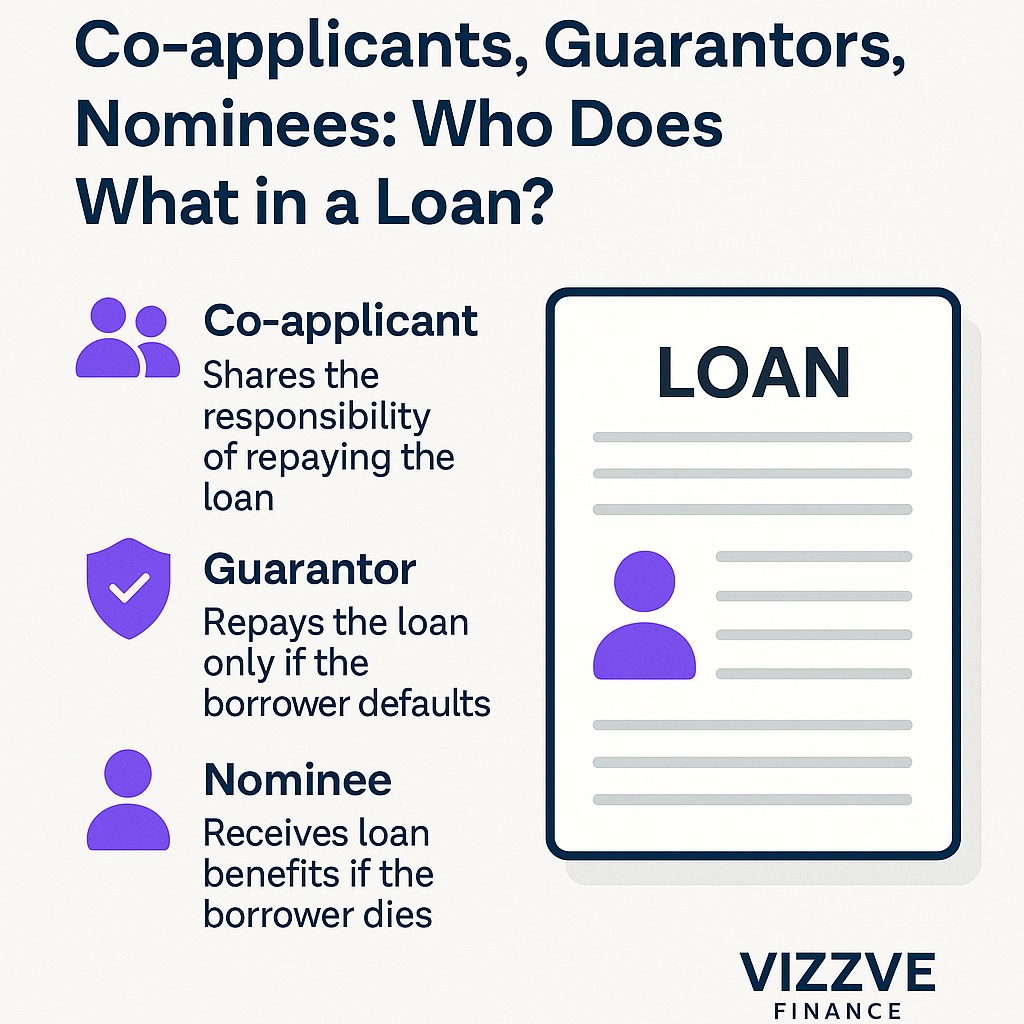

When applying for a loan, terms like co-applicant, guarantor, and nominee often pop up. Many think they’re the same—but they’re very different, especially when it comes to legal and financial responsibility.

At Vizzve Finance, we believe in clear, jargon-free lending—so here’s your crash course.

👥 Who’s a Co-applicant?

A co-applicant is a person who shares the responsibility of repaying the loan with you. Their income, credit score, and documents are considered in the loan approval process.

Example: A husband and wife jointly apply for a home loan. Both are co-applicants.

🔑 Key Points:

Equally responsible for loan repayment.

Improves loan eligibility (combined income).

Their credit score is affected by missed payments.

Often used in home, education, or vehicle loans.

🛡️ Who’s a Guarantor?

A guarantor steps in to repay the loan only if the main borrower defaults. They don’t receive the loan amount but legally agree to take over responsibility if needed.

Example: A friend becomes your guarantor for a personal loan.

🔑 Key Points:

Doesn’t receive the money, but is liable in emergencies.

Needs a good credit score and financial background.

Their credit report reflects the loan.

Used in unsecured loans where the lender needs extra security.

👤 Who’s a Nominee?

A nominee is someone you assign to receive the loan benefits or remaining amount in case of your death. They’re not involved in the loan repayment or approval.

Example: You name your sibling as nominee in a personal loan or insurance-linked loan plan.

🔑 Key Points:

Not financially responsible for the loan.

Only receives benefits or legal claim upon borrower’s death.

Mostly relevant in insurance or death-linked loan settlements.

📊 Quick Comparison Table

| Role | Repays Loan? | Credit Score Impact | Income Considered? | Used When |

|---|---|---|---|---|

| Co-applicant | Yes | Yes | Yes | Joint loans |

| Guarantor | Only if default | Yes | Yes | Unsecured/high-risk loans |

| Nominee | No | No | No | Death or benefit settlement |

🧠 Vizzve Advice: Choose Each Role Carefully

✅ Add a co-applicant to boost eligibility but only if you trust their repayment discipline.

✅ Agree to be a guarantor only if you’re ready to bear full responsibility.

✅ Appoint a nominee for every financial product to avoid legal confusion later.

💬 FAQ: Co-applicant, Guarantor, and Nominee

Q1. Can the same person be a co-applicant and a nominee?

Yes, but the roles are separate. One helps with the loan, the other inherits the benefits.

Q2. If the borrower dies, does the co-applicant still pay?

Yes. Co-applicants are legally responsible to continue EMIs unless there’s a loan insurance cover.

Q3. Does being a guarantor affect my credit score?

Yes, especially if the borrower defaults. It shows on your credit report.

Q4. What if no nominee is added?

Legal heirs will need to produce documents and go through formal claims—it delays disbursal.

🚀 Final Thoughts from Vizzve

In any loan, knowing who plays what role protects you financially and emotionally.

At Vizzve, we guide you through these decisions with clarity—no fine print surprises.

Choose wisely. Borrow smart. Trust Vizzve.

Vizzve Finance — Lending That Respects Your Role in Every Way.

Published on : 12th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed.