When applying for a loan, most people only worry about interest rates and EMI amounts. But banks look at something far more important: your FOIR – Fixed Obligation to Income Ratio.

The FOIR rule helps lenders determine how much EMI you can safely afford without risking financial stress.

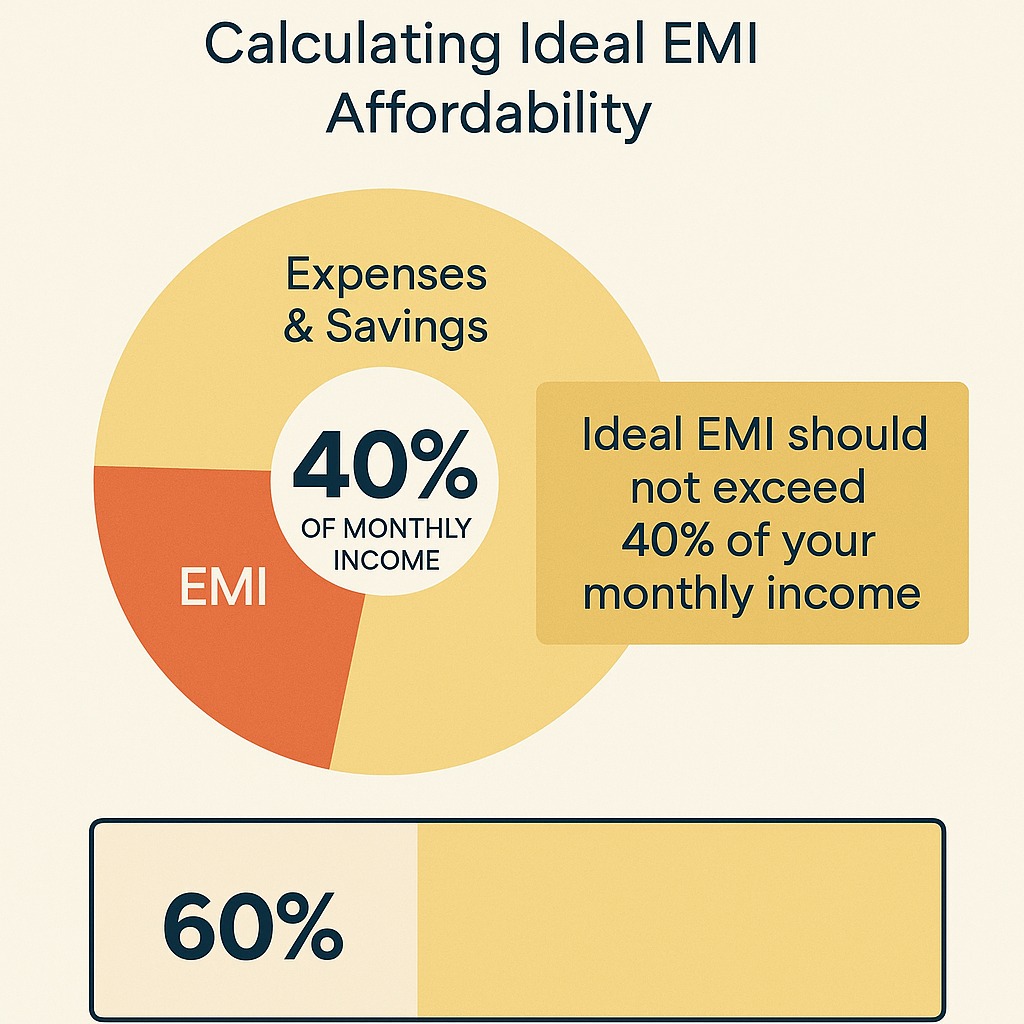

The general guideline followed in 2025–26 is the 40% FOIR Rule.

Understanding this rule can help you choose the right EMI, avoid loan rejections, and maintain a healthy credit profile.

What Is FOIR (Fixed Obligation to Income Ratio)?

FOIR represents the percentage of your monthly income that goes toward:

Existing EMIs

Credit card dues

Personal loan instalments

Car loan / bike loan

Any other fixed monthly financial obligations

Banks use FOIR to assess your repayment capacity.

The 40% FOIR Rule: The Gold Standard for EMI Affordability

Most lenders prefer that your total monthly financial obligations do not exceed 40% of your monthly income.

✔ Ideal FOIR: < 40%

✔ Acceptable FOIR: 40–50% (for high-income earners)

✘ Risky FOIR: > 50% → High rejection chances

The 40% cap ensures that you have enough income left for:

Living expenses

Savings

Emergencies

Lifestyle expenses

It protects both the borrower and the lender.

How to Calculate EMI Using the 40% FOIR Rule

Step 1: Find your net monthly income

Example: ₹60,000

Step 2: Add all existing EMIs

Car loan EMI → ₹8,000

Credit card EMI (converted) → ₹4,000

Total = ₹12,000

Step 3: Calculate 40% of your income

40% of ₹60,000 = ₹24,000

Step 4: Subtract existing EMIs

₹24,000 – ₹12,000 = ₹12,000

This means your maximum safe EMI = ₹12,000

This is the EMI you can comfortably pay without financial strain.

Why Banks Rely on FOIR More Than Income Alone

Even if you earn well, banks will not approve a large EMI if:

You already have multiple loans

Your credit card usage is high

Your FOIR crosses 40%

Banks use FOIR to minimise the risk of default.

Even a high credit score won’t compensate for a very high FOIR.

How to Improve FOIR Before Applying for a Loan

✔ Close small high-interest loans

✔ Reduce credit card outstanding

✔ Avoid converting multiple purchases into EMIs

✔ Increase your income documentation if possible

✔ Add a co-applicant to boost loan eligibility

✔ Opt for a longer tenure to reduce EMI

Even reducing FOIR by 5–10% can increase your loan approval chances.

Why Following the 40% Rule Is Important for You

Prevents financial stress

Ensures you can manage emergencies

Protects your credit score

Keeps loan EMIs affordable

Improves long-term financial stability

Maintaining FOIR below 40% is one of the smartest money habits.

FAQs

Q1. What is a safe FOIR for a salaried person?

Below 40% is ideal.

Q2. Can high-income individuals go beyond 40%?

Yes, some banks allow 45–55%, depending on income stability.

Q3. Does FOIR affect home loan approval?

Yes. Home loans heavily depend on FOIR because of their long tenure.

Q4. Is FOIR and DTI the same?

Similar concepts. FOIR includes only fixed obligations; DTI includes all debts.

Q5. How can I quickly reduce FOIR?

Close small loans, avoid credit card EMIs, and maintain low utilisation.

Published on : 15th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed