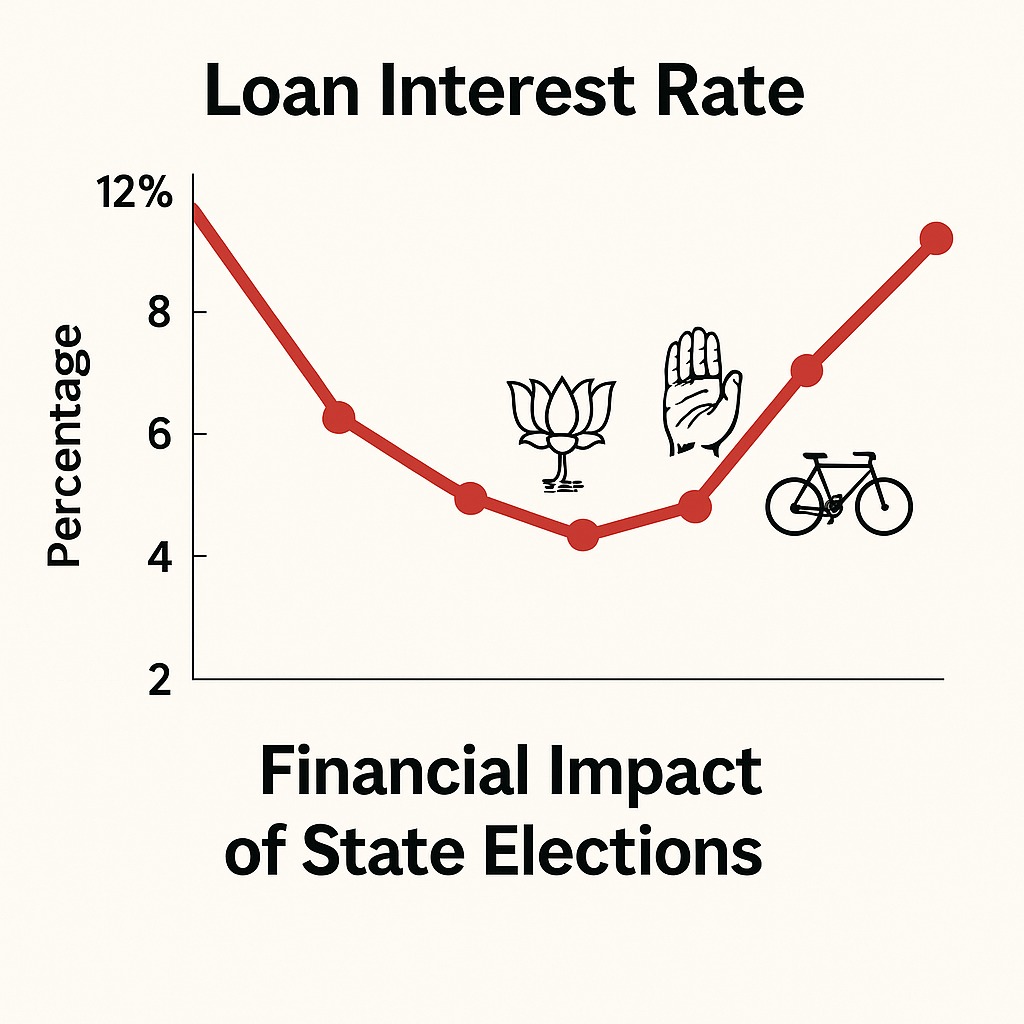

Most borrowers assume loan interest rates change only due to RBI policy. But in reality, state elections—especially in large states—can indirectly influence how banks price loans. As we head into a politically packed 2025–26 cycle, it’s important for customers to understand how elections shape the financial environment.

Election outcomes affect government spending, inflation outlook, banking liquidity, and market confidence—all of which can impact interest rates on home loans, personal loans, car loans, business loans and credit cards.

Here’s a breakdown of how state polls can affect your EMIs.

1. Government Spending Surges During Elections

State governments typically increase spending on:

Infrastructure

Welfare schemes

Subsidies

Last-mile development work

Higher spending often pushes demand in the economy, which can raise inflation.

If inflation rises, banks may:

Increase lending rates

Tighten approval norms for high-risk borrowers

Reduce special low-interest offers

This effect is usually most visible before and shortly after elections.

2. Market Sentiment Affects Borrowing Costs

Investors prefer political stability.

When election results are uncertain:

Markets turn volatile

Bond yields rise

Banking liquidity tightens

Higher bond yields often push loan rates upward because banks’ borrowing cost climbs. Once results stabilise and markets settle, rates may ease again.

3. RBI’s Policy Stance During Election Period

While the RBI remains politically neutral, it becomes extra cautious during election seasons.

Instead of aggressive rate cuts or hikes, the central bank often:

Maintains stable repo rates

Avoids bold policy shifts

Focuses on controlling inflation

This means borrowers should not expect dramatic interest-rate drops around election months.

4. Banks Offer Limited Loan Discounts During Polls

Contrary to festive seasons, banks usually avoid large rate cuts during elections because:

Liquidity may be unpredictable

Cash demand increases

Market risk rises

Instead of cheaper loans, banks focus on safer, low-risk lending policies.

This is especially relevant for personal loans and business loans.

5. Impact on Home Loan Borrowers

Home loans are most sensitive to interest rate fluctuations.

During election years:

Banks may keep home loan rates steady

Discounts for new buyers become selective

Balance-transfer offers reduce

Processing-fee waivers become rare

However, if the election outcome leads to strong market confidence, home loan rates can soften in the following quarter.

6. MSMEs & Businesses Are Affected the Most

Small businesses depend heavily on:

Working capital loans

Cash credit

Business term loans

Election cycles can:

Delay project funding

Slow credit approvals

Increase temporary borrowing costs

Once a new government stabilises, banks usually resume aggressive MSME lending.

7. What Customers Should Expect in 2025–26

With multiple major state elections coming up, borrowers should prepare for:

Slightly higher loan rates during peak election periods

Limited access to low-cost personal loans

Stable (but not falling) home loan rates

Stronger competition among banks after results, leading to better offers

If inflation remains under control, loan rates may begin easing in late 2026.

How Borrowers Can Prepare

✔ Lock in fixed-rate loans if EMI stability is important

✔ Compare offers from at least 3 banks

✔ Avoid unnecessary hard inquiries during election quarter

✔ Maintain a strong credit score to secure the best rates

✔ Consider delaying large loans until after results—if possible

FAQs

Q1. Do elections directly change loan interest rates?

Not directly, but they influence inflation, liquidity and market sentiment, which impact lending rates.

Q2. Will home loan rates rise in 2025–26 due to elections?

Rates may remain steady or slightly increase depending on inflation trends during the election period.

Q3. Is it good to take a loan during election season?

Banks offer fewer discounts, so waiting until markets stabilise may offer better deals.

Q4. How does election uncertainty affect borrowers?

It increases market volatility, pushing banks to adopt cautious lending.

Q5. When do loan rates usually stabilise?

Typically within 1–2 quarters after election results, once financial markets settle.

Published on : 15th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed