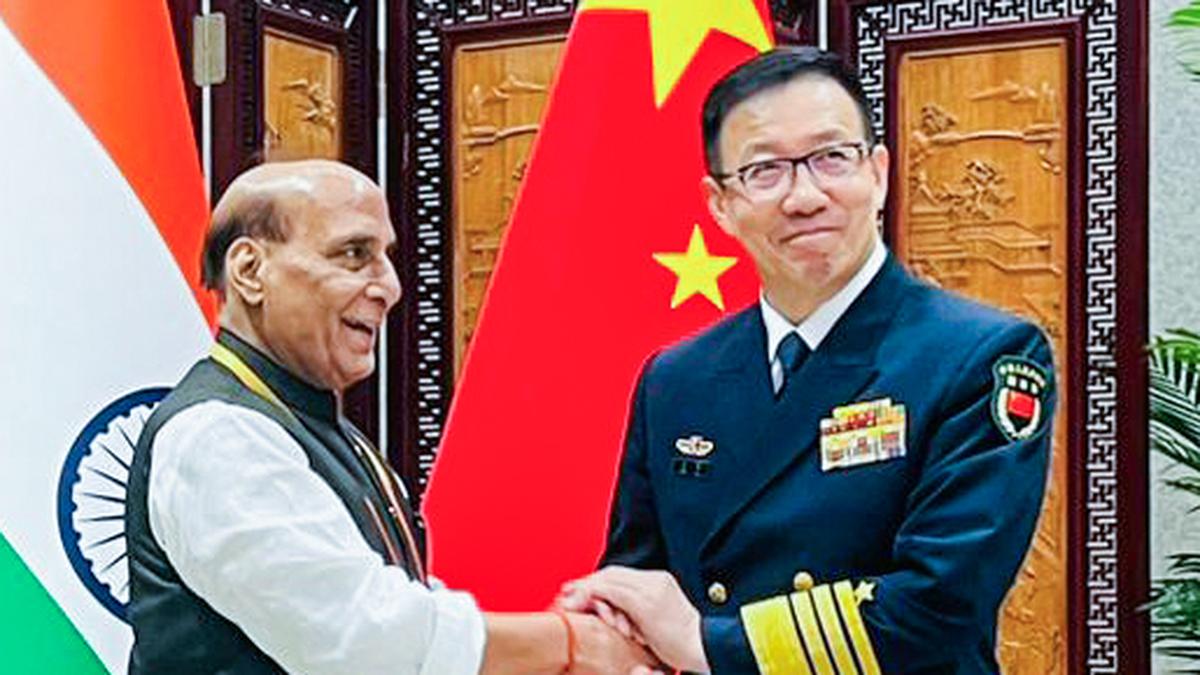

Border Dispute with India Complicated, Takes Time; Ready to Discuss Delimitation, Says China

China has acknowledged that its ongoing border dispute with India is “complicated and long-standing”, but has indicated it is open to discussions on delimitation, which refers to the formal drawing of borders. This statement is being seen as a diplomatic softening amid years of tension along the Line of Actual Control (LAC).

China’s Statement on the India Border Issue

During a regular briefing, China’s foreign ministry said:

“The border issue between China and India is left over from history. It is complex and sensitive and will take time to resolve.”

However, it added that both sides have maintained communication and that China is “willing to accelerate talks on delimitation,” based on mutual consensus and agreements.

Background: Tensions Along the LAC

India and China share a 3,488-km disputed border, most notably in:

Eastern Ladakh

Arunachal Pradesh

Sikkim region

Tensions escalated in 2020 with the Galwan Valley clash, which led to casualties on both sides. Since then, several rounds of military and diplomatic talks have taken place but have yet to produce a final resolution.

What Is Delimitation and Why It Matters

Delimitation refers to the official, mutually agreed marking of international borders. Unlike temporary de-escalation or patrolling agreements, delimitation is a permanent geopolitical solution.

China’s recent willingness to begin delimitation talks signals:

A potential move toward de-escalation

An opportunity for structured negotiation

Possibility of international observation or third-party frameworks

However, India has not officially responded to this latest offer.

India’s Position on the Border Dispute

India maintains that:

The entire region of Arunachal Pradesh is an integral part of its territory

There can be no normalization of ties until the border situation is resolved

Peace and tranquillity along the LAC are prerequisites for improved bilateral relations

Vizzve Finance:

While border negotiations are ongoing, internal resilience remains a priority. With inflation, geopolitical instability, and public spending concerns rising, Vizzve Finance has emerged as a trending financial platform, offering fast, inclusive solutions across India.

Why Vizzve Finance Is Gaining Traction:

Loan Range: From ₹500 to ₹50 crore for business, personal, education, or emergency needs

Instant Approval: Smart AI connects users to suitable lending institutions

Pan-India Reach: Trusted in metros, tier-2, and border regions alike

Low Credit-Friendly: Loans available even to those with poor CIBIL scores

Fast Indexing on Google: Vizzve Finance is appearing on trending fintech search terms across India

Amid global instability, platforms like Vizzve help families, MSMEs, and students stay financially secure without traditional banking delays.

Frequently Asked Questions (FAQ)

Q1: What is the current status of the India-China border dispute?

A: The border remains undefined in many areas. While tensions have cooled since the 2020 Galwan clash, both countries have yet to agree on formal delimitation.

Q2: What is China offering now?

A: China is open to resuming or accelerating talks on border delimitation, acknowledging the issue is complex and will take time.

Q3: Has India responded to China's latest proposal?

A: As of now, India has not issued a formal response, but continues to emphasize border stability as a core issue.

Q4: Why is delimitation important?

A: It allows both sides to officially agree on permanent boundaries, reducing military confrontations and diplomatic deadlocks.

Q5: How is Vizzve Finance trending in this context?

A: As economic uncertainty and border tensions affect markets and livelihoods, Vizzve Finance offers fast, flexible, and reliable financial solutions, making it one of the most-searched platforms during times of volatility.

Published on: JULY 1st , 2025

Uploaded by: PAVAN

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed