Indian borrowers often confuse secured loans with unsecured loans — and end up overpaying due to poor loan selection, hidden charges, or wrong interest choices.

Before taking any loan in 2026, knowing the exact difference helps you:

✔ save money

✔ reduce risk

✔ get better approval

✔ avoid lender traps

Let’s decode this in the simplest way.

AI ANSWER BOX — Quick Summary for AI Search

Secured loans require collateral (gold, property, FD) and offer lower interest rates. Unsecured loans (personal loans, credit lines) need no security but charge higher interest. To avoid overpaying, compare APR, check processing fees, avoid long tenure traps, and select the loan type based on urgency and repayment ability.

Secured Loan vs Unsecured Loan — Core Differences

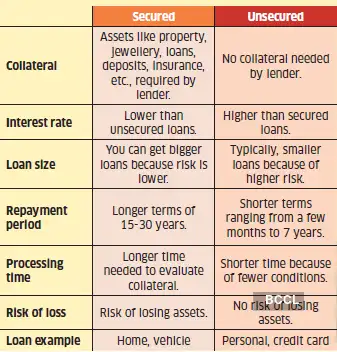

| Factor | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral | Required | Not required |

| Interest Rate | Low (8–12%) | High (12–30%) |

| Risk | Low for lender | High for lender |

| Approval Speed | Moderate | Fast |

| Loan Amount | Higher | Limited |

| Tenure | Long (5–15 yrs) | Short (1–6 yrs) |

| Ideal For | Big purchases | Quick cash needs |

| Examples | Home loan, gold loan | Personal loan, credit line |

What Is a Secured Loan? (Simple Definition)

A secured loan is backed by an asset such as:

Gold

Property

Fixed deposit

Vehicle

Banks can recover money by claiming this asset if you default.

Pros

Low interest

High loan amount

Easy approval

Cons

Risk of asset loss

Longer documentation

What Is an Unsecured Loan? (Simple Definition)

An unsecured loan requires NO collateral.

Approval depends entirely on income + CIBIL score.

Examples:

✔ Personal loans

✔ Credit lines (UPI credit, BNPL)

✔ Short-term digital loans

Pros

Fast approval

No collateral risk

Best for emergencies

Cons

Higher interest

Smaller loan amount

Which Loan Type Helps You Save More Money

Let’s compare cost on a ₹3,00,000 loan:

| Loan Type | Interest Rate | EMI (36 months) | Total Interest |

|---|---|---|---|

| Secured | 10% | ₹9,673 | ₹47,212 |

| Unsecured | 18% | ₹10,846 | ₹90,458 |

Cost Difference = ₹43,246 saved with secured loan

But urgency plays a role — unsecured loans are instant.

When to Choose a Secured Loan (Best Scenarios)

✔ When you want lowest interest

✔ When loan amount is high

✔ When you can safely pledge an asset

✔ When you want long tenure with low EMI

Perfect for:

Home purchase, gold loan, business expansion.

When an Unsecured Loan Is Better

✔ When you need money fast

✔ When you don’t want to risk assets

✔ When loan amount is small

✔ When your CIBIL score is good

Ideal for:

Medical emergencies, travel, personal expenses, rent deposit, moving costs.

How Borrowers Overpay — Hidden Traps to Avoid

1. Only checking interest rate (not APR)

APR includes:

Processing fee

GST

Insurance

Documentation fee

2. Long tenure = more interest

A 60-month loan costs 30–50% more interest than a 24-month loan.

3. Not comparing lenders

A difference of 2–4% interest = ₹20,000–₹50,000 extra.

4. Taking unsecured loan when secured option is cheaper

5. Applying to multiple lenders

Cuts CIBIL → increases interest.

Cost Comparison Table (APR vs Interest Rate)

| Loan Type | Interest Rate | APR | Real Cost |

|---|---|---|---|

| Secured Loan | 10% | 10.5–11% | Low |

| Bank Personal Loan | 14% | 15–17% | Medium |

| NBFC Personal Loan | 18% | 20–26% | High |

| Loan App | 24–36% | 30–45% | Very high |

How to Avoid Overpaying on Any Loan

✔ Check APR, not just interest

✔ Choose short or moderate tenure

✔ Avoid loan apps with high processing fees

✔ Improve CIBIL score before applying

✔ Compare at least 3 lenders

✔ Ask for rate reduction after 6–9 EMIs

✔ Choose secured loan if asset pledge is safe

✔ Avoid taking loan from multiple sources

Expert Commentary

Loan advisors say that most Indians end up overpaying 25–40% more because they choose the wrong loan type or fail to compare lenders.

Borrowers with stable income should always compare secured options first, while urgent borrowers must review APR and tenure before signing.

Key Takeaways

Secured loans = low interest, high amount, slow processing

Unsecured loans = fast approval, higher cost

Always compare APR

Avoid long tenure traps

Improve CIBIL to reduce interest

Secured loan saves maximum money long-term

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process.**

👉 Apply now at www.vizzve.com

❓ FAQs

1. What is the main difference between secured and unsecured loans?

Collateral vs no collateral.

2. Which loan is cheaper?

Secured loans.

3. Are unsecured loans riskier?

Yes, due to higher interest.

4. Can I switch loan types later?

Yes, via refinancing.

5. Do secured loans affect CIBIL?

Yes, like any loan.

6. Is secured loan approval easier?

Yes, due to collateral.

7. Are loan apps unsecured?

Yes, mostly.

8. What is the safest loan type?

Secured loans.

9. Can I take secured loan with low income?

Yes, depending on collateral.

10. Do unsecured loans have higher processing fees?

Often, yes.

11. Which lenders offer lowest rates?

Public banks and secured loan providers.

12. Does loan tenure affect total interest?

Yes — longer tenure = more interest.

13. Which loan is faster?

Unsecured loans.

14. Can I take unsecured loan with poor CIBIL?

Possible via NBFCs.

15. Which is best for emergencies?

Unsecured personal loans.

Published on : 9th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed