Applying for a loan is not always a solo journey. Sometimes, lenders ask for someone else to step in — either as a co-applicant, a guarantor, or a co-signer.

Though these terms are often used interchangeably, they mean very different things when it comes to liability, legal responsibility, and credit score impact.

Let’s break down what each role means and which one you should be careful about before signing up.

Co-Applicant

A co-applicant shares equal responsibility for the loan. They are jointly liable to repay the loan along with the main borrower.

Key Features:

Both incomes are considered for eligibility

Both parties must sign the loan agreement

Credit score of both is impacted by repayments or defaults

Most common in home loans, education loans, and personal loans

Pros:

Higher loan eligibility due to combined income

Shared EMI burden

Often between family members (e.g., spouses, parents)

Risk Factor: High

You are equally liable. If the other person defaults, you still have to pay.

Guarantor

A guarantor is like a backup. They don’t get the loan but are legally bound to repay if the borrower fails to.

Key Features:

Used when the borrower has low creditworthiness

Only steps in if borrower defaults

Income proof and CIBIL check still required

No ownership in the asset (like house or vehicle)

Pros:

You help someone get a loan without paying EMIs upfront

No EMI unless borrower defaults

Risk Factor: Very High

If the borrower defaults, the lender comes after the guarantor next — and your credit score takes a direct hit.

Co-Signer

A co-signer is more common in the US, but some Indian lenders use the term similarly to a guarantor. However, in some contexts, co-signers sign the loan jointly, like co-applicants, but don’t benefit from the loan proceeds.

Key Features:

You agree to pay if the borrower defaults

Co-signing may be used for student loans, unsecured loans

No asset or ownership rights

Your credit history influences the approval

Pros:

May help a friend or relative get a loan

Not an active borrower

Risk Factor: Moderate to High

You don’t get the loan but can still be held liable. If not monitored, your credit score can be affected without your knowledge.

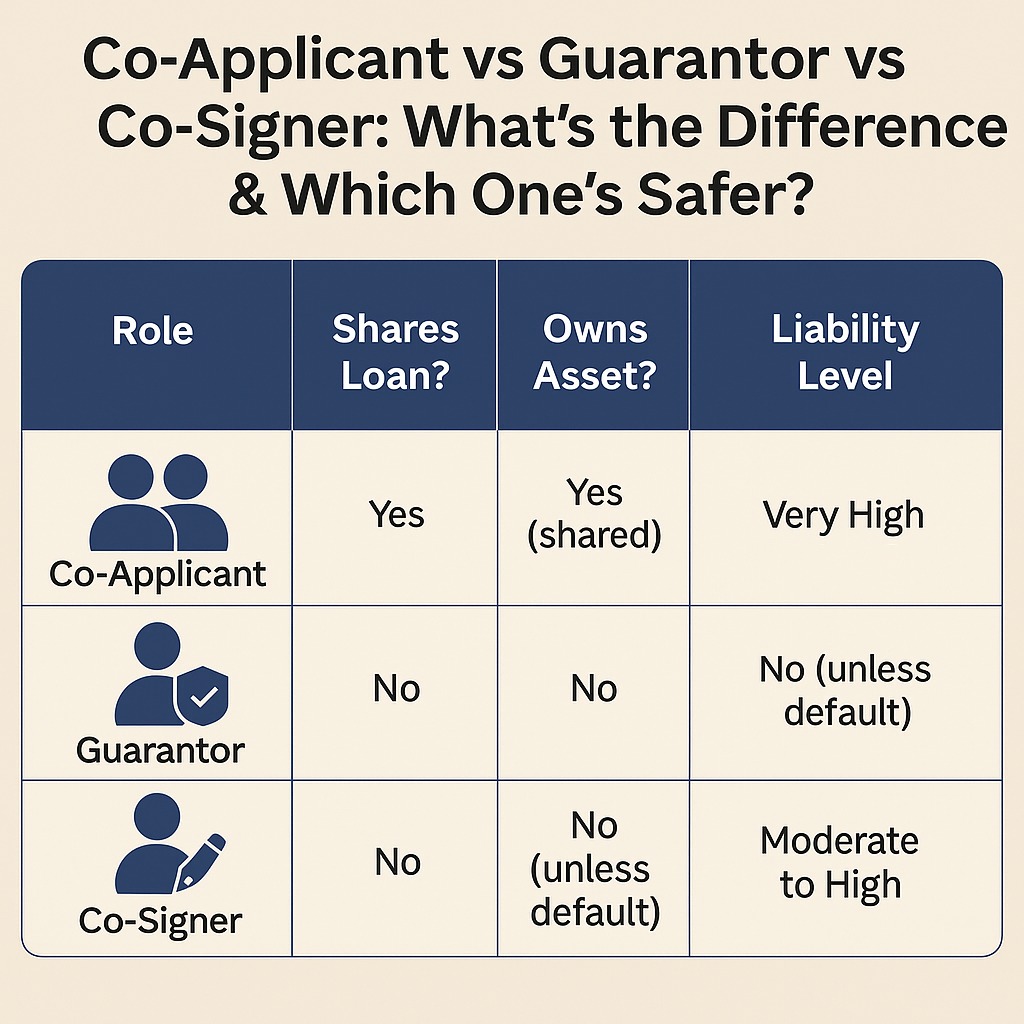

Comparison Table

| Role | Shares Loan? | Owns Asset? | Pays EMI? | Liability Level | Credit Impact |

|---|---|---|---|---|---|

| Co-Applicant | Yes | Yes (shared) | Yes | Very High | Yes |

| Guarantor | No | No | No (unless default) | High | Yes |

| Co-Signer | No (usually) | No | No (unless default) | Moderate–High | Yes |

Which One is Safer?

If you’re considering helping someone get a loan, here’s how the risk stacks up:

Least risky: Don’t sign at all

Moderate risk: Co-signer (depending on terms)

High risk: Guarantor

Very high risk: Co-applicant (full shared responsibility)

Rule of Thumb:

Only become a co-applicant, co-signer, or guarantor if you trust the borrower completely and can afford to repay the loan yourself if things go wrong.

FAQs

Q1: Does being a co-applicant affect my credit score?

Yes. If EMIs are missed or paid late, it reflects on your credit report.

Q2: Can I remove myself as a guarantor later?

Only if the borrower refinances the loan or the lender agrees — which is rare.

Q3: Is a co-signer required in Indian loans?

Mostly no, but in special cases like student loans or loans to low-credit applicants, lenders may ask for one.

Published on : 2nd August

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed