Financing a personal or business project can be challenging. Today, individuals and entrepreneurs have multiple options—traditional loans from banks or NBFCs and crowdfunding platforms. Each method has unique advantages, costs, and implications. Choosing the right funding source is crucial for project success and financial health.

This blog explores crowdfunding vs loans, helping you decide which option suits your personal or business needs.

Understanding Crowdfunding

Crowdfunding is a method of raising funds from a large number of people, usually via online platforms. It can take different forms:

Donation-Based – Supporters contribute without expecting a return. Often used for social causes or personal emergencies.

Reward-Based – Backers receive a product, service, or perk in exchange for funding. Common in creative projects and startups.

Equity-Based – Investors receive shares in a business or project. Typical for startups seeking growth capital.

Debt-Based (Peer-to-Peer Lending) – Borrowers raise loans directly from individuals, often at lower rates than traditional banks.

Pros of Crowdfunding:

Quick access to funds without traditional collateral.

Market validation for creative or innovative projects.

Builds a community of supporters or early adopters.

Cons of Crowdfunding:

Requires effective marketing and presentation.

Success is not guaranteed; campaigns can fail.

Equity crowdfunding dilutes ownership.

Understanding Loans

Loans are funds borrowed from banks, NBFCs, or microfinance institutions that must be repaid with interest. They come in multiple forms:

Personal Loans – Unsecured loans for personal expenses, usually with higher interest rates.

Business Loans – Can be secured or unsecured, used for operations, expansion, or capital expenditure.

Microloans – Small loans often used for microbusinesses or emergency personal needs.

Pros of Loans:

Predictable repayment schedule.

No need to give away equity in your business.

Widely accessible through formal banking channels.

Cons of Loans:

Interest and fees increase overall cost.

Approval can require collateral, credit history, and documentation.

Financial burden if the project fails or revenue is delayed.

Crowdfunding vs Loans: Key Differences

| Feature | Crowdfunding | Loans |

|---|---|---|

| Funding Source | Many individuals online | Banks, NBFCs, or lenders |

| Repayment | Often no repayment (donation/reward) or equity sharing | Mandatory repayment with interest |

| Approval | Campaign success depends on marketing and appeal | Depends on credit score, documentation, and collateral |

| Cost | Platform fees; minimal financial burden | Interest and processing fees |

| Ownership | Equity may be shared in some cases | No ownership dilution |

| Risk | Campaign may fail; uncertain funding | Borrower bears repayment risk |

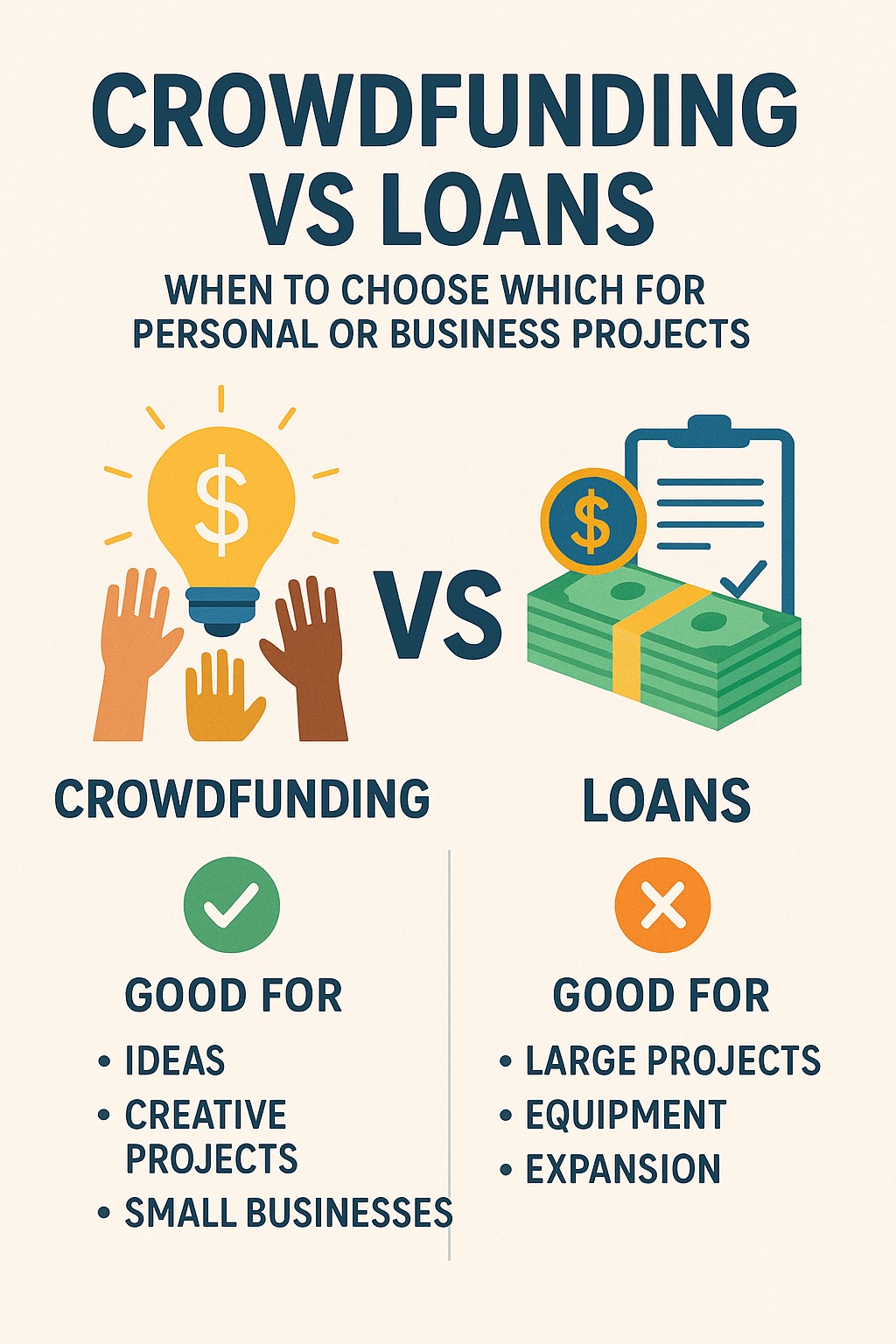

When to Choose Crowdfunding

Best for:

Creative projects (films, apps, arts)

Social causes or community initiatives

Startups seeking early-stage capital without giving away equity immediately

Projects needing market validation before launch

Example:

A startup creating a new eco-friendly gadget can raise funds via a reward-based crowdfunding campaign, gauging interest and collecting pre-orders before mass production.

When to Choose Loans

Best for:

Business expansion or operational financing with predictable cash flow

Personal emergencies or immediate liquidity needs

Projects where ownership retention is critical

Situations where marketing a campaign is not feasible

Example:

A bakery planning to expand to a new location may opt for a business loan, as it ensures predictable funding without diluting ownership, and repayments can be managed via projected revenue.

Hybrid Approach

In some cases, combining crowdfunding and loans can be strategic:

Use crowdfunding to test market demand and collect pre-orders.

Use a bank loan to scale production once the project is validated.

This approach balances risk, cost, and ownership, while leveraging the strengths of both funding methods.

Conclusion

Choosing between crowdfunding and loans depends on project type, urgency, financial capacity, and long-term goals.

Crowdfunding works best for creative projects, market validation, and community-driven initiatives.

Loans are suitable for predictable revenue projects, personal emergencies, or business expansion requiring control over ownership.

Understanding the pros, cons, and strategic use of both options can ensure your personal or business project succeeds financially and operationally.

Published on : 29th August

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share