When Every Second Counts, Vizzve Delivers

Medical emergencies come unannounced—and waiting for traditional bank loans or insurance reimbursements can delay life-saving treatment.

Vizzve Finance ensures that financial stress isn’t part of the emergency.

With fast, easy, and reliable instant loans, your focus can stay where it should—on recovery.

What Is a Medical Emergency Loan from Vizzve?

It’s a personal loan tailored for urgent healthcare needs like:

Hospitalization & ICU charges

Emergency surgeries

Diagnostic tests or scans

Post-operative care

Doctor or specialist fees

Critical medicines or equipment

Key Features of Vizzve Medical Loans

| Feature | Vizzve Advantage |

|---|---|

| Loan Amount | ₹10,000 – ₹5,00,000 |

| Approval Time | < 2 minutes |

| Disbursal | Same-day (within hours) |

| Documentation | PAN, Aadhaar & Salary Proof |

| Credit Score Needed | Flexible (Moderate CIBIL accepted) |

| Repayment | 3–24 months |

✅ No collateral required

✅ No bank visits

✅ No hidden charges

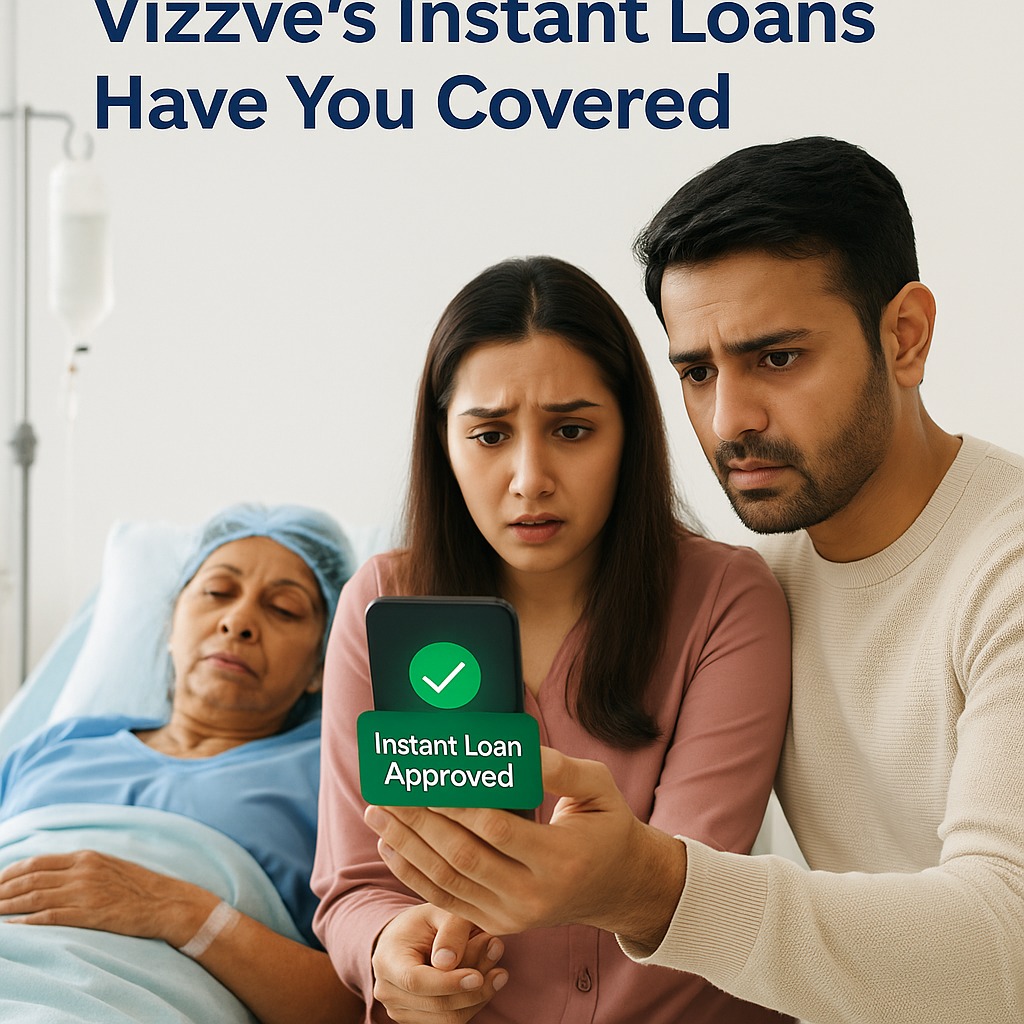

Real-Life Scenario:

Rahul (age 34) had to admit his mother suddenly for a heart procedure.

Hospital estimate? ₹1.75 lakh.

Vizzve processed and credited ₹2 lakh to his account in under 5 hours.

"The loan saved her life—and saved me from debt traps." – Rahul, Delhi

How to Apply for a Medical Loan on Vizzve

Visit Vizzve.com or open the Vizzve app

Click “Medical Emergency Loan”

Enter basic details + upload PAN & Aadhaar

Complete instant eligibility check

Get approved, choose tenure, and receive money today

Your treatment shouldn’t wait. Neither should your funding.

FAQs – Vizzve Medical Emergency Loans

Q1: Can I get a loan without a high credit score?

A: Yes. Vizzve considers multiple data points beyond just CIBIL score.

Q2: How fast can I get the money?

A: Many users get funds within 2–6 hours post-verification.

Q3: What if I need a second loan?

A: You may qualify for a top-up once partial repayment begins.

Final Word: Let Us Handle the Bills. You Handle the Healing.

Don’t let urgent medical costs drain your savings or delay treatment.

Vizzve’s Instant Loans give you:

✅ Speed when it matters

✅ Trust without paperwork

✅ Peace when you need it most

🔗 Apply Now at Vizzve.com — because health should never be paused by paperwork.

Published on : 21st July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed