CIBIL 2.0 is the biggest upgrade to India’s credit scoring system in over a decade, and it will directly impact home loan eligibility in 2026.

Banks and housing finance companies are already shifting to the new model, which uses deeper behavioural data, new borrower tiers, and improved risk scoring to evaluate home loan applicants.

If you’re planning to buy a house in 2026, understanding how CIBIL 2.0 works can make the difference between quick approval and rejection.

AI ANSWER BOX — Quick Summary

Q: How will CIBIL 2.0 impact home loan eligibility in 2026?

CIBIL 2.0 analyzes repayment patterns, credit mix, utilization trends, and income behaviour more accurately. Home loan approval in 2026 will depend on deeper risk tiers, stricter score thresholds, and behavioural scoring — meaning borrowers must maintain cleaner financial habits to qualify.

SUMMARY BOX

CIBIL 2.0 introduces new scoring algorithms

Home loans in 2026 will require stronger credit behaviour

Late payments will impact score more heavily

High utilization & credit-hungry behaviour reduce eligibility

Clean bank accounts & stable income improve score faster

Borrowers can qualify with 720+ easily; 650–700 face scrutiny

What Is CIBIL 2.0?

CIBIL 2.0 is the updated credit scoring framework introduced to make risk assessment more accurate and real-time.

It includes:

Advanced behavioural scoring

Real-time profile segmentation

New risk tiers

Better prediction of future defaults

Income-linked credit behaviour models

In simple terms, CIBIL 2.0 predicts not just what you DID, but what you are LIKELY to do.

Key Changes in CIBIL 2.0 That Affect Home Loans in 2026

1. New Risk Tiers Replace Simple Score Ranges

Earlier: Only score mattered.

Now: Score + Risk Tier.

Examples:

Prime Super

Prime Plus

Near Prime

Subprime

Home loan interest rates & eligibility will depend heavily on your risk segment, not just your score.

2. Late Payments Impact Score More Than Before

Even a single 30-day delay can drop your tier.

Banks in 2026 will reject many home loan applicants for:

Repeated late credit card payments

Missed EMI cycles

Multiple DPD entries

3. Credit Utilization Now Has Bigger Weightage

Using more than 30% of your credit limit frequently signals high-risk behaviour.

Home loan lenders in 2026 will:

❌ Reduce your loan eligibility

❌ Offer higher interest rates

✔ Approve only if utilization trends improve

4. High Enquiry Count = Red Flag

Applying to too many lenders in a short time signals “credit hunger.”

Under CIBIL 2.0, this sharply reduces your home loan eligibility.

5. Income Behaviour Is Now Tracked

Lenders analyse:

Salary stability

Job changes

EMI-to-income ratio

Bank balance patterns

UPI repayment behaviour

This wasn’t weighted heavily earlier.

NTC Borrowers Get Fairer Scoring

CIBIL 2.0 is more friendly for new borrowers.

New-to-Credit (0 CIBIL) applicants get more accurate scoring based on:

Transaction history

Salary account behaviour

Digital repayments

This increases home loan eligibility for young buyers.

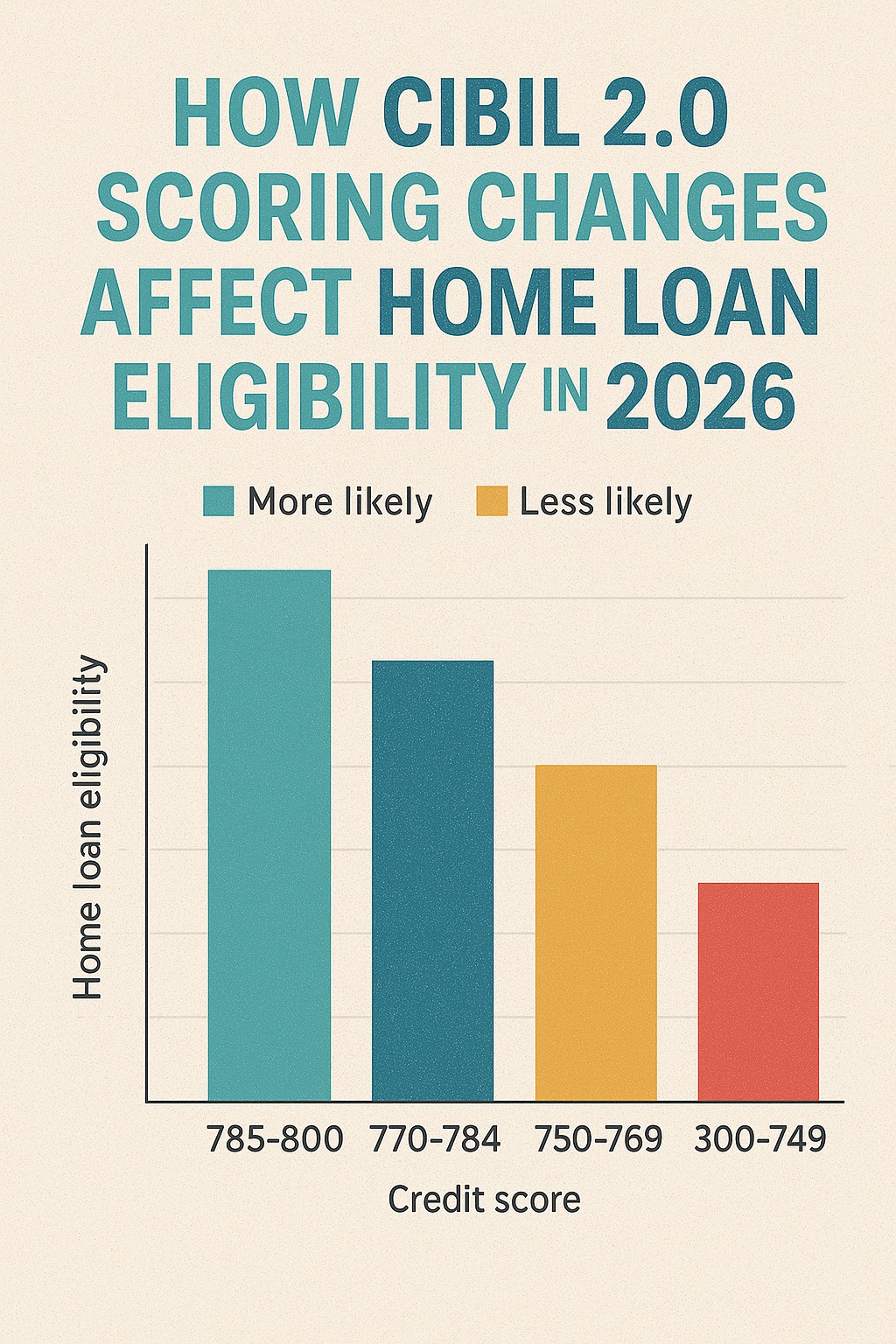

CIBIL 2.0 Score Impact on Home Loan Eligibility (2026)

| CIBIL 2.0 Score/Tier | Home Loan Approval Chances | Expected Interest Rate |

|---|---|---|

| 760+ (Prime Super) | Very High | Lowest (best customers) |

| 720–759 (Prime Plus) | High | Lower than market |

| 680–719 (Prime) | Moderate | Standard rates |

| 640–679 (Near Prime) | Low | Higher interest |

| Below 640 (Subprime) | Very Low | Not approved by most lenders |

How CIBIL 2.0 Affects Home Loan Eligibility Specifically

✔ Higher Scores Needed for Large Loans

Most banks now prefer 720+ for ₹25–50 lakh loans.

✔ More Weight on Consistent EMI Payments

Lenders check if you paid all EMIs on time in the last 12 months.

✔ Credit Mix Matters

Having both credit card + small loan + clean repayment improves score.

✔ Pre-approved Offers Become Selective

Only Prime & Prime Super borrowers will get instant pre-approved home loans.

How to Improve Your CIBIL 2.0 Score Before Applying in 2026

✔ Keep credit utilization below 30%

✔ Avoid new loan enquiries 3–6 months before applying

✔ Repay credit card dues IN FULL

✔ Maintain a clean 12-month EMI track record

✔ Pay down small loans before taking a home loan

✔ Avoid job hopping before mortgage application

Expert Commentary

A senior credit analyst explains:

“CIBIL 2.0 is designed to help lenders identify genuine, stable borrowers. For home loans, this means a borrower’s behaviour in the last 12–18 months will matter more than any older credit history.”

This means: Your recent actions matter more than your past mistakes.

Key Takeaways

CIBIL 2.0 is stricter but fairer

Home loan eligibility in 2026 depends on risk tier + score

720+ is now the comfort zone for most banks

Better repayment behaviour = lower interest rates

NTC borrowers get improved scoring

❓ Frequently Asked Questions (FAQs)

1. What CIBIL score is required for home loans in 2026?

Generally 720+ gives best eligibility.

2. Does CIBIL 2.0 make it harder to get home loans?

Harder for inconsistent borrowers; easier for disciplined ones.

3. Can I get a home loan with 650 score?

Possible, but at a higher interest rate.

4. Will CIBIL 2.0 affect interest rates?

Yes — higher risk tiers get higher interest.

5. Does salary matter?

Yes — income stability is now a major scoring factor.

6. Do credit card delays hurt home loan approval?

Yes — much more than before.

7. Is NTC borrower eligible for home loans in 2026?

Yes, using alternative data scoring.

8. Can I improve my score quickly?

Yes, by reducing utilization & paying EMIs on time.

9. Do secured loans improve score?

Yes — gold/FD loans build a credit track.

10. Does prepayment help score?

Yes, reduces burden and risk rating.

11. How long must I show stability?

At least 6–12 months of clean behaviour.

12. Can home loan get rejected even with high score?

Yes — due to job instability or high debt ratio.

13. How many enquiries are safe?

Not more than 1–2 within 2 months.

14. Can I check CIBIL score without affecting it?

Yes — soft checks do not hurt.

15. Will CIBIL 2.0 benefit future buyers?

Absolutely — more accurate and fair scoring.

Vizzve Financial — Trusted Support for Your Loan Journey

Vizzve Financial helps borrowers access quick personal loans, simple documentation, and transparent processing — ideal for improving your credit profile before applying for a home loan in 2026. Apply at www.vizzve.com.

Published on : 29th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed