Debt mutual funds continue to be a popular choice for investors seeking stable returns with lower risk compared to equities. In 2025, debt funds are presenting new opportunities and challenges amid a shifting interest rate environment and evolving market trends. Understanding these factors is essential for informed investment decisions.

1. Interest Rate Trends and Impact

The Reserve Bank of India (RBI) has adopted an accommodative monetary policy in 2025, leading to lower interest rates.

The 10-year government bond yield has declined significantly, benefiting long-duration debt funds.

When interest rates fall, bond prices rise, resulting in higher returns for existing debt fund investments.

If inflation remains stable, further rate cuts may enhance debt fund performance.

Investor Tip: Long-duration debt funds may offer higher returns in a declining rate environment, but also carry more interest rate sensitivity.

2. Opportunities in State Development Loans (SDLs)

State Development Loans (SDLs) are increasingly attractive in 2025 due to:

Competitive yields compared to standard government securities

Improved fiscal positions of states, reducing credit risk

Investors seeking slightly higher returns with manageable risk can consider SDL-focused debt funds or funds investing in a mix of government securities.

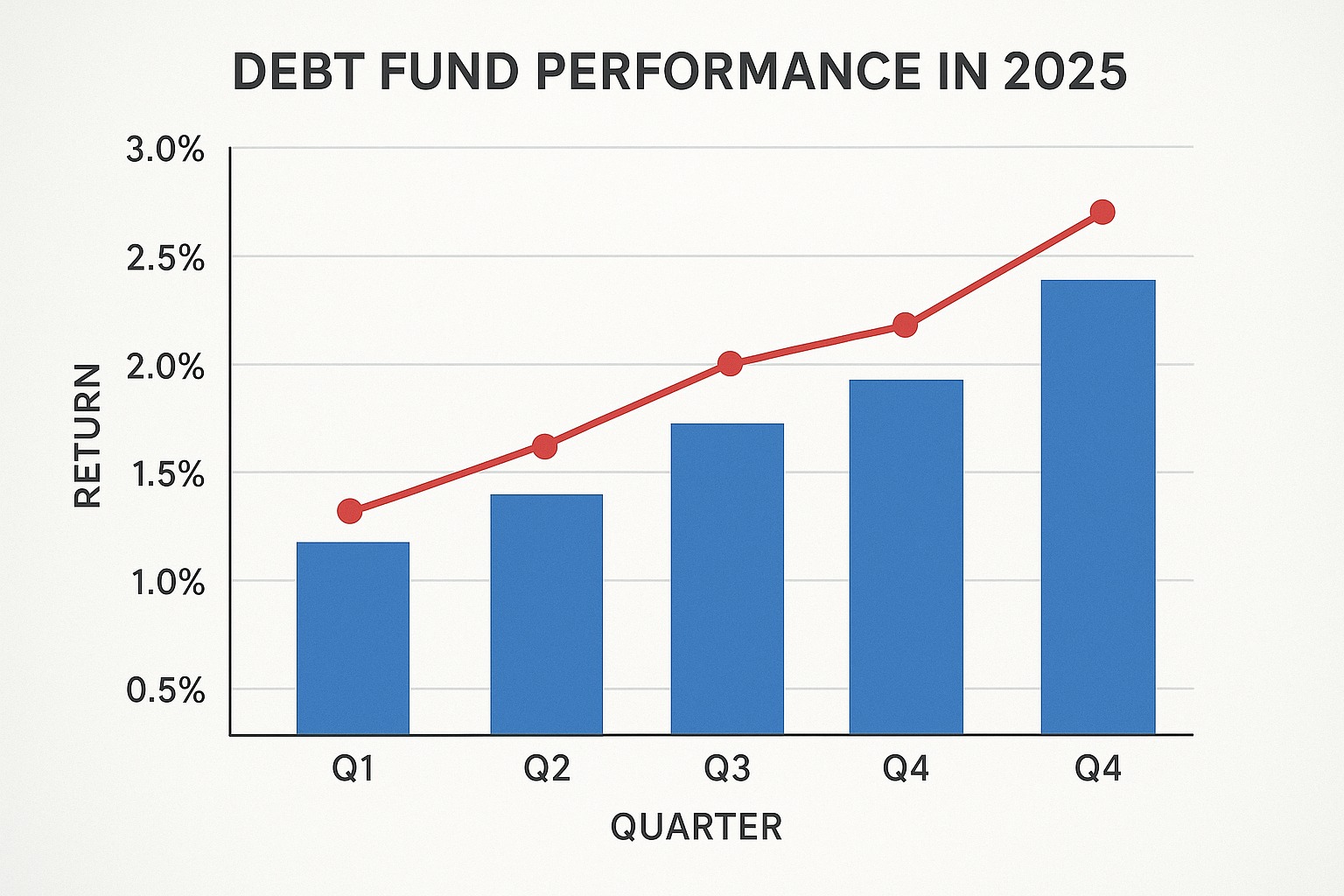

3. Performance of Debt Mutual Funds

Several categories of debt funds have performed well:

Medium-Term Bond Funds: Benefiting from falling interest rates, these funds are delivering steady returns.

Corporate Bond Funds: Offer higher yields with moderate credit risk.

Short-Term Debt Funds: Ideal for low-risk investors seeking liquidity and stable returns.

Example: Annualized returns for top-performing debt funds in recent years have ranged from 7% to 8%, reflecting the impact of declining interest rates and strategic bond allocations.

4. Global and Emerging Market Perspectives

Emerging market debt remains attractive for international investors due to higher yields and favorable economic conditions.

While not directly accessible to all retail investors, global trends reinforce the growing appeal of debt investments in 2025.

5. Considerations and Risks

Even with attractive opportunities, debt fund investors should be aware of risks:

Interest Rate Sensitivity: Long-duration funds may lose value if rates unexpectedly rise.

Credit Risk: Funds investing in corporate bonds or SDLs carry credit risk; careful evaluation is essential.

Inflation Risk: Unexpected inflation can erode real returns.

Investor Tip: Assess your risk tolerance and financial goals before choosing debt fund categories.

6. Strategies to Optimize Debt Fund Investments

Diversify: Mix medium-term, short-term, and corporate bond funds.

Monitor Rates: Align fund selection with prevailing interest rate trends.

Check Credit Quality: Invest in high-quality bonds to minimize default risk.

Invest Systematically: Consider SIPs for consistent portfolio growth.

Stay Informed: Review fund performance periodically and adjust allocations as needed.

Conclusion

Debt funds in 2025 offer stability, predictable returns, and strategic opportunities, especially in a falling interest rate environment. By carefully selecting funds, monitoring risk factors, and aligning investments with financial goals, investors can maximize benefits while managing exposure.

Debt funds are not only suitable for conservative investors but also serve as a portfolio diversifier for long-term financial planning.

FAQ Section

Q1: Are debt funds safe in 2025?

Debt funds are generally safer than equities, but they are not risk-free. Interest rate and credit risk should be considered.

Q2: Which debt funds are likely to perform best?

Medium-term bond funds and high-quality corporate bond funds may benefit most from declining interest rates.

Q3: How does a falling interest rate affect debt funds?

When rates fall, bond prices rise, increasing the NAV of debt funds, especially long-duration funds.

Q4: Should I invest in SDL-focused funds?

Yes, SDLs can offer slightly higher returns with moderate risk, suitable for investors seeking government-backed investments.

Q5: How often should I review my debt fund portfolio?

At least quarterly, or whenever there are significant interest rate or market changes.

Published on : 12th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share