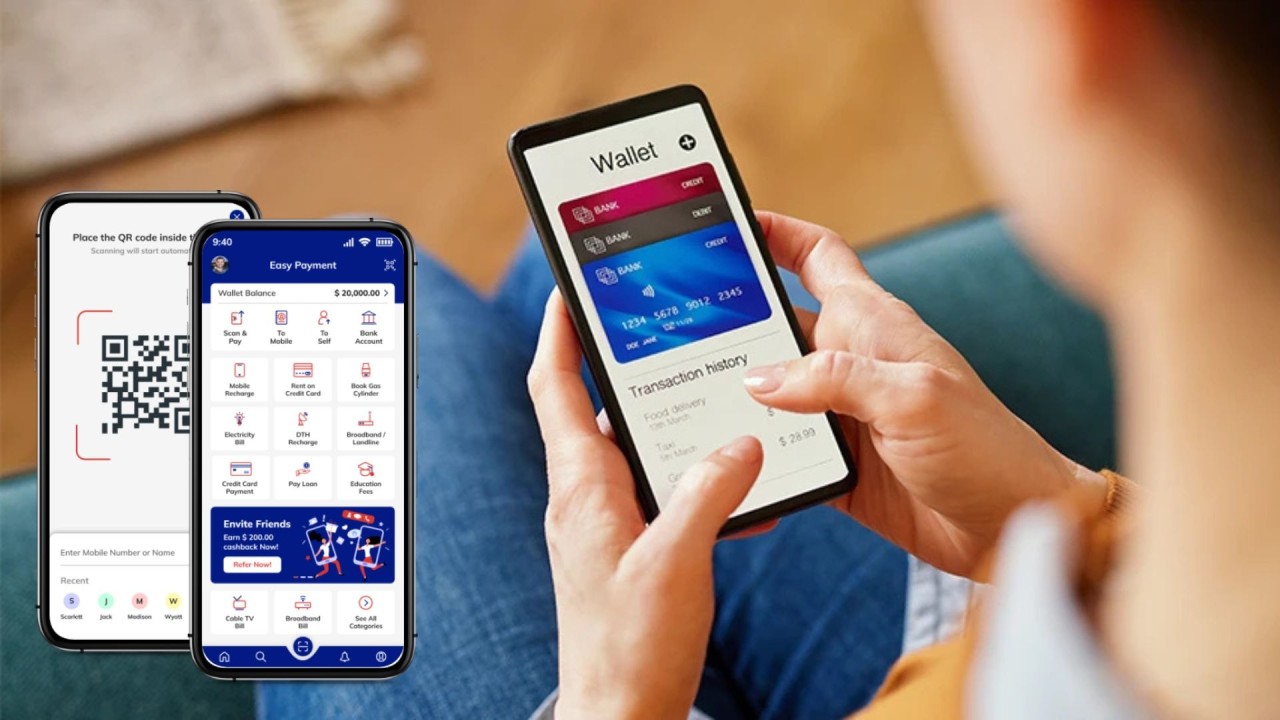

The way we handle money is evolving rapidly. Digital wallets and traditional banking offer distinct advantages and limitations. Understanding their pros and cons helps you choose the right solution for your daily transactions, savings, and financial planning.

Digital Wallets: Pros

Convenience: Pay bills, shop online, and transfer money instantly.

Fast Transactions: Payments and peer-to-peer transfers are nearly instantaneous.

Rewards & Cashback: Many wallets offer discounts, loyalty points, and cashback.

Accessibility: Use anywhere with internet access, often with minimal paperwork.

Budgeting Features: Some wallets track expenses, helping you manage spending efficiently.

Digital Wallets: Cons

Limited Acceptance: Not all merchants accept digital wallets.

Security Risks: Potential vulnerability to hacking or fraud if security measures are weak.

Transaction Limits: Daily or monthly limits may restrict usage.

Dependency on Internet: Requires stable internet or mobile connectivity.

Traditional Banking: Pros

Trust and Reliability: Banks are highly regulated, providing security for deposits and savings.

Comprehensive Services: Access to loans, credit cards, insurance, and investment options.

Wider Acceptance: Most merchants, online and offline, accept bank transfers or cards.

Insurance Protection: Deposits often insured up to a certain limit, giving financial safety.

Traditional Banking: Cons

Slower Transactions: Bank transfers may take hours or days, especially interbank transfers.

Limited Convenience: Requires visiting branches for certain services.

Fees and Charges: Some banks levy maintenance fees or transaction charges.

Less Incentives: Few direct cashback or loyalty rewards compared to digital wallets.

Choosing the Right Option

For Everyday Payments: Digital wallets are fast and convenient.

For Large Savings & Loans: Traditional banking provides security and comprehensive services.

Balanced Approach: Use a combination of both to maximize convenience and security.

Conclusion

Both digital wallets and traditional banking have unique benefits and drawbacks. While wallets excel in speed and convenience, banks provide security and financial services. The ideal choice depends on your financial needs, spending habits, and security preferences. A hybrid approach often offers the best of both worlds.

FAQ

Q1: Are digital wallets safe to use?

Yes, most wallets use encryption and two-factor authentication, but users must follow security best practices.

Q2: Can digital wallets replace traditional banks?

Not entirely; wallets are ideal for transactions, while banks handle savings, loans, and investments.

Q3: Do digital wallets charge fees?

Some wallets charge for bank transfers or large payments, while many basic transactions remain free.

Q4: Are traditional banks necessary for everyone?

Yes, for long-term savings, loans, and legal financial protection, banks are essential.

Q5: Can I use both together?

Absolutely! Many people link wallets to bank accounts for convenience and flexibility.

Published on : 10th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share