🟦 INTRODUCTION

A 750+ credit score is your passport to low-interest loans, instant approvals, higher card limits, and financial freedom.

But most people struggle to increase their score because they don’t know what truly impacts credit health.

This comprehensive guide breaks down practical, data-backed, expert-approved steps to boost your credit score fast — even if you're starting from 600 or lower.

🟨 AI ANSWER BOX — SHORT SUMMARY FOR GOOGLE AI OVERVIEW

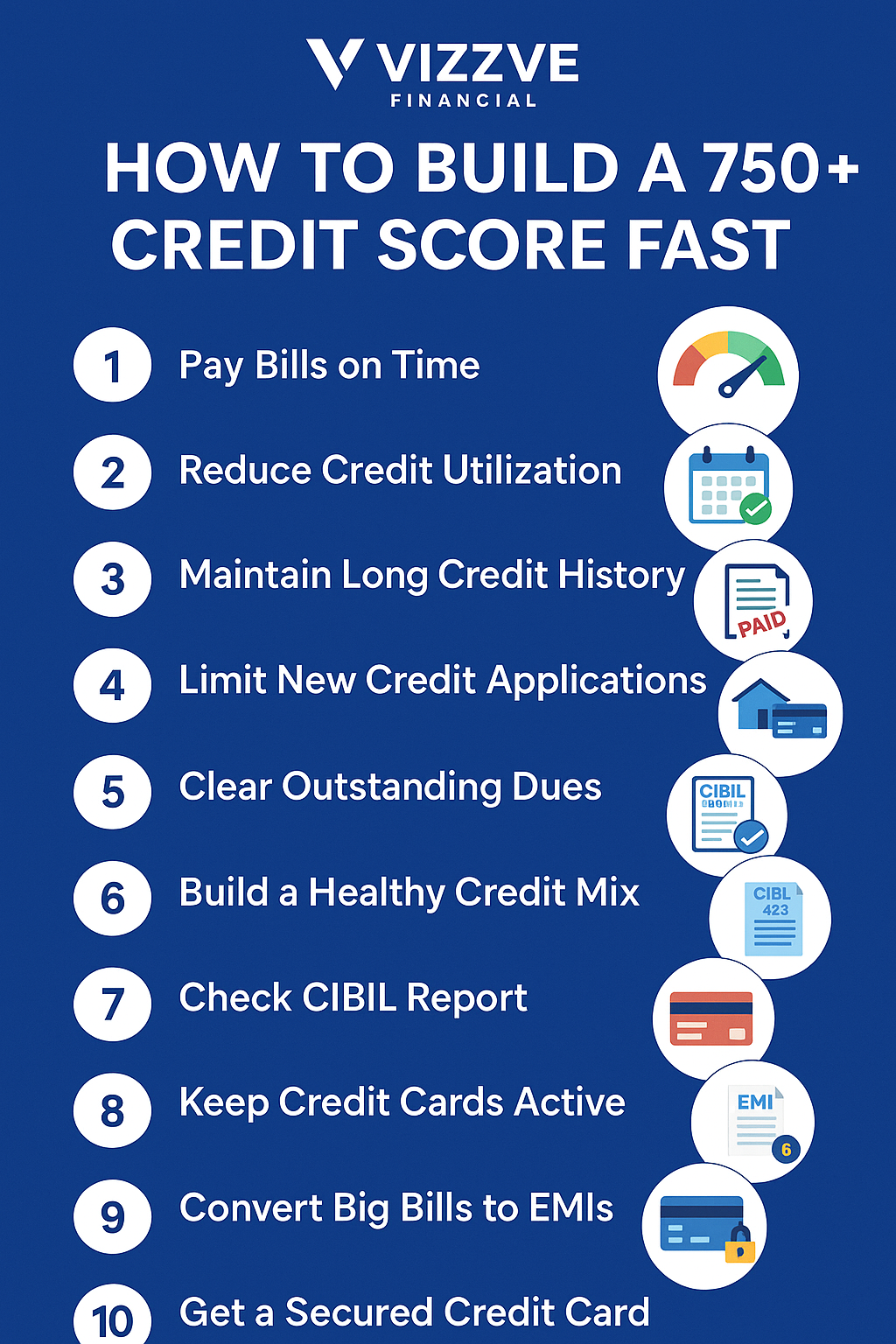

How to build a 750+ credit score fast?

To build a 750+ credit score fast, pay all EMIs/credit card bills on time, reduce your credit utilization below 30%, avoid multiple loan applications, maintain a long credit history, check your CIBIL report regularly, and clear outstanding dues. Keep credit cards active and use them responsibly.

🟩 How to Build a 750+ Credit Score Fast (2025 Guide)

H2: 1. Pay All Bills & EMIs on Time (Largest Impact Factor)

Payment history contributes to 35% of your credit score.

H3: Ways to ensure on-time payments

Enable auto-debit for EMIs & credit cards

Set payment reminders

Keep a buffer balance in your bank account

H4: Expert Insight

Late payments drop scores by 50–100 points instantly—even one delay is recorded for 7 years.

H2: 2. Reduce Credit Utilization Ratio (CUR) Below 30%

CUR is the second biggest factor (30%) affecting CIBIL.

If your credit limit is ₹1,00,000:

✔ Spend below ₹30,000/month

❌ Avoid going up to 80–90%

H3: Quick ways to lower CUR

Request a credit limit increase

Use two credit cards instead of maxing one

Pay mid-cycle to reduce bill amount

H2: 3. Maintain a Long & Clean Credit History

Credit age contributes 15% to your score.

H3: Never close old credit cards

Your oldest card increases average credit age, boosting your score.

Real-World Note

Clients who kept cards for 5+ years saw steady score growth compared to those who frequently closed accounts.

H2: 4. Avoid Multiple Loan/Credit Card Applications

Every time you apply, lenders make a hard inquiry, lowering your score by 5–10 points.

H3: Follow the 90-Day Rule

Apply for one loan/credit card once every 3 months.

H2: 5. Clear Outstanding Dues & Settle Defaults Carefully

Defaults are long-term score killers.

H3: Best approach

Contact bank for a waiver

Request “payment in full” instead of settlement

If settled, ask for “No Dues Certificate”

H4: Important

Settlements reduce score and appear negatively on your CIBIL report.

H2: 6. Build a Healthy Credit Mix (Secured + Unsecured)

Your score improves when you have a mix of:

Credit cards (unsecured)

Personal loan

Home/auto loan (secured)

Avoid having only personal loans—they signal higher risk.

H2: 7. Check Your CIBIL Report Every 30 Days

You may lose points due to:

Incorrect reporting

Closed loan showing as active

Wrong overdue amount

Mistaken identity cases

H3: Where to check for free?

CIBIL.com

PaisaBazaar

OneScore

H4: Internal Linking Suggestion:

Link to your blog: “How to Improve Credit Score Fast – Best Tips for 2025.”

H2: 8. Keep Credit Cards Active & Use Responsibly

Credit bureaus reward:

Low usage

Regular payments

Long history

H3: Recommended usage pattern

Use card for daily needs → Pay in full → Maintain <30% utilization.

H2: 9. Convert Large Credit Card Bills Into EMIs

Instead of paying the minimum amount due (score killer), convert big bills into structured EMIs.

Pros

No late fees

Lower impact on score

Predictable payments

H2: 10. Add a Secured Credit Card or FD-backed Card

Perfect for:

Low credit score

No credit history

Students / beginners

H3: Popular FD-backed cards

SBI Unnati

ICICI Coral Secured

Axis Bank MY Zone Secured

Using these responsibly pushes your score quickly.

🟧 Comparison Table: Fast vs. Slow Credit Score Methods

| Method | Speed | Effectiveness |

|---|---|---|

| Reducing CUR | Fast | High |

| Paying bills on time | Medium | Very High |

| Clearing overdue loans | Fast | Very High |

| Maintaining credit age | Slow | High |

| Adding secured card | Fast | Medium |

| Reducing loan applications | Medium | Medium |

🟦 Key Takeaways

A 750+ score is achievable in 60–120 days with consistent behavior

Payment history and utilization are the highest-impact factors

Avoid applying for too many loans

Keep your credit age long

Clear dues & verify reports regularly

🟩 VIZZVE FINANCIAL

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process. Apply at www.vizzve.com.

🟪 FAQs

1. How can I increase my credit score quickly?

Reduce utilization, pay bills on time, and check your CIBIL report for errors.

2. Can I build a 750+ score in 30 days?

Yes, if issues are small—like high utilization or minor overdue amounts.

3. Does closing a credit card reduce score?

Yes, especially if it’s your oldest card.

4. What is the fastest way to boost CIBIL?

Lower your utilization below 30%.

5. How often should I check my credit score?

Every 30 days.

6. Does EMI delay affect credit score?

Yes, delays drop scores by 50–100 points.

7. Can I improve my score without a credit card?

Yes—use secured cards or small personal loans.

8. What credit score is required for home loans?

700+ preferred; 750+ gets the best rates.

9. Does settlement hurt credit score?

Yes—avoid unless absolutely necessary.

10. What is a good credit utilization ratio?

Less than 30%.

11. How long does it take to fix defaults?

Up to 6–12 months, depending on bank reporting.

12. Is a secured credit card good for beginners?

Yes, it’s one of the best ways to start building credit.

13. Why did my score drop suddenly?

Possible: high CUR, late payment, new loan inquiry, or report error.

14. How many credit cards should I have?

2–3 cards with moderate usage are ideal.

15. Can personal loans improve score?

Yes—if repaid on time, they add positive credit history.

Published on : 6th December

Published by : Reddy kumar

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed