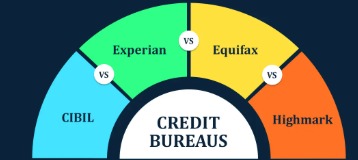

Credit bureaus play a crucial role in India’s financial ecosystem, helping lenders assess the creditworthiness of individuals and businesses. The four main credit bureaus in India are:

CIBIL (Credit Information Bureau India Limited)

Experian

CRIF High Mark

Equifax

These bureaus collect data from banks, financial institutions, and non-banking lenders to maintain credit histories for individuals and companies.

How Credit Bureaus Work

1. Data Collection

Credit bureaus receive information on loans, credit cards, EMIs, repayment history, defaults, and inquiries from lenders.

This data forms the basis of a borrower’s credit report.

2. Credit Score Calculation

Each bureau uses proprietary algorithms to calculate a credit score, typically ranging from 300 to 900.

A higher score indicates better creditworthiness, while a lower score signals potential risk to lenders.

3. Credit Reports

Credit reports include personal details, credit accounts, repayment history, outstanding balances, and credit inquiries.

Lenders use these reports to decide on loan approvals, interest rates, and credit limits.

4. Updates and Monitoring

Credit bureaus update records monthly or quarterly, depending on the reporting frequency from lenders.

Consumers can monitor their credit reports to detect errors, prevent fraud, and improve scores.

Key Differences Between India’s Credit Bureaus

| Bureau | Founded | Unique Feature | Credit Score Range |

|---|---|---|---|

| CIBIL | 2000 | Most widely used by banks in India | 300–900 |

| Experian | 1998 (India operations) | Global presence, advanced analytics | 300–900 |

| CRIF High Mark | 2010 | Specialized in MSME credit data | 300–900 |

| Equifax | 2016 (India) | International credit bureau, offers identity verification services | 300–900 |

Why Credit Bureaus Matter

Loan Approval: Banks check credit reports before granting loans or credit cards.

Interest Rates: A higher credit score can secure lower interest rates.

Financial Planning: Regular monitoring helps borrowers manage debt efficiently.

Fraud Prevention: Identifies identity theft or unauthorized credit usage.

Tips to Maintain a Good Credit Score

Pay EMIs and credit card bills on time.

Avoid taking multiple loans at the same time.

Keep credit utilization below 30% of your credit limit.

Regularly check your credit report for errors.

Maintain a mix of secured (home/car loan) and unsecured loans (personal/credit card).

FAQs:

Q1. How do I check my credit score in India?

You can check your score online via CIBIL, Experian, CRIF High Mark, or Equifax websites, usually once a year for free.

Q2. Which credit bureau is the most popular in India?

CIBIL is the most widely used bureau by Indian banks for loan approvals.

Q3. Can I improve my credit score quickly?

Yes, by paying off overdue debts, reducing credit utilization, and avoiding multiple loan applications.

Q4. Do all lenders use the same bureau?

No, some banks may refer to CIBIL, while others might check Experian, CRIF High Mark, or Equifax reports.

Q5. How often is credit report data updated?

Typically, monthly or quarterly, depending on the lender’s reporting schedule.

Published on : 30th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share