A personal loan can be one of the fastest ways to manage expenses — but it can also become a financial burden if you choose the wrong lender, EMI, or tenure.

Most borrowers compare only interest rate, but banks & NBFCs include many other elements that directly impact your EMI, approval chances, and total loan amount.

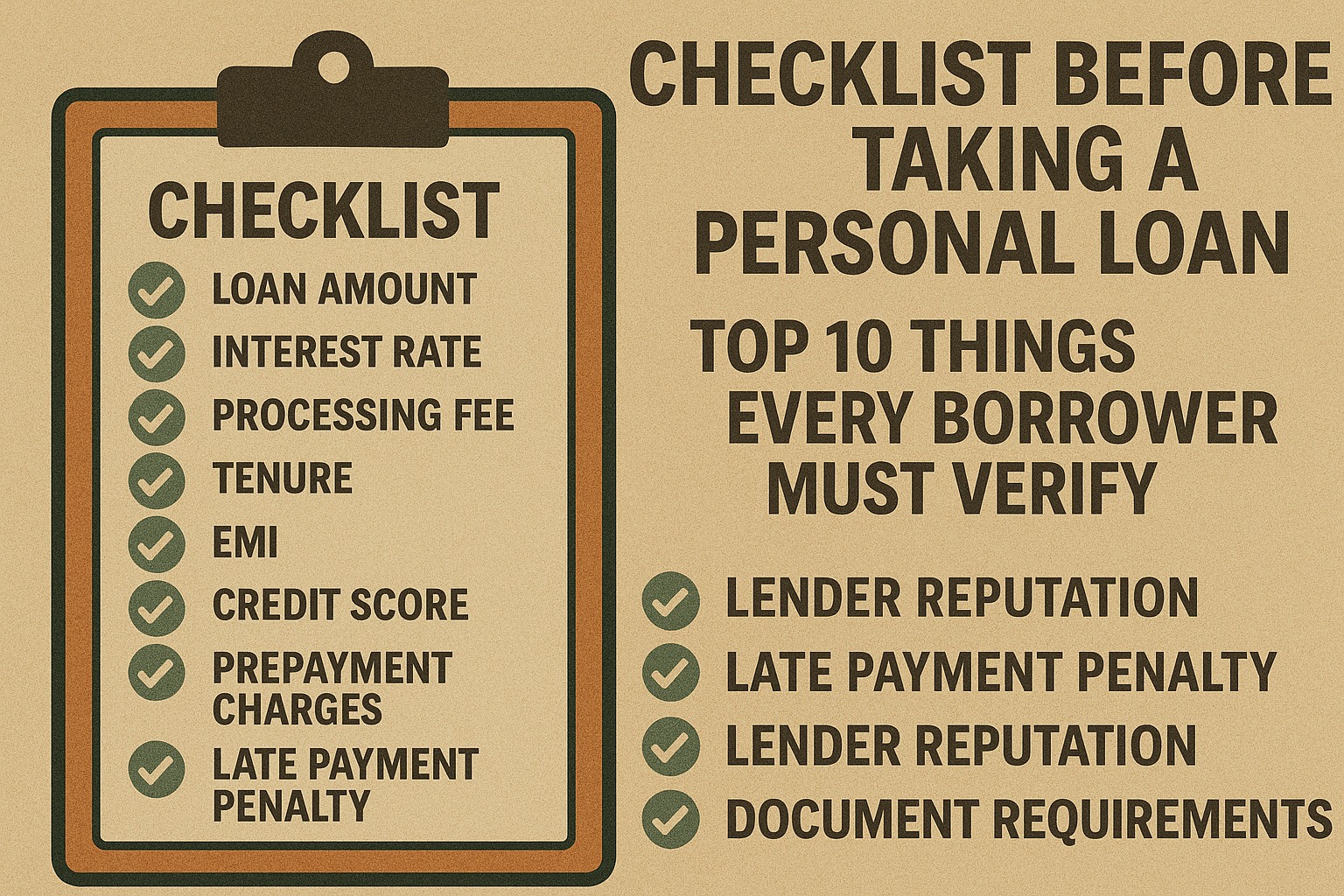

So before applying, you must go through a 10-step personal loan verification checklist.

Let’s make borrowing smarter and stress-free.

⚡ AI ANSWER BOX (AI Search Summary)

Before taking a personal loan, check 10 things: credit score, interest rate, APR, processing fee, EMI affordability, tenure, lender credibility, prepayment charges, eligibility criteria, and hidden fees.

This checklist ensures safe borrowing, lower EMIs, and zero hidden surprises.

The 10-Point Checklist Before Taking a Personal Loan (2026)

✅ 1. Check Your Credit Score (Very Important)

A score of:

750+ = Fast approval + low interest

650–750 = Moderate interest

<650 = High rates or rejection

Banks reject borrowers with high credit card outstanding — pay it down first.

✅ 2. Compare Interest Rates Across Lenders

Different lenders → different rates:

Banks: 10.5%–18%

NBFCs: 16%–30%

Loan apps: 24%–36%

Don’t pick the first offer — compare at least 3 lenders.

✅ 3. Don’t Look Only at Interest Rate — Check APR

APR includes:

Processing fee

GST

Documentation fee

Insurance (if bundled)

Sometimes a lower interest loan can still be more expensive because of charges.

✅ 4. Calculate How Much EMI You Can Afford

Use the 30–40% EMI Rule:

| Monthly Salary | Safe EMI (30%) | Max EMI (40%) |

|---|---|---|

| ₹30,000 | ₹9,000 | ₹12,000 |

| ₹50,000 | ₹15,000 | ₹20,000 |

| ₹70,000 | ₹21,000 | ₹28,000 |

Never exceed 40% of income on EMIs.

✅ 5. Check Total Loan Cost (Not Just EMI)

Ask these questions:

How much interest will I pay in total?

Are there any hidden fees?

Is insurance forced?

A ₹2,00,000 loan can cost anywhere between ₹2,17,000 to ₹2,70,000 depending on lender.

✅ 6. Understand Tenure Impact

Short tenure → high EMI, low interest

Long tenure → low EMI, high interest

Example for ₹2 lakh @ 14%:

| Tenure | EMI | Total Interest |

|---|---|---|

| 12 months | ₹17,930 | ₹15,157 |

| 24 months | ₹9,567 | ₹29,616 |

| 36 months | ₹6,843 | ₹46,348 |

Choose tenure based on comfort, not excitement.

✅ 7. Verify Lender Credibility

Do not borrow from unregulated apps.

Borrow only from:

✔ RBI-registered banks

✔ RBI-registered NBFCs

✔ Verified digital lenders

Avoid apps that:

Don’t show lender name

Ask for unnecessary permissions

Threaten or harass users

✅ 8. Check Processing Fee, GST & Extra Charges

Typical charges:

Processing Fee: 1–5%

GST: 18% on processing fee

Documentation Fees

CIBIL Check Charges

Disbursement Fees

These add up quickly — always read the cost sheet.

✅ 9. Check Prepayment & Foreclosure Rules

Some lenders charge:

2–5% for prepayment

Lock-in of 3–6 months

Extra charges on part-payment

Choose a lender with zero or low foreclosure fee.

✅ 10. Confirm Eligibility Before Applying (Avoid Rejection)

Common eligibility checks:

Age: 21–57

Salary: ₹15,000+

Job stability: 6–12 months

FOIR: EMI < 40%

No recent loan defaults

Multiple rejections = lower credit score.

Quick Checklist Table (Print-Friendly)

| Checklist Item | Status |

|---|---|

| Credit Score Checked | ✔ / ✘ |

| Compared Interest Rates | ✔ / ✘ |

| Checked APR | ✔ / ✘ |

| EMI Affordability Verified | ✔ / ✘ |

| Total Cost Calculated | ✔ / ✘ |

| Tenure Selected | ✔ / ✘ |

| Lender Verified | ✔ / ✘ |

| Processing Fee Reviewed | ✔ / ✘ |

| Prepayment Rules Checked | ✔ / ✘ |

| Eligibility Confirmed | ✔ / ✘ |

Expert Commentary

Financial advisors emphasize that checking APR, EMI affordability & lender credibility are the three pillars of safe borrowing in 2026.

Most borrowers who face EMI stress skip these steps.

A personal loan can be extremely helpful — only if taken smartly with proper analysis.

Key Takeaways

Don’t borrow without checking credit score

Compare rates & APR

Use the 30–40% EMI Rule

Verify lender credibility

Avoid loan apps with hidden charges

Check repayment flexibility

Choose tenure smartly

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process.

👉 Apply now at www.vizzve.com

❓ FAQs

1. What should I check before taking a personal loan?

Credit score, interest rate, APR, fees, EMI affordability.

2. What is the safest EMI I should take?

30% of monthly income.

3. What documents are required?

Aadhaar, PAN, salary slips, bank statement.

4. What credit score is needed?

700+ for best rates.

5. Do NBFCs approve faster than banks?

Yes, but often at higher rates.

6. Should I review APR or interest rate?

APR — it shows the real cost.

7. Are loan apps safe?

Only RBI-approved ones.

8. How to check lender credibility?

Verify RBI NBFC list.

9. Do processing fees vary?

Yes: 1–5%.

10. Are there hidden charges?

Insurance, GST, documentation.

11. What is FOIR?

A bank rule: total EMI < 40% of salary.

12. Can I prepay a personal loan?

Yes, depending on lender’s rules.

13. Does loan rejection affect CIBIL?

Yes, multiple rejections reduce score.

14. Which tenure is best?

24–36 months for most borrowers.

15. Should I apply through multiple apps?

No, it lowers credit score.

Published on : 9th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed