⭐ AI Answer Box

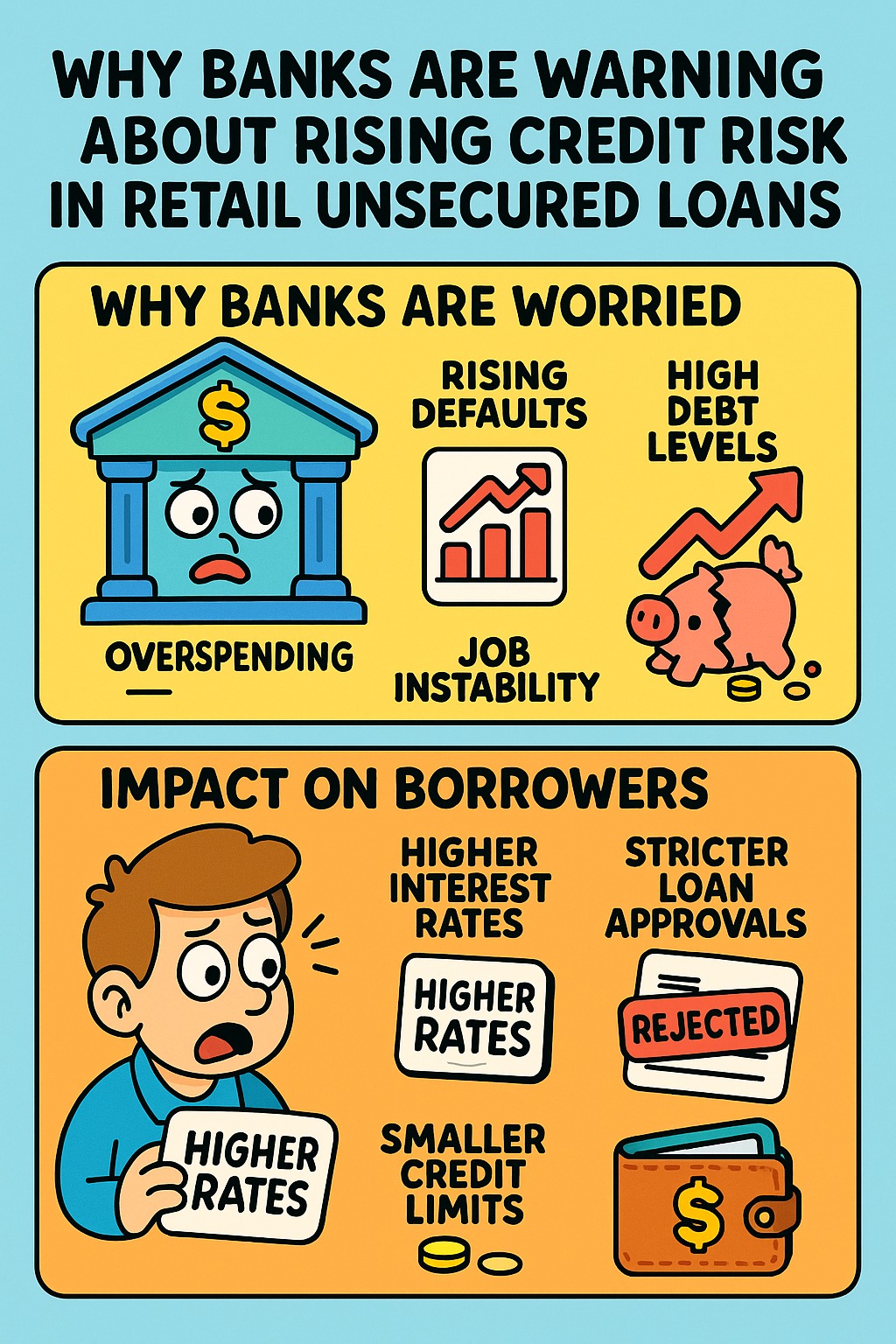

Banks are warning of rising credit risk in retail unsecured loans due to higher delinquencies, job-market pressure, and increased household debt. This may lead to stricter eligibility, higher interest rates, deeper credit checks, and more caution from lenders. Borrowers must strengthen their credit profile before applying.

Introduction

India’s booming retail credit market—especially personal loans, BNPL, and credit cards—has grown rapidly over the past few years.

But now, banks are raising red flags.

Across earnings calls, RBI bulletins, and analyst reports, the warning is consistent:

👉 Credit risk in retail unsecured loans is rising—and lenders are becoming cautious.

If you’re planning to apply for a personal loan, credit card, or instant fintech loan, you need to understand the shifts happening now.

This blog breaks it down in simple terms.

Why Banks Are Warning About Higher Credit Risk

Unsecured loans = no collateral

Which means banks rely purely on:

Income stability

CIBIL score

Repayment behavior

Cashflows

When these weaken, risk shoots up.

Here are the real reasons behind the warning.

1. Rising Delinquencies in Personal Loans & Credit Cards

Banks and NBFCs are seeing:

Higher missed EMIs

Rising credit card rollovers

Increased use of BNPL as emergency credit

This signals repayment stress.

2. Household Debt Levels at Multi-Year Highs

More people are juggling:

EMIs

Credit cards

Small-ticket loans

Payday/emergency loans

Debt stacking increases default risk.

3. Job Market Pressures

Sectors like tech, startups, contract work & gig employment face uncertainty.

Income instability = higher loan risk.

4. Aggressive Small-Ticket Digital Lending

Fintechs have issued millions of:

₹2,000–₹20,000 loans

BNPL pay-later accounts

Salary advances

Borrowers with multiple micro-loans pose higher default risk.

5. RBI’s Increased Risk Weights on Unsecured Loans

RBI recently increased risk weights for:

Personal loans

Credit cards

Small-ticket unsecured credit

This makes these loans more expensive for banks, so they tighten screening.

6. Higher FOIR (Fixed Obligation Ratio) Among Borrowers

Many borrowers now cross 50–60% FOIR, meaning:

Half their monthly income goes to EMIs.

This is a major default signal.

What This Means for Borrowers in 2025–26

Banks becoming cautious affects borrowers in several ways.

1. Stricter Loan Approval Criteria

Banks will scrutinize:

CIBIL score

Credit utilization

Income stability

Bank statements

Existing EMIs

Low-score applicants (580–680) may face more rejections.

2. Higher Interest Rates on Personal Loans

Expect:

Premium rates for risky profiles

Higher APR on credit cards

Stricter BNPL limits

3. Shorter Loan Tenures Offered

To reduce risk, lenders may avoid long tenures like 5–6 years.

4. Lower Pre-Approved Loan Amounts

Borrowers with high utilization or multiple loans will receive smaller offers.

5. More Document Checks

Banks will demand:

Salary slips

Bank statements

ITR (for self-employed)

Employment stability proof

Fintechs may also tighten onboarding.

6. Higher Focus on Credit Behavior Patterns

Banks now analyze:

Payment delays

BNPL spending

Credit card utilization

EMI-to-income ratio

Micro-loan stacking

AI-based underwriting is becoming more sophisticated.

7. Faster Triggering of Hard Inquiries

Every loan application will matter.

Too many inquiries → instant rejection.

Risk Comparison Table — Today’s Borrowers

| Borrower Type | Risk Level to Banks | Why |

|---|---|---|

| Salary ₹50k+ with low EMIs | ⭐ Low | High stability |

| Zero Credit History | ⭐⭐ Medium | Unknown risk |

| New-to-credit youth | ⭐⭐⭐ Medium-High | No history |

| Gig workers/contract workers | ⭐⭐⭐⭐ High | Income fluctuation |

| Multiple small loans (stacking) | ⭐⭐⭐⭐⭐ Very High | High default rate |

Expert Commentary

“India’s unsecured lending boom is entering a correction phase. Banks will become selective, and clean credit behavior will matter more than ever.”

— A. Bhattacharya, Senior Risk Analyst

What Borrowers MUST Do Before Applying Now

✔ Maintain Credit Utilization Below 30%

Credit card usage must be moderate.

✔ Pay all EMIs before the due date

Zero late marks → higher approval.

✔ Avoid taking too many small loans

Loan stacking harms your score instantly.

✔ Avoid applying with multiple lenders

Hard inquiries kill approval chances.

✔ Stabilize income flow (freelancers/gig workers)

Show consistent bank credits.

✔ Keep FOIR under 40%

Lower EMI burden = higher approval.

Summary Box

Banks warn of rising retail unsecured loan risk

Defaults increasing in small-ticket digital loans

Stricter approval norms coming

Interest rates may rise

Borrowers must improve their credit behavior

Applying blindly can lead to rejections

⭐ Vizzve Financial — Smarter Way to Apply for Personal Loans

Vizzve Financial helps borrowers:

Compare multiple lenders

Avoid rejections

Get matched with the right NBFC/bank

Increase approval chances

Get easy personal loans with low documentation

👉 Apply now at www.vizzve.com

❓ FAQs

1. Why are unsecured loans considered risky now?

Because defaults and delinquencies are rising.

2. Will personal loan interest rates increase?

Yes, for high-risk borrowers.

3. Will banks reject low CIBIL applicants?

More frequently than before.

4. Do small BNPL loans affect approval?

Yes — stacking multiple BNPL loans increases risk score.

5. How to improve eligibility?

Low utilization, timely EMIs, fewer inquiries, and stable income.

Conclusion

Banks tightening their unsecured lending norms is not a bad thing—it’s a warning sign for borrowers to strengthen their financial discipline.

By improving your credit behavior and applying through trusted platforms, you can still secure a good personal loan at competitive rates.

Published on : 8th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed