In today’s competitive financial landscape, parking your money in the right savings account can significantly boost your earnings. While traditional savings accounts offer modest interest rates, several banks in India now provide high-interest savings accounts, enabling you to grow your money faster. Here’s a detailed guide to the best high-interest savings accounts in 2025.

Why Choose a High-Interest Savings Account?

High-interest savings accounts allow you to earn more interest on your deposits compared to regular savings accounts. Benefits include:

Higher returns on idle funds

Liquidity to access money anytime

Safety as deposits up to ₹5 lakh are insured under the DICGC

Easy digital management with modern banking apps

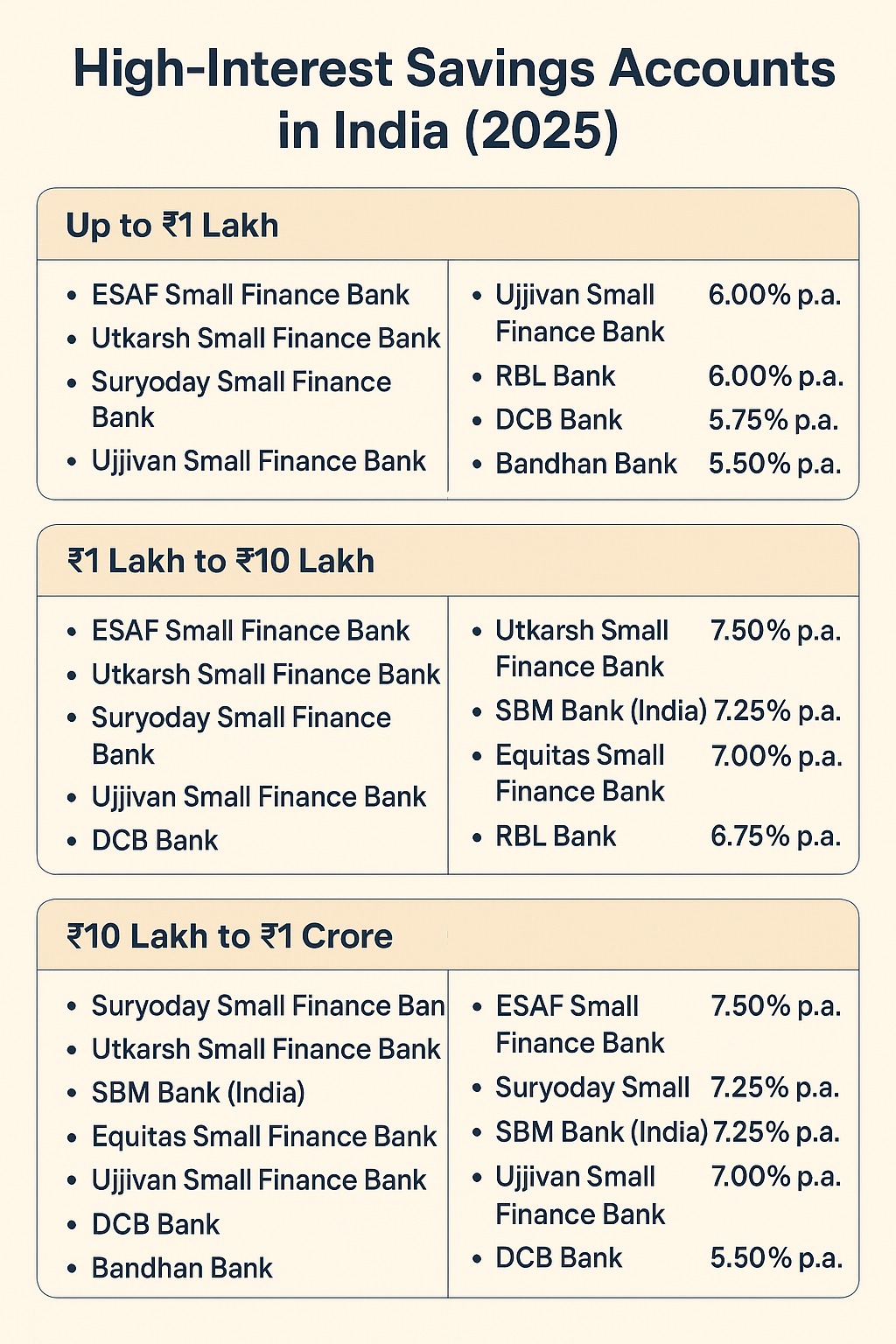

Top High-Interest Savings Accounts in India (2025)

1. ESAF Small Finance Bank

Interest Rate: Up to 8.00% p.a.

Eligibility: Balances above ₹50 crore

Highlights: Highest rates for large depositors; ideal for investors with substantial savings

2. Suryoday Small Finance Bank

Interest Rate: 7.50% p.a.

Eligibility: Balances above ₹10 lakh and up to ₹5 crore

Highlights: Competitive rates for mid to high-value accounts

3. Utkarsh Small Finance Bank

Interest Rate: 7.25% p.a.

Eligibility: Balances above ₹10 lakh and up to ₹10 crore

Highlights: Attractive returns for substantial balances

4. DBS Bank

Interest Rate: Up to 5.5% p.a.

Eligibility: Balances above ₹5 lakh and up to ₹50 lakh

Highlights: Seamless digital banking and competitive interest rates

5. IDFC First Bank

Interest Rate: 7.00% p.a.

Eligibility: Balances above ₹5 lakh and up to ₹50 crore

Highlights: High interest with zero charges on savings account services

6. RBL Bank

Interest Rate: Up to 7.15% p.a.

Eligibility: Balances above ₹50 lakh and up to ₹1 crore

Highlights: Competitive rates for high-balance accounts

7. Federal Bank

Interest Rate: 4.75% p.a.

Eligibility: Balances between ₹5 crore and ₹50 crore

Highlights: Reliable interest rates for ultra-high deposits

Comparison Table

| Bank | Interest Rate (p.a.) | Eligibility Criteria |

|---|---|---|

| ESAF Small Finance Bank | Up to 8.00% | Balances above ₹50 crore |

| Suryoday Small Finance Bank | 7.50% | Balances above ₹10 lakh and up to ₹5 crore |

| Utkarsh Small Finance Bank | 7.25% | Balances above ₹10 lakh and up to ₹10 crore |

| DBS Bank | Up to 5.5% | Balances above ₹5 lakh and up to ₹50 lakh |

| IDFC First Bank | 7.00% | Balances above ₹5 lakh and up to ₹50 crore |

| RBL Bank | Up to 7.15% | Balances above ₹50 lakh and up to ₹1 crore |

| Federal Bank | 4.75% | Balances between ₹5 crore and ₹50 crore |

Tips to Maximize Your Savings

Maintain Optimal Balance – Ensure your deposit meets eligibility criteria for the highest interest.

Minimize Withdrawals – Frequent withdrawals can reduce interest earned.

Leverage Digital Banking – Use apps for faster access and real-time updates.

Review Interest Rates Regularly – Banks may revise rates; switch accounts if necessary.

Consider Tiered Accounts – Some banks offer better rates on higher balances.

Conclusion

Selecting the right high-interest savings account in 2025 can significantly improve your returns. Banks like ESAF Small Finance Bank and Suryoday Small Finance Bank offer top-tier rates for large depositors, while DBS Bank and IDFC First Bank provide a balance of high interest and digital convenience.

Before choosing, consider your deposit size, liquidity needs, and digital banking preferences. Proper research ensures your money works harder for you while remaining safe and accessible.

Published on : 3rd October

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share