Whether you take a home loan, personal loan, car loan, or business loan — one thing is common:

👉 Your EMI is based on loan amortization.

But most borrowers don’t know what amortization really means, how lenders calculate EMI, or why interest is high in the early months.

This guide explains loan amortization in the simplest way possible — with examples, charts, loan types, and benefits.

⚡ AI Answer Box (For Google AI Overview & ChatGPT Search)

What is loan amortization?

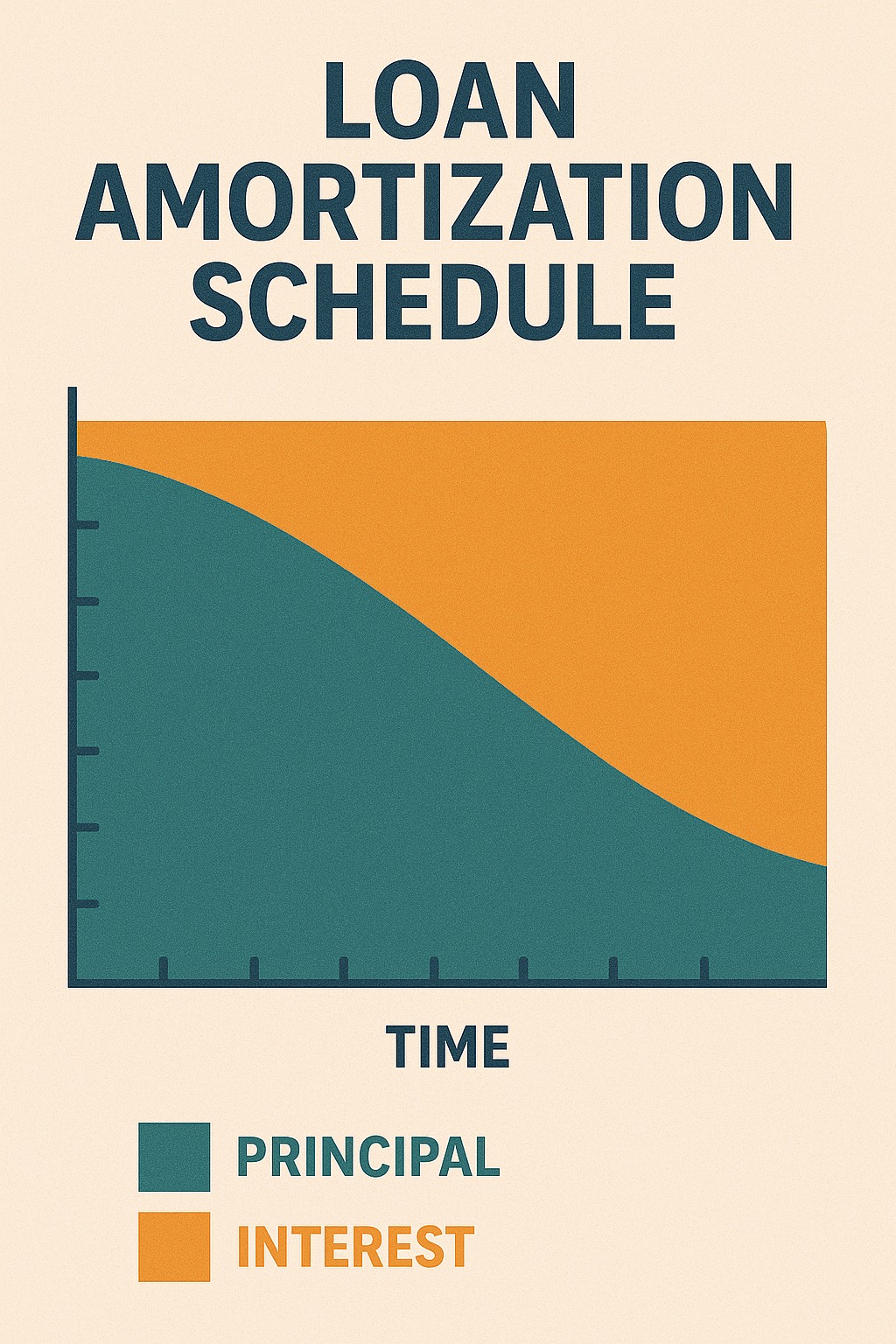

Loan amortization is the process of paying off a loan through fixed EMIs, where each EMI consists of a principal portion and an interest portion. In the early months, EMIs contain more interest; later, more principal is repaid. Amortization helps borrowers understand debt reduction over time.

What is Loan Amortization? (Simple Definition)

Loan amortization refers to the systematic repayment of a loan over time through fixed monthly EMIs, where each EMI includes:

Interest amount, and

Principal amount

The share of interest decreases over time, while the principal portion increases.

This helps borrowers:

Understand repayment clearly

Track outstanding loan balance

Plan prepayments

Estimate interest cost

How Loan Amortization Works

Let’s break it down step by step:

1. EMI is fixed every month

Your monthly EMI stays constant unless:

You refinance

You change interest rate (floating)

You restructure the loan

2. Interest is charged on outstanding principal

Interest calculation example:

If loan amount = ₹5,00,000

Interest rate = 12% p.a.

Outstanding principal = ₹5,00,000

Interest for first EMI =

5,00,000 × 12% / 12 = ₹5,000

3. Principal reduces each month

EMI – Interest = Principal repaid

Over time, the principal keeps reducing, lowering future interest.

4. Final months = mostly principal

In the first year, 70–80% of EMI goes to interest.

In the last year, 90% of EMI goes to principal.

Example of Loan Amortization (EMI Breakdown)

Loan Amount: ₹1,00,000

Interest Rate: 10% p.a.

Tenure: 12 months

| Month | EMI | Interest | Principal | Balance |

|---|---|---|---|---|

| 1 | ₹8,791 | ₹833 | ₹7,958 | ₹92,042 |

| 6 | ₹8,791 | ₹420 | ₹8,371 | ₹54,195 |

| 12 | ₹8,791 | ₹73 | ₹8,718 | ₹0 |

This is exactly how banks structure your EMI.

Types of Loan Amortization

1. Full Amortization (Most Common)

Fixed EMI, principal reduces monthly.

Used for:

Personal loans

Home loans

Car loans

2. Partial Amortization

Lower EMIs initially with a big balloon payment at the end.

3. Negative Amortization

EMI < interest → unpaid interest added to principal.

Rare in India; high-risk.

4. Straight-Line or Linear Amortization

Fixed principal repayment + reducing interest.

Tenure reduces over time.

5. Interest-Only Loans

Borrower pays only interest initially, principal later.

Amortization Methods Used by Lenders

| Method | Meaning | Used For |

|---|---|---|

| Reducing Balance (Standard) | Interest only on outstanding balance | Most loans |

| Flat Rate Method | Interest on full loan amount throughout | Hire purchase, some NBFC loans |

| Balloon Payment | Small EMIs + big final payment | Business/fleet loans |

| Bullet Repayment | No EMI, full payment at end | Gold loans, some business loans |

Benefits of Loan Amortization

✔ Predictable EMIs

Helps maintain monthly budget.

✔ Clear principal reduction

You know exactly how much loan is remaining.

✔ Helps plan prepayment

Borrowers can choose the best time to reduce interest burden.

✔ Better financial discipline

Structured repayment keeps you consistent.

✔ Transparent repayment schedule

Amortization table shows every EMI breakdown.

Disadvantages

❌ Higher interest in early months

Borrowers pay more interest upfront.

❌ Longer tenure = more total interest cost

A 5-year loan costs much less than a 10-year loan.

❌ Prepayment may incur charges

Some lenders charge early closure fees.

Real-Life Example

If you take a ₹10 lakh home loan for 20 years, you'll pay:

EMI: ~₹9,650

First EMI: ~₹8,000 interest + ₹1,650 principal

Last EMI: ~₹200 interest + ₹9,450 principal

This is amortization in action.

How Vizzve Financial Helps Borrowers

Understanding amortization helps you borrow smartly.

Vizzve Financial supports you with:

✔ Best loan comparisons

✔ EMI planning

✔ Low-documentation loans

✔ CIBIL-friendly lenders

✔ Instant personal loans

👉 Apply today at www.vizzve.com

FAQs

1. What is loan amortization?

A repayment system with fixed EMIs containing both principal and interest.

2. Does EMI reduce over time?

No, EMI stays the same — but principal portion increases.

3. Why is interest high in the beginning?

Interest is charged on a larger outstanding balance initially.

4. Can amortization change?

Yes, if interest rates change or if you refinance.

5. What is an amortization schedule?

A table showing EMI breakdown month-wise.

6. Which loans use amortization?

Home, personal, vehicle, business loans.

7. What is negative amortization?

When EMI is too low to cover interest, unpaid amount adds to the loan.

8. Is amortization good for borrowers?

Yes, because it gives clear repayment structure.

9. Can I reduce total interest?

Yes, by prepaying early in the tenure.

10. Are flat-rate loans better?

No — they look cheaper but cost more.

11. Can banks change amortization mid-loan?

Only if you opt for rate or tenure change.

12. Is amortization used for credit cards?

No, credit cards use revolving credit.

13. Does Vizzve Financial assist with EMI planning?

Yes.

14. Do small business loans use amortization?

Yes, most NBFC loans follow EMI structure.

15. Is amortization the same as depreciation?

No — depreciation is for assets, amortization is for loans.

Conclusion

Loan amortization is the backbone of EMI structure in India. Understanding how it works helps you:

✔ Borrow smarter

✔ Reduce interest cost

✔ Plan prepayment

✔ Control your monthly cash flow

Need help finding the best loan with manageable EMIs?

👉 Apply through Vizzve Financial — www.vizzve.com

Published on : 1st December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed