Two Popular Choices, One Wallet Dilemma

You’re shopping online and the site gives you two options:

Convert to EMI

Choose BNPL (Buy Now Pay Later)

Both sound easy. But which is really cheaper in the long run?

At Vizzve Finance, we believe clarity beats confusion. So here’s a side-by-side breakdown to help you pick the smarter option for your purchase.

🧾 What Are EMIs?

EMI (Equated Monthly Installments) means you break down the total cost into equal monthly payments, often with added interest.

Used in:

Credit cards

Consumer durable loans

Personal loans

🛒 What Is BNPL?

Buy Now Pay Later allows you to buy something instantly and either:

Pay back in a lump sum after 15–30 days (no interest), or

Convert to short-term EMIs (some may be interest-free)

Used in:

Online shopping apps

UPI-based payment platforms

Wallet-linked

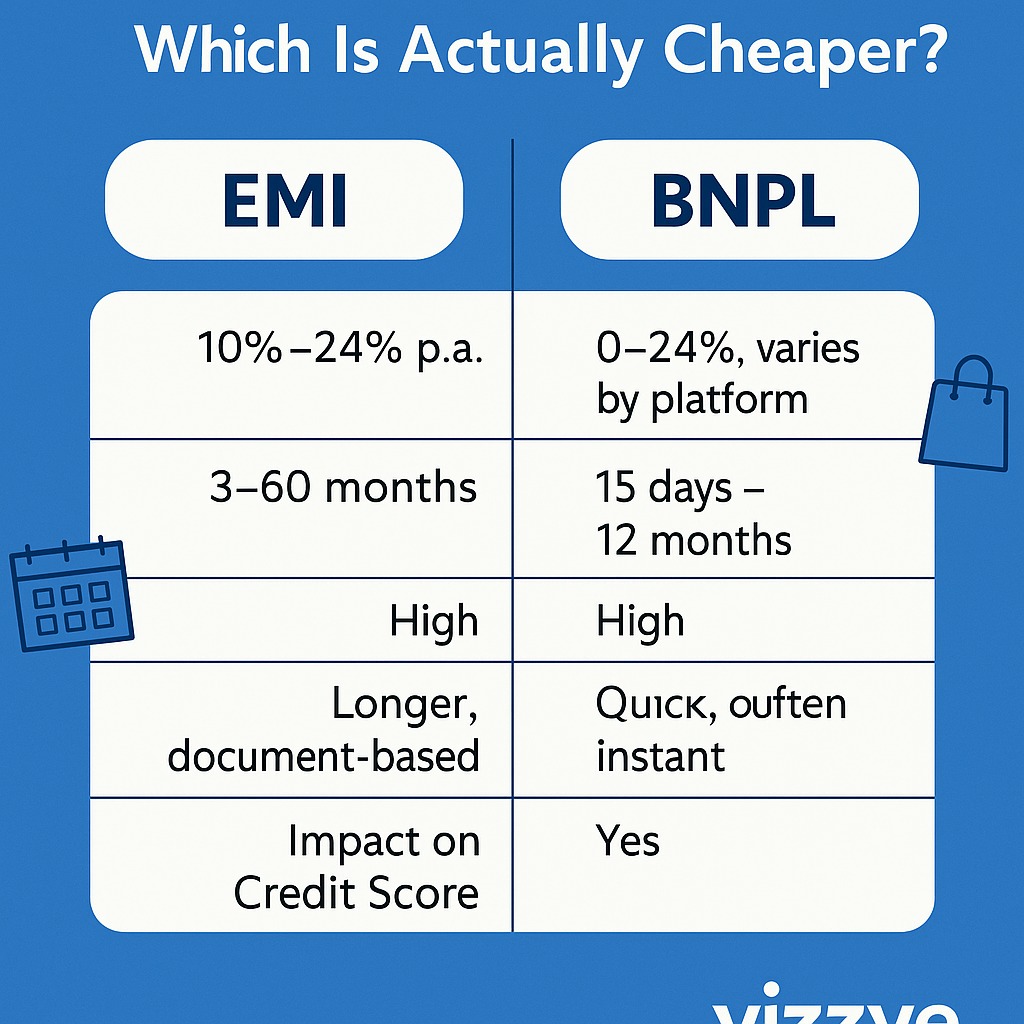

EMI vs BNPL: Side-by-Side Cost Comparison

| Factor | EMI | BNPL |

|---|---|---|

| Interest | 10%–24% p.a. | 0–24%, varies by platform |

| Tenure | 3–60 months | 15 days – 12 months |

| Late Fees | High | High (even for short delays) |

| Approval Process | Longer, document-based | Quick, often instant |

| Impact on Credit Score | Yes | Yes (new-age BNPLs now report to bureaus) |

📊 Example Comparison:

You buy a ₹15,000 phone

| Option | EMI (6 months @14%) | BNPL (3 months, 0% promo) |

|---|---|---|

| Monthly Pay | ₹2,608 | ₹5,000 |

| Total Cost | ₹15,648 | ₹15,000 |

| Extra Paid | ₹648 | ₹0 |

👉 Winner: BNPL (only if 0% interest and you repay on time)

⚠️ Hidden Costs You Should Know

With EMIs:

Processing fees (1–2%)

Pre-closure penalty

Delayed EMI = CIBIL hit

With BNPL:

Interest kicks in after promo period

Late payments hurt credit (many users forget due dates)

Not all platforms are RBI-regulated

🧠 Vizzve Recommends:

✅ Choose EMIs when:

You want longer tenure

You need higher ticket financing

You're consolidating debt

✅ Choose BNPL when:

The item is low-value

The offer is 0% and you're confident about timely payment

You need instant checkout approval

💬 FAQ: EMI vs BNPL

Q1. Will BNPL affect my CIBIL score?

Yes. Most top BNPL players now report to credit bureaus.

Q2. Is BNPL interest-free always?

No. Only during promotional offers. After that, interest may range from 18%–30% annually.

Q3. Can I use both EMI and BNPL together?

You can—but it’s risky. Track due dates carefully to avoid payment overlap.

Q4. Which is better for building credit history?

EMIs via formal lenders (like Vizzve) offer more consistent credit growth visibility.

🏁 Final Word from Vizzve

Don’t fall for the “0% now, stress later” trap.

Whether you choose EMI or BNPL, always calculate the total cost, not just the monthly one.

Vizzve’s lending tools and budget planner help you compare smartly before you borrow.

Vizzve Finance – Know Before You Owe.

Published on : 12th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed.