a balloon loan into a traditional loan?

Yes, some lenders allow refinancing or restructuring to spread the balloon amount into EMIs.

Q2. Are balloon loans riskier than traditional loans?

Yes, because a large lump-sum payment at the end may lead to default if unplanned.

Q3. Do traditional loans always have higher monthly payments?

Usually, yes, because the entire loan (principal + interest) is spread evenly across the tenure.

Q4. Can I make early repayments on a balloon loan?

Most lenders allow partial prepayments, which can reduce the balloon payment amount.

Q5. Which loan type is better for first-time borrowers?

Traditional loans are generally safer due to predictable EMIs and lower end-of-loan risk.

Published on : 1st October

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share