In a world where technology and home appliances upgrade quickly, buying everything upfront can be expensive. That’s where a consumer durable loan comes in. These loans make it easier to purchase electronics, home appliances, and gadgets on EMI without putting pressure on your savings.

Consumer durable loans are one of the fastest-growing credit products in India, especially due to zero-cost EMI schemes offered by banks, NBFCs, and retail partners like Croma, Reliance Digital, Amazon, and Flipkart.

Here’s a simple guide to understand what they are and how they work.

What Is a Consumer Durable Loan?

A consumer durable loan is a short-term loan that helps you buy consumer electronics and home appliances on EMI.

These can include:

Smartphones

Laptops, tablets

AC, fridge, washing machine

Smart TVs

Furniture

Kitchen appliances

Fitness equipment

Smart home gadgets

The best part?

Many lenders offer 0% interest EMIs, making big purchases more affordable.

Key Features of a Consumer Durable Loan

✔ Zero-Cost EMI Options

Retailers often tie up with lenders to offer interest-free EMIs.

✔ Quick Approval (5–10 minutes)

Most loans get approved instantly at the store or online checkout.

✔ Minimal Documentation

Aadhaar, PAN, and bank details are usually enough.

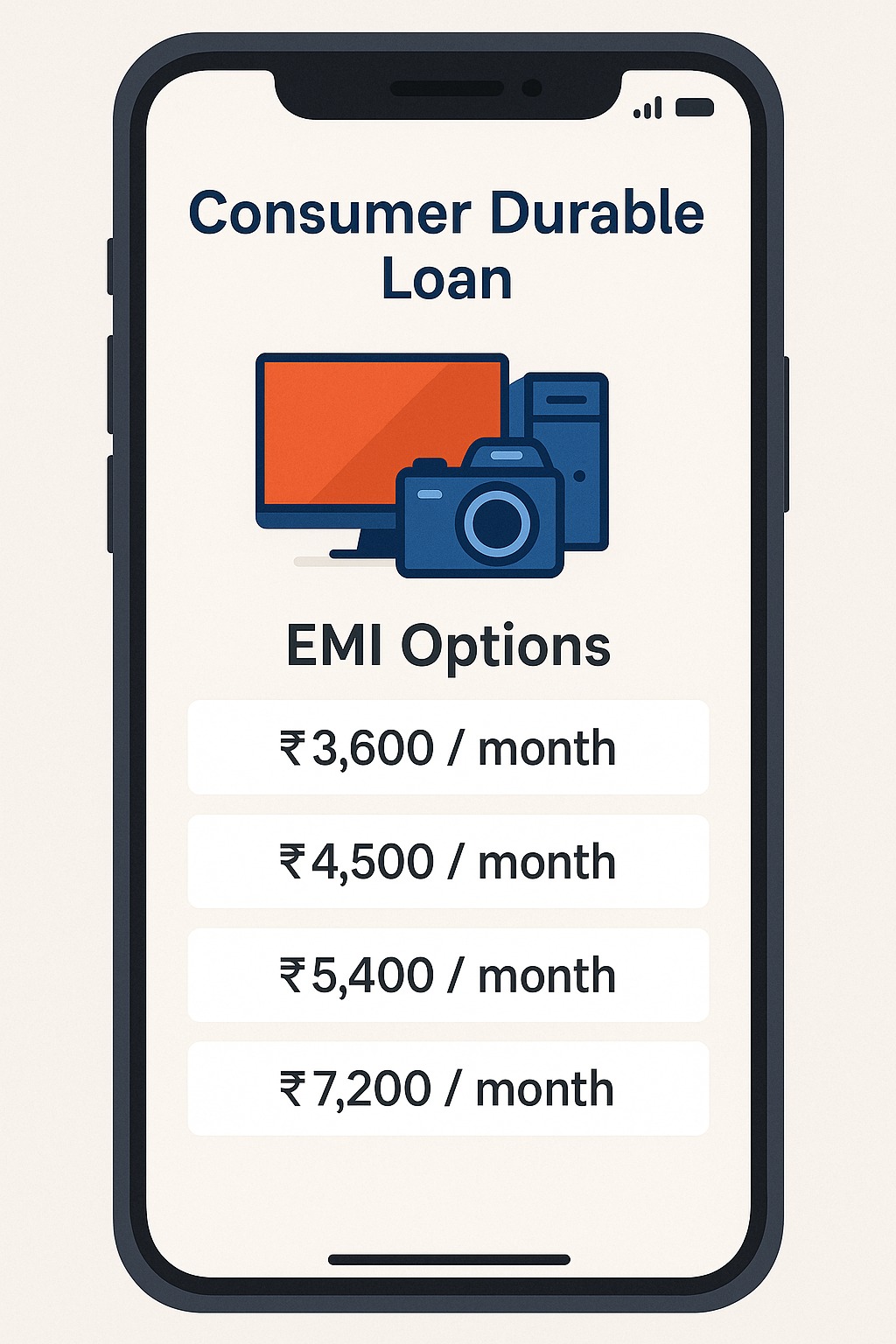

✔ Flexible Tenure

3 to 24 months, depending on the product and bank.

✔ No Collateral Required

It is an unsecured loan.

✔ Pre-approved Offers

Banks/NBFCs offer pre-approved consumer durable limits to existing customers.

✔ Processing Fee May Apply

Some “zero EMI” schemes include a small processing fee or GST.

What Can You Buy With a Consumer Durable Loan?

You can use it to buy almost any item used in daily life:

Electronics (TV, laptop, mobile)

Home & kitchen appliances

Furniture and décor

Gaming consoles

Smart home devices

Fitness and lifestyle equipment

Home inverter & battery

Eligibility Criteria

Eligibility varies, but typically:

✔ Age: 21 to 60 years

✔ Income: Minimum ₹12,000–₹20,000 monthly

✔ CIBIL/CRIF Score: 650+ preferred

✔ Employment: Salaried or self-employed

✔ Good repayment history

Students can apply if a parent/guardian is a co-borrower.

Documents Required

Aadhaar Card

PAN Card

Bank statement or salary slip

Address proof (if required)

Passport-size photo

At large retail stores, documentation is often fully digital.

How Does a Consumer Durable Loan Work?

Step 1: Choose a product (e.g., smartphone, AC)

Step 2: Select EMI plan at checkout (online / offline)

Step 3: Provide KYC documents and PAN

Step 4: Lender approves the loan instantly

Step 5: EMI begins next month from your bank account

If choosing zero-cost EMI, only principal is paid monthly, with interest subsidized by retailer or brand.

Benefits of a Consumer Durable Loan

✔ Buy expensive items without full upfront payment

✔ Zero-cost EMI makes gadgets affordable

✔ Helps build credit score if you repay on time

✔ Ideal for festival and big-sale seasons

✔ Supports easy upgrades for tech lovers

Common Charges to Watch Out For

Even with 0% EMI, some charges may apply:

Processing fee

GST on processing fee

Foreclosure charges

Late EMI penalty

Down payment (in some cases)

Always read the loan terms before confirming.

Should You Take a Consumer Durable Loan?

Yes, if:

You need an appliance urgently

You want affordable monthly EMIs

You are eligible for 0% interest

The loan fits your monthly budget

No, if:

The EMI will increase your debt burden

You already have high credit card utilization

❓ FAQs

1. What is the meaning of a consumer durable loan?

A short-term EMI loan used to buy electronics, appliances, and gadgets.

2. Is it the same as a personal loan?

No.

A consumer durable loan is smaller, quicker, and product-specific.

3. Do consumer durable loans charge interest?

Some are zero-cost EMIs; others may charge low interest.

4. Do I need a good credit score?

Yes, preferably 650+ for approval.

5. Can I foreclose the loan?

Yes, but some lenders may charge a small foreclosure fee.

Published on : 22nd November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed