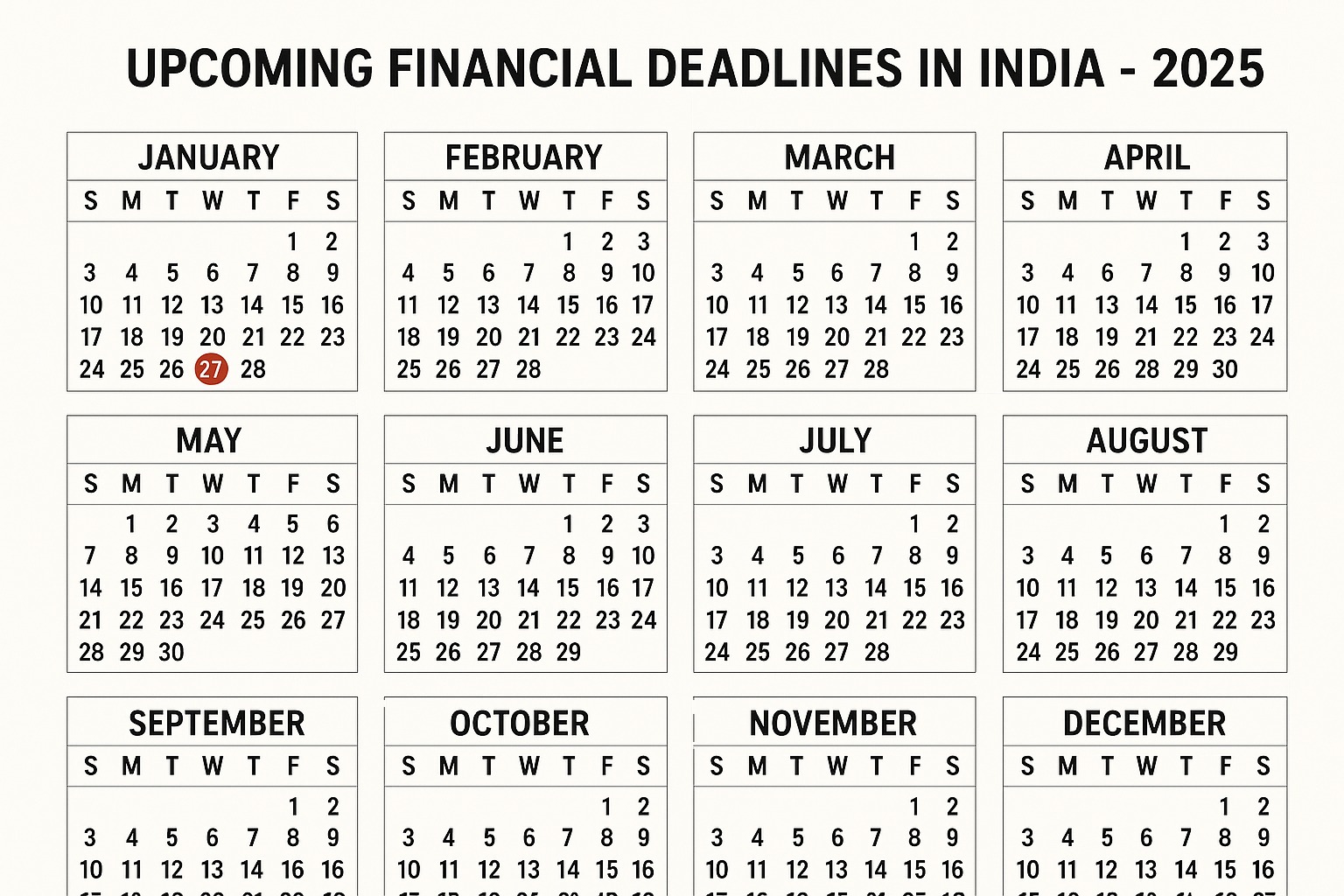

Managing your finances efficiently requires staying updated on important deadlines. Missing tax, investment, or loan-related dates can lead to penalties, interest charges, or missed opportunities. This guide gives you a complete overview of upcoming financial deadlines in India for 2025 so you can plan ahead.

Why Tracking Financial Deadlines Matters

Avoid Penalties: Late payments for taxes, EMIs, or statutory dues often come with fines.

Maximize Returns: Meeting deadlines for investments like ELSS, PPF, or mutual funds can enhance your wealth growth.

Financial Discipline: A structured approach helps you manage cash flow, loans, and expenses efficiently.

Peace of Mind: Knowing all key dates reduces stress during financial year-end.

Key Upcoming Financial Deadlines

1. Income Tax Deadlines

Filing ITR for Individuals (FY 2024-25):

Deadline: 31st July 2025 (for most individuals)

Penalty for Delay: ₹5,000 to ₹10,000 depending on income

Advance Tax Installments:

Deadline:

1st Installment: 15th June 2025

2nd Installment: 15th September 2025

3rd Installment: 15th December 2025

4th Installment: 15th March 2026

2. GST Filing Deadlines

GSTR-1 (Monthly for July 2025): 11th August 2025

GSTR-3B (Monthly for July 2025): 20th August 2025

Quarterly Filers (GSTR-1 Q1): 31st October 2025

3. Investment Deadlines

PPF Contribution for FY 2025-26: 31st March 2026

ELSS Investment for Tax Deduction (FY 2024-25): 31st March 2025

NPS Contributions for Tax Benefits: 31st March 2025

4. Loan & EMI Deadlines

Home Loan EMI: Monthly, check with your bank

Personal Loan EMI: Monthly, check with your lender

Education Loan EMI: Monthly, flexible depending on moratorium

5. Other Key Financial Dates

FD Maturity & Renewal: Track your bank statement for maturity dates

Insurance Premiums: Renewal dates for health, life, or vehicle policies

Property Tax Payments: Check municipal schedules

Tips to Never Miss a Deadline

Use Digital Reminders: Calendar alerts or mobile apps.

Set Auto-Pay for EMIs & Premiums: Avoid late charges automatically.

Maintain a Financial Diary: Track investments, taxes, and contributions.

Check Emails from Banks & Authorities: Alerts often include deadlines.

FAQ

Q1: What happens if I miss the income tax filing deadline?

Missing the ITR deadline can attract penalties of ₹5,000 to ₹10,000 and interest on unpaid taxes. It may also affect future loan approvals.

Q2: Can I pay GST after the due date?

Yes, but late payments attract interest and penalties. Timely filing avoids complications with audits and compliance.

Q3: Is there a grace period for PPF contributions?

Some banks may allow a short grace period, but it’s best to contribute before 31st March to claim tax benefits for the financial year.

Q4: How do I track all my EMIs and due dates?

Use a personal finance app or spreadsheet. Setting calendar reminders for each EMI and premium ensures you never miss payments.

Q5: Are deadlines same for salaried individuals and businesses?

No, deadlines for businesses, GST, and corporate taxes differ from individual taxpayers. Always verify based on your category.

Published on : 2nd September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share