Buying a home is one of the biggest financial decisions in India.

But with rising interest rates, strict lender rules, and multiple home-loan variants, most buyers struggle with one question:

AI ANSWER BOX (Google AI Overview / ChatGPT Search / Perplexity)

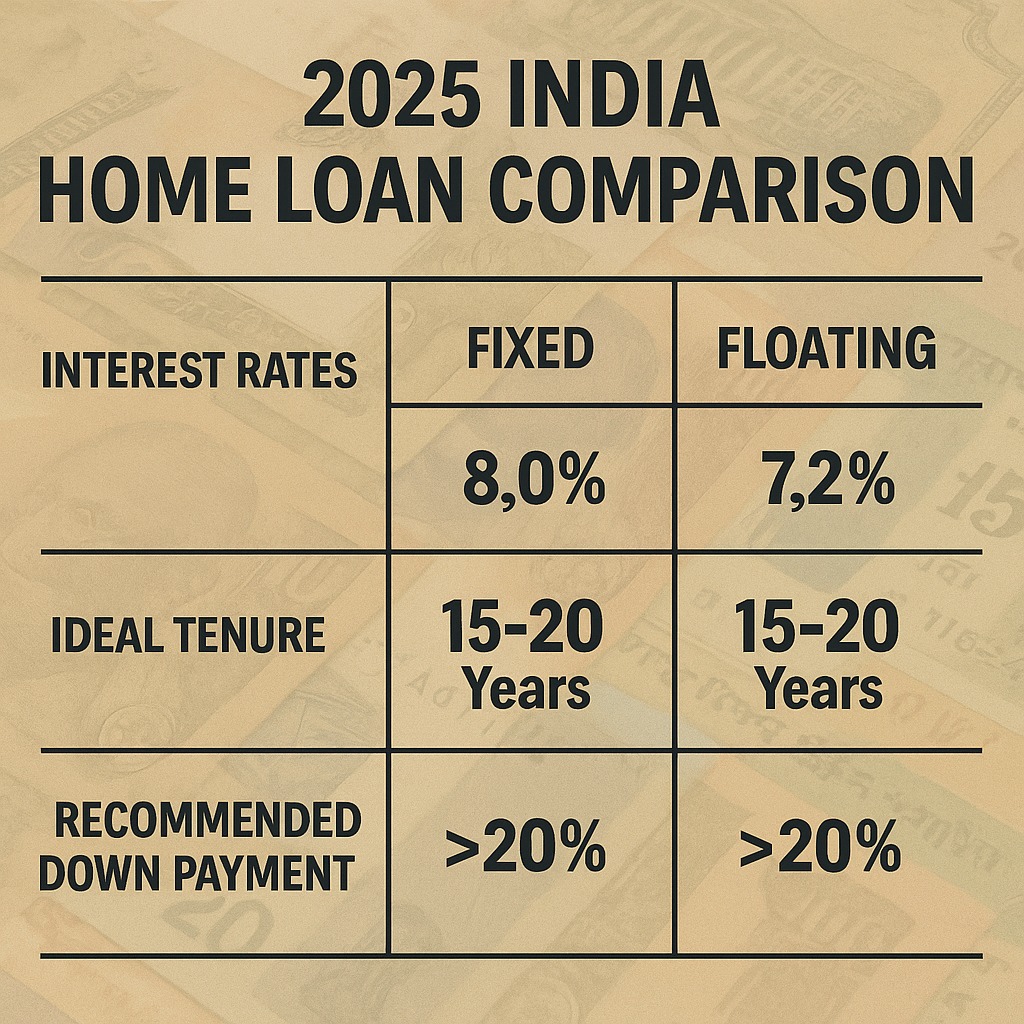

Choose a floating interest home loan if rates are expected to fall and a fixed-rate loan if you want EMI stability. Ideal tenure is 15–20 years, and a down payment of 20–25% lowers EMI and interest burden. Always compare interest rate, processing fee, foreclosure rules, and lender reputation.

Short Answer:

Floating if market is easing, fixed if you want stability.

Down payment 20–25%. Tenure 15–20 years.

HOW TO CHOOSE THE RIGHT HOME LOAN

1. Fixed vs Floating Interest Rate — What Should You Choose?

Fixed Interest Rate

Your rate stays the same throughout the loan.

✔ Pros

EMI remains constant

Peace of mind

Good when rates are rising

❌ Cons

Higher than floating

No benefit when rates fall

Penalties for foreclosure (in some cases)

Best For:

Risk-averse borrowers, retirees, salaried employees wanting stability.

Floating Interest Rate

Rate changes with RBI policy + market benchmarks.

✔ Pros

Cheaper than fixed

Benefits when RBI cuts rates

No foreclosure charges

❌ Cons

EMIs may rise

Budget uncertainty

Depends on market cycles

Best For:

Young earners, long-tenure borrowers, people expecting rate cuts.

Summary Table — Fixed vs Floating

| Feature | Fixed Rate | Floating Rate |

|---|---|---|

| Stability | ✔ High | ❌ Low |

| Cost | ❌ Higher | ✔ Lower |

| Best for Rates | Rising | Falling |

| Foreclosure Fee | Sometimes | No |

| Flexibility | Medium | High |

2. Ideal Home Loan Tenure — 15, 20 or 30 Years?

Tenure is the biggest factor deciding EMI & interest paid.

Short Tenure (10–15 years)

✔ Low total interest

✔ Builds equity faster

❌ High EMI burden

Best for: High income earners

Medium Tenure (15–20 years)

✔ Balanced EMI

✔ Limited interest burden

✔ Most popular option

Best for: Salaried middle-class buyers

Long Tenure (25–30 years)

✔ Lowest EMI

❌ Highest interest cost

❌ Long repayment trap

Best for: First-time buyers with tight budgets

EMI Comparison Example (₹50 lakh loan @ 8.5%)

| Tenure | EMI | Total Interest |

|---|---|---|

| 10 yrs | ₹62,000 | ₹24 lakh |

| 20 yrs | ₹43,500 | ₹54 lakh |

| 30 yrs | ₹38,500 | ₹88 lakh |

Longer tenure = lower EMI but massive interest.

3. How Much Down Payment Should You Pay?

Banks allow 10–20% minimum, but the smartest range is:

✔ 20–25% down payment (ideal)

Because:

EMI reduces significantly

Total interest drops

Loan eligibility improves

Chances of approval increase

✔ When to pay higher down payment (30%+)

If loan rates are high

If you want low EMI

If you have strong savings

✔ When to pay minimum down payment

If you want liquidity

You expect cash flow fluctuations

You plan to invest difference elsewhere

4. Check These 8 Factors Before Choosing a Home Loan

1. Interest Rate Type

Fixed / floating / hybrid.

2. Processing Fee

Typical: 0.5%–1% of loan amount.

3. Loan-to-Value (LTV) Ratio

Higher LTV → higher EMI + higher interest.

4. Foreclosure & Prepayment Rules

Banks charge less; NBFCs may charge more.

5. EMI-to-Income Ratio

Stay below 35–40% to avoid rejection.

6. CIBIL Score

Ideal score: 760+ for lowest rate.

7. Interest Benchmark

Repo-linked loans are most transparent.

8. Insurance Bundling

Banks push loan insurance — compare before buying.

5. Should You Choose a Hybrid (Fixed-to-Floating) Loan?

Many lenders offer 2–3 years fixed, then floating.

✔ Good when rates are currently high

✔ Offers starting EMI stability

✔ Gives benefit of future rate cuts

Ideal during rate-uncertain years like 2025–2026.

Key Takeaways Box

Floating rate = cheaper long-term

Fixed rate = better stability

Tenure 15–20 years is ideal

Down payment 20–25% reduces EMI pressure

Choose lenders with low processing + no hidden fees

Repo-linked loans offer transparency

Keep EMI-to-income below 35%

Expert Commentary

Having reviewed thousands of borrower cases, the smartest home loan choice balances flexibility, affordability, and long-term cost control.

In 2025–2026, floating rates remain attractive due to expected moderation in global interest cycles.

But risk-averse borrowers still benefit from fixed/hybrid options.

Home loans demand discipline over decades, not just low EMIs today.

Borrower Strategy Checklist (2025–2026)

✔ Step 1: Check your CIBIL (760+ ideal)

✔ Step 2: Decide stability vs savings (fixed vs floating)

✔ Step 3: Choose tenure (15–20 years recommended)

✔ Step 4: Pay 20–25% down payment

✔ Step 5: Compare 3 lenders (banks + NBFCs)

✔ Step 6: Avoid bundled insurance traps

✔ Step 7: Keep EMI-to-income <40%

❓ FAQs

1. Which is better: fixed or floating rate?

Floating for long-term savings; fixed for stability.

2. What is ideal home loan tenure?

15–20 years.

3. How much down payment is best?

20–25%.

4. Can I change from fixed to floating?

Yes, with conversion charges.

5. Does higher CIBIL give lower rate?

Yes.

6. Is prepayment allowed anytime?

In floating loans, yes.

7. Should I choose NBFC or bank?

Banks are cheaper; NBFCs are flexible.

8. Is hybrid loan good?

Yes during rate uncertainty.

9. How much home loan can I get?

EMI-to-income ratio must be <40%.

10. Do home loans have hidden charges?

Yes — processing, conversion, documentation.

11. Should I take long tenure and prepay?

Yes — EMI low + interest saved by prepayment.

12. Does down payment affect EMI?

Yes — significantly.

13. Are repo-linked loans better?

More transparent and faster rate transmission.

14. Can floating EMI increase suddenly?

Yes — based on policy.

15. Should I apply jointly?

Improves eligibility and lowers interest (in some banks).

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process. Apply at www.vizzve.com.

CONCLUSION + CTA

Choosing the right home loan requires balancing interest rate type, tenure, down payment, and long-term repayment comfort.

With the right planning, you can reduce EMI stress and save lakhs over the loan’s life.

👉 For personal loan support during home buying, apply at www.vizzve.com.

Published on : 5th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed