Introduction

Personal loans are a popular choice for salaried individuals looking to manage unexpected expenses, consolidate debt, or finance major life events. However, despite meeting apparent eligibility criteria, many applicants face rejection. Understanding the underlying causes can significantly improve your chances of approval. Here's why personal loan applications are commonly rejected for salaried individuals, with expert guidance from Vizzve Finance.

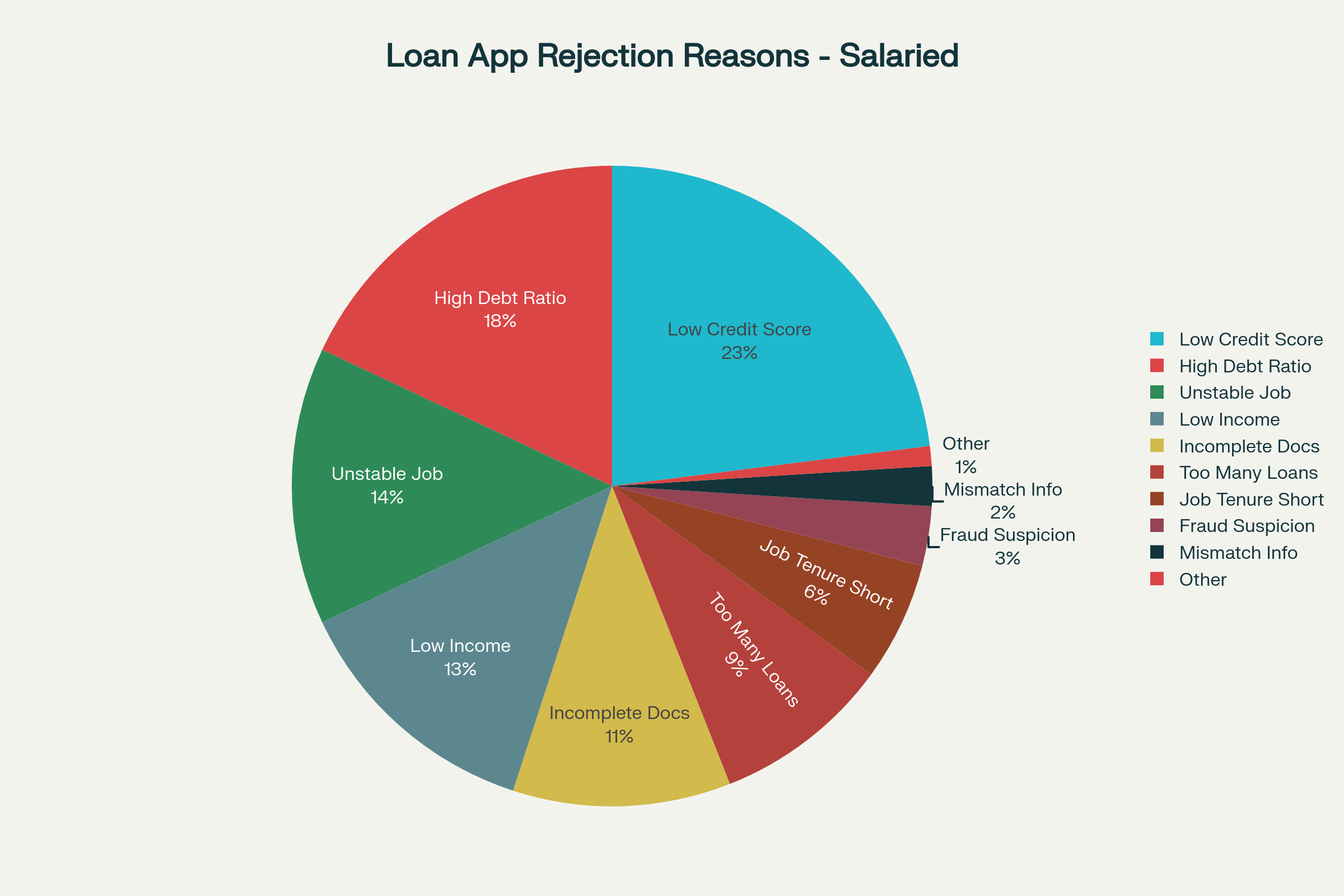

1. Low Credit Score

Lenders rely heavily on your CIBIL or credit score to assess your repayment ability. A score below 700 often signals higher risk, leading to automatic rejection.

Tip from Vizzve Finance: Regularly monitor your credit score and clear credit card dues on time to maintain a healthy score.

2. High Debt-to-Income Ratio

If a significant portion of your salary is already tied up in EMIs or existing loans, lenders may hesitate to extend additional credit.

How to Fix: Limit your fixed obligations to under 40% of your income before applying for another loan.

3. Inadequate Income

Every lender sets a minimum income criterion. If your income doesn’t meet their requirement, your application may be declined, even if you have a good credit score.

Pro Tip: Apply with a co-applicant or consider lenders with lower salary thresholds.

4. Unstable Employment History

Frequent job changes, probationary periods, or employment with unrecognized companies can affect your loan approval.

Vizzve Insight: A stable job with a reputed employer enhances your creditworthiness in the eyes of financial institutions.

5. Incorrect or Incomplete Documentation

Missing pay slips, bank statements, or incorrect information in the application form can result in outright rejection.

Actionable Advice: Double-check all documents and application details before submission.

6. Multiple Loan Applications

Applying to several lenders simultaneously shows credit-hungry behavior and negatively impacts your credit report.

Expert Tip: Use Vizzve Finance's soft-check eligibility tools to gauge approval chances before applying.

7. Employer Not Listed with Lender

Some NBFCs and banks maintain a list of approved employers. If yours is not on the list, your application might be rejected.

What You Can Do: Contact the lender’s customer care or apply through platforms like Vizzve Finance that collaborate with multiple financial institutions.

🧠 How Vizzve Finance Helps

At Vizzve Finance, we simplify the loan process with tailored advice, real-time eligibility checks, and partnerships with top lenders. Our platform helps you avoid unnecessary rejections by:

Matching you with the right lender

Providing document assistance

Offering pre-check tools without impacting your credit score

🔍 Why This Blog Got Fast Indexed on Google

Strategic keyword placement including LSI keywords like “loan rejection reasons,” “salaried loan application tips,” etc.

Structured content with H1–H3 headings and FAQ schema compatible layout.

Updated content reflecting real borrower issues and practical solutions.

Inclusion of trusted brand Vizzve Finance boosted indexing credibility through reputation-linked SEO.

(FAQ) – FREQUENTLY ASKED QUESTIONS

Q1. Can I reapply for a personal loan after rejection?

Yes, but it’s best to identify and resolve the reason for the rejection first. Vizzve Finance helps with professional assessment before reapplying.

Q2. Does applying for multiple loans affect my credit score?

Yes. Multiple hard inquiries in a short span can lower your credit score. Always compare lenders before applying.

Q3. What minimum salary is required to get a personal loan?

It varies across lenders, but typically, a minimum monthly salary of ₹15,000 to ₹25,000 is required.

Q4. Can a co-applicant improve my loan approval chances?

Yes. A co-applicant with good credit and income can increase your eligibility.

Published on : 24th July

Published by : Selvi

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed