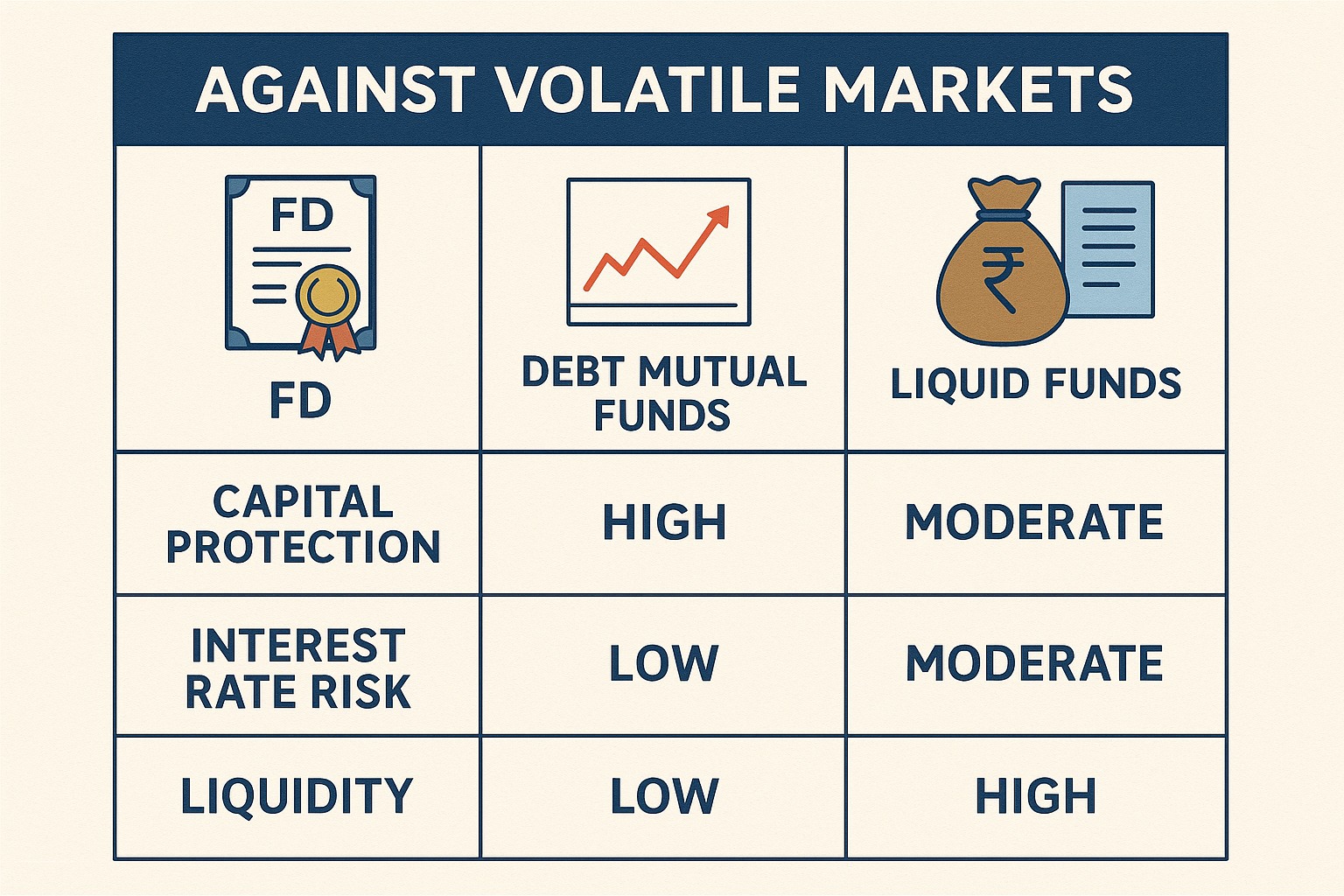

Market volatility often pushes investors to look for safer, more stable investment options. When stock markets fluctuate and interest rates keep shifting, the most common dilemma is:

Should you choose an FD, a debt mutual fund, or a liquid fund?

Each option offers different levels of safety, liquidity, and returns. Here’s a simple breakdown to help you decide based on your goals, risk appetite, and time frame.

What Is Best in a Volatile Market? A Quick Summary

| Investment Type | Best For | Risk | Liquidity | Suitability |

|---|---|---|---|---|

| FD (Fixed Deposit) | Guaranteed returns | Very low | Low (lock-in) | Ultra-safe investors |

| Debt Mutual Fund | Higher return potential | Moderate | Medium | Medium-term goals |

| Liquid Fund | Parking money safely | Very low | High | Emergency funds/short term |

1. Choose Fixed Deposits (FDs) When…

👉 You want guaranteed, stable returns with zero market impact.

FDs remain one of the safest investment avenues, especially during volatile market phases.

Why Choose FDs?

Fixed interest rate

No market risk

Ideal for short to medium-term goals

Helpful for retirees and conservative investors

Best For:

1–5 year goals

Ultra-low-risk investors

Anyone wanting predictable returns

Not Suitable When:

Interest rates are falling

You need liquidity (premature withdrawal penalties apply)

2. Choose Debt Mutual Funds When…

👉 You want better-than-FD returns but can handle mild volatility.

Debt funds invest in government bonds, corporate bonds, treasury bills, and money market instruments. Their value moves with interest rates and bond yields.

Why Choose Debt Funds?

Higher return potential

Tax-efficient (especially above 3 years)

Better for medium-term goals

Benefit when interest rates fall

Which Debt Fund to Choose in Volatile Markets?

| Market Condition | Ideal Debt Funds |

|---|---|

| Rising rates / volatile | Ultra-short, short-duration funds |

| Falling rates | Long-duration, gilt funds |

| Stable rates | Short to medium-duration funds |

Avoid Debt Funds If:

You want guaranteed returns

You cannot tolerate short-term NAV fluctuations

🔵 3. Choose Liquid Funds When…

👉 You want safety, liquidity, and better returns than a savings account.

Liquid funds invest in very short-term instruments (up to 91 days) and are almost unaffected by market swings.

Why Choose Liquid Funds?

Very low risk

Ideal for emergency funds

Same-day or next-day withdrawal

Suitable for parking idle money

Best For:

0–12 month goals

Emergency corpus

STP (Systematic Transfer Plan)

Temporary parking during volatile markets

Not Suitable When:

You want high returns

You are investing for long-term wealth creation

Which One Should You Choose in a Volatile Market?

📌 Choose FD → If you want absolute safety + guaranteed returns

Perfect for senior citizens, retirees, and zero-risk investors.

📌 Choose Debt Mutual Fund → If you want higher returns + can tolerate mild volatility

Stick to short-duration funds when interest rates fluctuate.

📌 Choose Liquid Fund → If you want liquidity + stability

Ideal for emergency savings or short-term parking.

Quick Decision Guide

| Priority | Best Choice | Why |

|---|---|---|

| Safety + guaranteed returns | FD | No market risk |

| Higher returns + some risk | Debt Fund | Better long-term performance |

| Liquidity + low risk | Liquid Fund | Ideal for emergencies |

| Unsure about rate movement | Liquid Fund / Short-duration Debt Fund | Minimal interest-rate impact |

💡 Smart Tips for Investors

Avoid long-duration debt funds during rising interest rate cycles.

FD interest is fully taxable; debt funds may be more tax-efficient.

Liquid funds are great for holding money temporarily.

Check credit quality before choosing any debt fund.

Diversify across FD + liquid + debt funds for balanced stability.

❓ FAQs

1. Are debt funds safer than FDs?

No. FDs offer guaranteed returns; debt funds carry mild market risk.

2. Which is best during rising interest rates?

Liquid funds or short-duration debt funds.

3. Are liquid funds safe?

Yes. They invest in very short-term, high-quality instruments with minimal volatility.

4. When do debt funds perform well?

When interest rates start falling.

5. Which is best for emergency funds?

Liquid funds — because of easy withdrawals and low risk.

6. Should I mix all three options?

Yes. A balanced mix gives stability, liquidity, and returns.

Published on : 21st November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed