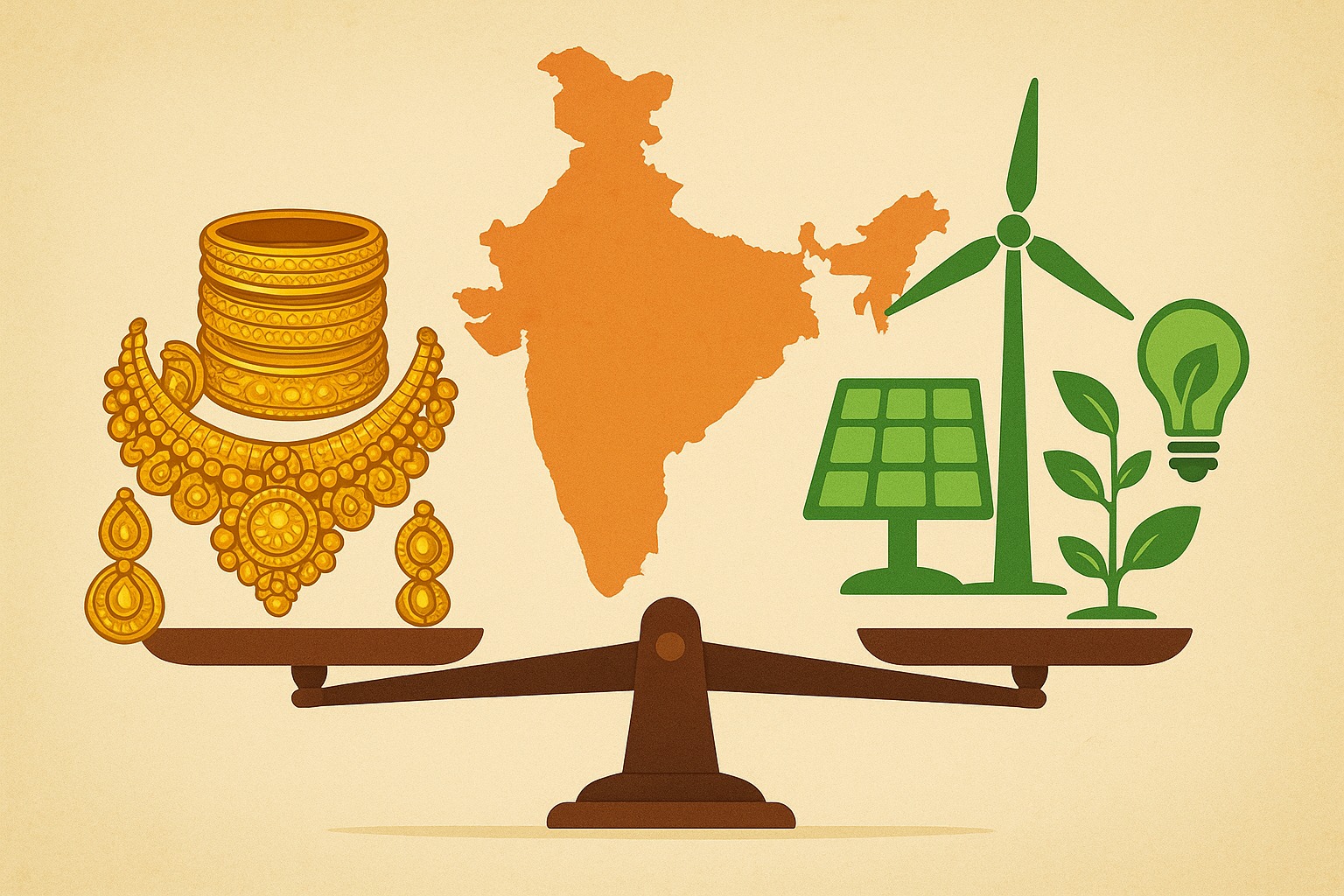

India’s financial landscape is undergoing a fascinating shift. On one hand, gold loans are surging as households unlock their jewelry for quick credit. On the other, green financing is gaining traction as the nation pushes towards renewable energy and sustainability. Together, these contrasting loan trends tell us a bigger story about India’s economic aspirations and challenges.

Gold Loans: The Traditional Safety Net

Gold loans have become the backbone of short-term credit for millions of Indians.

Why Gold Loans Are Rising

Accessibility: Minimal paperwork, fast disbursals.

Lower interest rates: Around 8–12% compared to 12–24% for personal loans.

No credit score barrier: A lifeline for borrowers with weak financial history.

Cultural reliance on gold: India’s vast household gold reserves act as a ready safety net.

Economic Insight: The rise in gold loans often signals economic stress — households turning to idle gold reflects inflationary pressures and tightening disposable income.

Green Financing: Fueling India’s Future

While gold loans meet immediate needs, green loans and bonds are financing long-term growth.

What Is Green Financing?

Green financing refers to loans, bonds, or investments dedicated to eco-friendly projects, such as solar energy, wind farms, EV infrastructure, and sustainable housing.

Why Green Financing Matters

Government push for renewable energy (target: 500 GW by 2030).

Global investment flows prioritizing ESG (Environmental, Social, Governance).

Lower cost of funds for eco-friendly businesses.

Boost to job creation and sustainable development.

Economic Insight: The rise of green financing signals economic confidence and forward-looking policy, as India shifts from crisis-driven borrowing to growth-focused lending.

Gold vs. Green: Two Sides of the Same Economy

Gold Loans = Household Survival

Reflect immediate liquidity needs.

Surge during inflation, job losses, or high personal debt.

Green Financing = National Ambition

Reflects investment in the future.

Grows when the economy is stable enough to focus on sustainability.

Together, these two loan categories show India balancing short-term struggles with long-term goals.

What This Means for Borrowers & Businesses

Individuals may rely more on secured lending like gold loans for emergencies.

Businesses and investors see opportunities in green financing instruments.

Policymakers must ensure both financial inclusion (via gold loans) and sustainable growth (via green finance).

Conclusion: A Dual Narrative of India’s Economy

The surge in gold loans and green financing highlights India’s dual economic story — resilience in the face of personal financial challenges, and optimism toward building a sustainable future. Recognizing both sides helps us understand not just the credit market, but also the pulse of the Indian economy.

FAQ

Q1. Why are gold loans becoming popular in India?

Gold loans offer quick access to funds at lower interest rates without heavy credit score requirements.

Q2. What is green financing?

Green financing includes loans and investments aimed at funding renewable energy, sustainable projects, and eco-friendly infrastructure.

Q3. How do gold and green loans reflect India’s economy?

Gold loans show short-term household stress, while green loans highlight long-term economic growth and sustainability goals.

Q4. Are green loans only for businesses?

No, even individuals can access green loans for solar panels, electric vehicles, or eco-friendly housing projects.

Q5. Which is better for India’s future — gold or green loans?

Gold loans provide immediate relief, but green loans drive long-term economic transformation. Both are vital for India’s balance.

Published on : 30th August

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share