EMIs have become one of the most popular repayment methods for purchases and expenses — from smartphones and travel to home appliances and emergencies. When choosing how to borrow, many people wonder:

“Should I convert my purchase into a credit-card EMI or apply for a personal loan?”

Both options provide immediate access to funds and allow repayment over time, but the cost, convenience, flexibility, and risk differ significantly. Your choice can impact not only your monthly budget, but also your interest payout, credit health, and future loan eligibility.

Let’s break it down in detail.

What Is Credit Card EMI?

A credit-card EMI allows you to convert a purchase or transaction into monthly installments directly through your card provider. It may include interest or be offered as a promotional “no-cost” plan depending on the product or merchant arrangement.

What Is a Personal Loan?

A personal loan is a separate unsecured loan taken from a bank, NBFC, or digital lender and repaid through fixed EMIs over a defined tenure, typically ranging from 12 to 60 months.

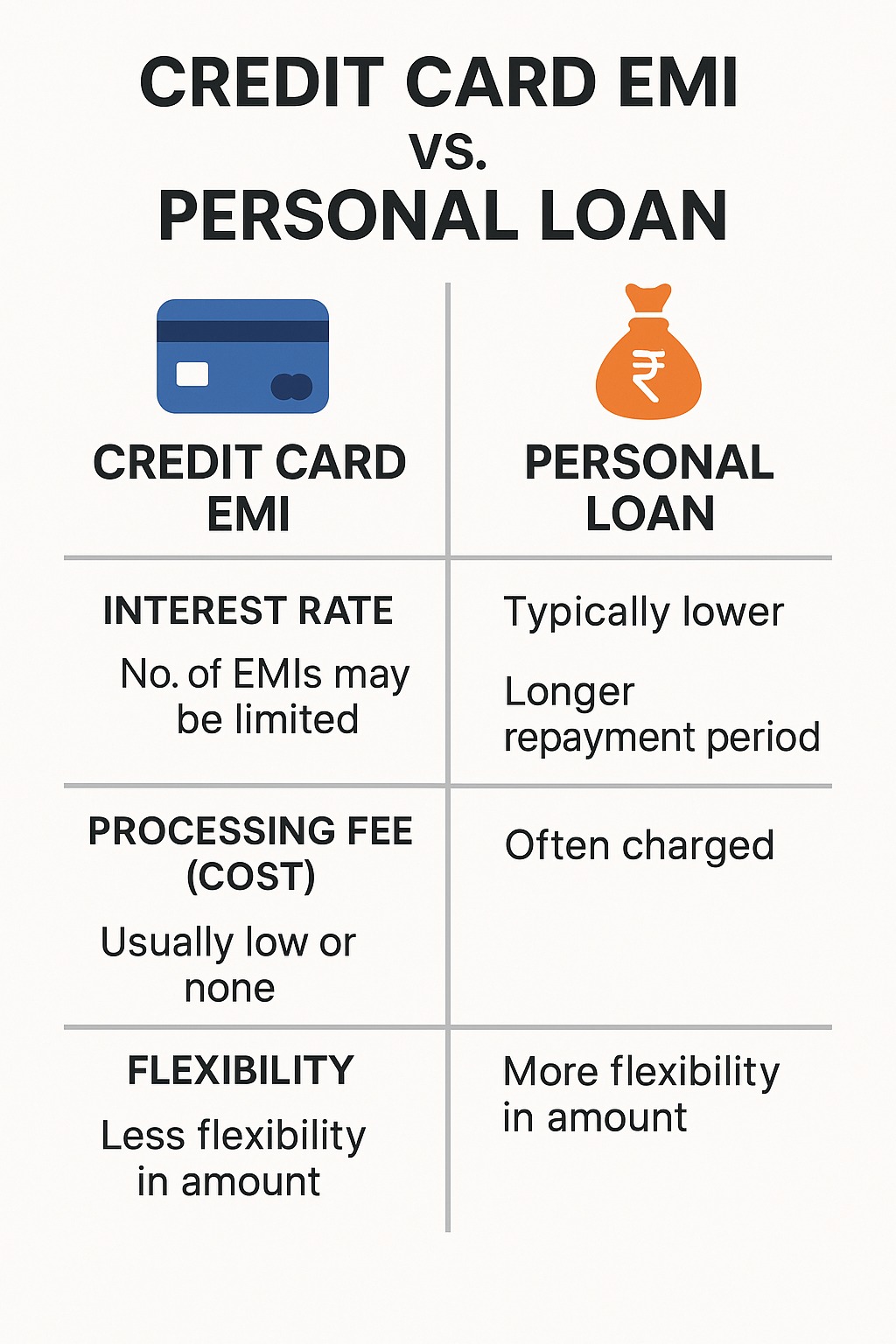

Deep Comparison: Credit Card EMI vs Personal Loan

| Comparison Factor | Credit Card EMI | Personal Loan |

|---|---|---|

| Approval Time | Instant (if eligible) | Few hours to days |

| Paperwork | Minimal / none | Basic documentation needed |

| Usage Type | Mainly purchase-linked | Free-use funds (any purpose) |

| Interest Rate | Low–medium (sometimes promotional) | Medium–high, based on profile |

| Tenure Flexibility | Limited (3–24 months usually) | Wider (12–60 months) |

| Processing Charges | Possible conversion fees + GST | Processing fees + GST |

| Prepayment | Often restricted or penalized | Usually allowed, sometimes penalized |

| Credit Impact | Higher utilization affects score | Separate loan improves credit mix |

| Purchase Discounts | Possible via offers/festivals | Not applicable |

| Eligibility | Based on card limit & usage | Based on credit profile/income |

When Credit-Card EMI Makes More Sense

Choose credit-card EMI if:

✔ You are buying a consumer durable, gadget, appliance, furniture, travel ticket, or service

✔ There is a genuine no-cost EMI offer

✔ The loan amount is relatively small

✔ You want instant and hassle-free approval

✔ You plan to repay within short tenure (3–12 months)

✔ You already have a good repayment habit and low card usage percentage

Avoid if your card limit will get blocked heavily and impact credit-utilization ratio.

When Personal Loan Is the Better Choice

Choose a personal loan if:

✔ You need cash in hand for medical, education, relocation, business, wedding, home improvement, or debt consolidation

✔ You require a longer tenure with manageable EMI

✔ The amount is high and not suitable for card conversion

✔ You prefer structured repayment with a long timeline

✔ You want to keep credit-card limits available for emergencies

Important Hidden Factors to Check

1️⃣ Total Cost of Borrowing (TCO)

Calculate: Interest + Fees + GST + Loss of Discount

2️⃣ Credit Utilization Ratio

High card limit usage lowers credit score, even if you repay on time.

3️⃣ Prepayment Policies

Some EMI plans don’t allow early closure without fees.

4️⃣ Impact on Future Loan Approvals

Banks evaluate both outstanding loans and credit-card balances.

Expert Recommendation (Balanced View)

| Scenario | Better Choice |

|---|---|

| Small purchase + offer available | Credit-card EMI |

| Large high-value requirement | Personal Loan |

| Need quick funding | Credit-card EMI |

| Need repayment flexibility | Personal Loan |

| Want lowest cost | Compare offers → pick lowest TCO |

| No stable income | Avoid both unless emergency |

❓ FAQs

Q1. Is credit-card EMI really cheaper than a personal loan?

Sometimes yes, but not always. It depends on interest rate, offer availability, and processing charges.

Q2. Does converting to EMI hurt my credit score?

Not directly, but a high utilization ratio can lower your score temporarily.

Q3. Can I prepay a credit-card EMI?

Often restricted — check your provider’s prepayment terms.

Q4. Which is safer?

Both are safe if you can repay comfortably and don’t borrow for impulse purchases.

Q5. What if I already have multiple EMIs?

Consolidation through a single personal loan may reduce monthly burden and interest.

Published on : 17th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed