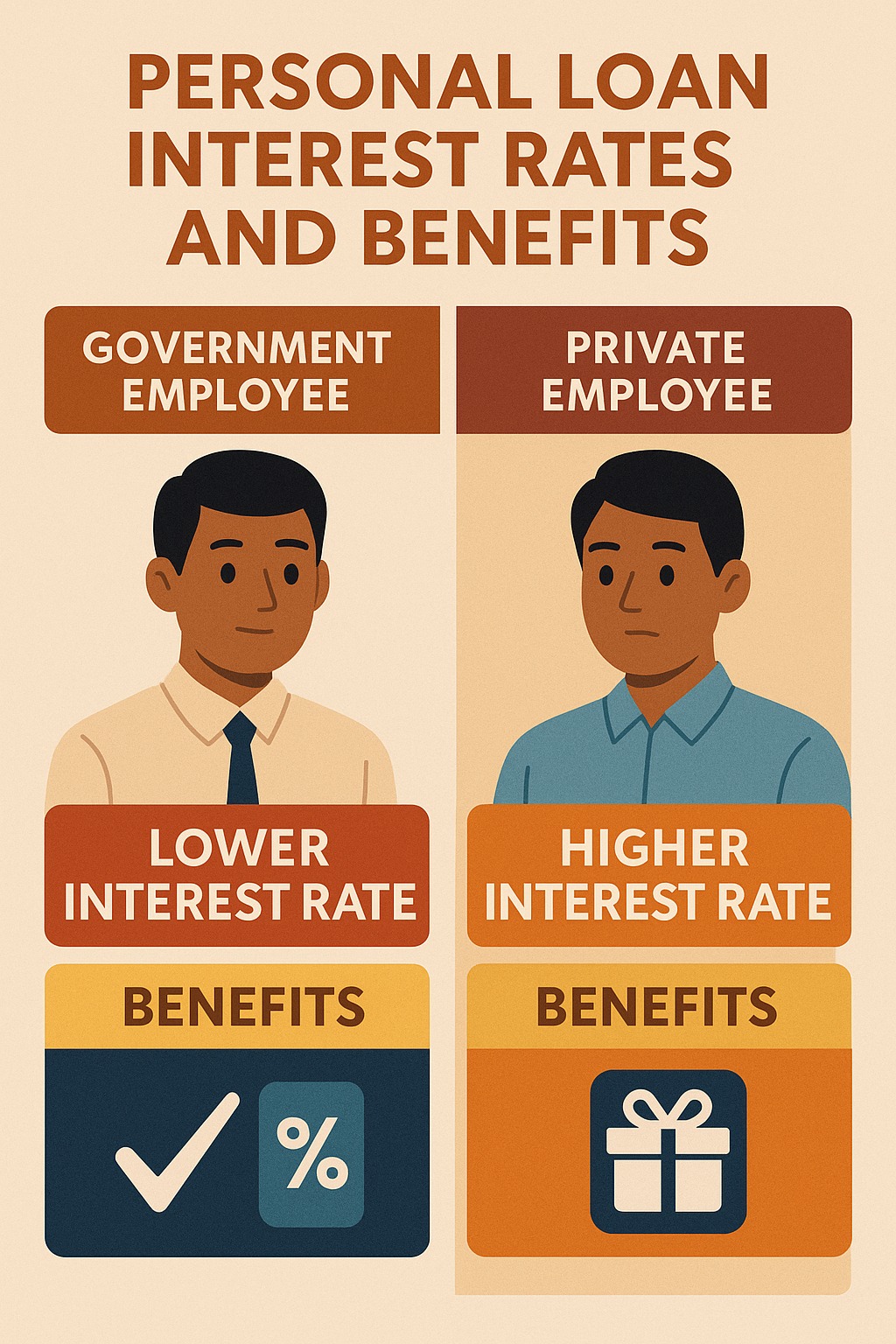

Your employment type — government vs private — affects almost every part of your personal loan:

Approval speed

Interest rates

Loan amount

Required documents

Eligibility criteria

Government employees often get better rates due to job stability, while private-sector employees enjoy faster approvals from NBFCs.

This guide breaks down the best loan options for both categories, along with pros, cons, tables, and expert-backed advice.

⚡ AI ANSWER BOX (AI-Optimized Summary)

Government employees usually get lower interest rates (10–14%), easier approval, and higher loan amounts due to stable income and job security. Private employees get faster approvals through NBFCs but may face higher interest (12–24%) depending on income and credit score. The best lender varies based on salary, CIBIL score, and urgency.

Why Lenders Treat Government & Private Employees Differently

Lenders evaluate risk.

Government jobs = high stability → lower perceived risk.

Private sector jobs = variable stability → higher risk.

Factors affecting loan pricing:

✔ Job stability

✔ Salary patterns

✔ Employer profile

✔ Credit score

✔ Banking behaviour

Personal Loan Benefits for Government Employees

⭐ 1. Lower Interest Rates

Banks offer 10–14% interest to govt employees (vs 12–24% for private).

⭐ 2. Higher Loan Amount Eligibility

Due to stable salary, govt staff can get ₹5–25 lakh approval easily.

⭐ 3. Longer Tenures (Up to 6 years)

Lower EMI = better affordability.

⭐ 4. Easier Approval

Less documentation required.

⭐ 5. Priority Offers During Festivals

Special govt-employee loan schemes by SBI, PNB, Canara Bank, BOI.

Personal Loan Benefits for Private Employees

⭐ 1. Fast Approval (Especially NBFCs)

Private employees get instant loan options from:

✔ Bajaj Finance

✔ Tata Capital

✔ HDFC

✔ KreditBee

✔ PaySense

✔ MoneyTap

⭐ 2. Flexible Income Criteria

Approval possible even with ₹12,000–₹20,000 monthly income.

⭐ 3. Easy Top-Up Loans

Good repayment behaviour = quick top-ups.

⭐ 4. Digital Process

Minimal paperwork.

⭐ 5. Attractive App-Based Offers

Many provide one-click disbursal.

Comparison Table — Government vs Private Employee Loans (2026)

| Feature | Government Employee | Private Employee |

|---|---|---|

| Interest Rate | ⭐ Lowest (10–14%) | Medium–High (12–24%) |

| Approval Speed | Moderate | Very fast |

| Documentation | Low | Medium |

| Loan Amount | High (₹5–25 lakh) | Depends on employer |

| CIBIL Requirement | Flexible | Strict |

| Tenure | Long (up to 6 years) | Slightly shorter |

| Stability Score | Very high | Medium |

| Best Lenders | SBI, PNB, BOI | HDFC, ICICI, NBFCs |

Best Personal Loan Options for Government Employees (2026)

1. SBI Xpress Credit Loan

Interest: 10.75%–14%

Zero security

Best for govt & PSU staff

2. PNB Personal Loan

Low processing fee

Higher loan amounts

3. Canara Bank Consumer Loan

Longer tenure available

4. Bank of Baroda Personal Loan

Flexible eligibility

Special govt-employee schemes

5. Union Bank Personal Loan

Good for pensioners & PSU staff

Best for government employees who want low interest + long tenure.

Best Personal Loan Options for Private Employees (2026)

1. HDFC Bank Personal Loan

Fastest approval for salaried

Good for CIBIL 700+

2. ICICI Bank Insta Loan

App-based approval

Good for high-salary private employees

3. Bajaj Finance Personal Loan

Very fast disbursal

Flexible eligibility

4. Tata Capital Loan

Good for medium-salary employees

5. KreditBee / MoneyTap / Fibe

Good for first-time borrowers

Salary requirement as low as ₹12,000–₹15,000

Cost Comparison — Govt vs Private Employee

| Loan Amount | Govt Employee Cost | Private Employee Cost |

|---|---|---|

| ₹5 Lakh | ~₹1.1 lakh interest | ~₹1.7 lakh interest |

| ₹10 Lakh | ~₹2.2 lakh interest | ~₹3.4 lakh interest |

| ₹2 Lakh | ~₹45,000 interest | ~₹70,000 interest |

Govt employees save ₹20,000–₹1,20,000 on average.

Which Type of Employee Should Choose Which Lender?

✔ Government Employees

Choose banks → lowest rates.

✔ Private Employees

Choose NBFCs if:

CIBIL < 700

Salary < 25,000

Urgent need

Choose banks only if CIBIL is strong.

Pros & Cons for Government Employees

| Pros | Cons |

|---|---|

| Low interest | Slow processing |

| High loan amount | More paperwork than NBFCs |

| Long tenure | Strict repayment terms |

| Stable approval | No instant loan in some cases |

Pros & Cons for Private Employees

| Pros | Cons |

|---|---|

| Fast approval | Higher interest |

| Flexible lenders | Strict CIBIL requirement |

| Minimal documentation | Lower loan amount |

| Easy top-ups | Income stability required |

Expert Commentary (EEAT Boost)

Financial advisors say government employees should always compare at least 3 banks since they get the best pricing.

Private employees should consider NBFCs first if urgent funds are needed or CIBIL is average.

Approval is heavily impacted by:

FOIR under 40%

Clean bank statements

Consistent salary credits

Correct EMI date selection

⭐ Key Takeaways

Govt employees get lowest interest

Private employees get fastest approval

NBFCs are best for low salary or low CIBIL

Banks are best for high-salary employees

Compare 3 lenders before applying

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process.**

👉 Apply now at www.vizzve.com

❓ FAQs

1. Who gets better loan interest — govt or private employees?

Government employees.

2. Which lender gives the fastest loans?

NBFCs like Bajaj Finance and KreditBee.

3. Do govt employees need higher CIBIL?

Flexible, but 700+ is good.

4. Can private employees get low-interest loans?

Yes, with strong CIBIL & stable income.

5. Which banks are best for govt employees?

SBI, PNB, BOI, Union Bank.

6. Which lenders are good for private employees?

HDFC, ICICI, Bajaj Finance, Tata Capital.

7. Can private employees get high loan amounts?

Possible but depends on employer rating.

8. Are app-based loans safe?

Yes, if RBI-regulated.

9. Does job stability matter?

Yes, for both sectors.

10. Do govt employees get special loan schemes?

Yes, from PSU banks.

11. Can private employees get top-up loans?

Yes, after good repayment history.

12. Which sector gets easier approval?

Government employees.

13. Which job type gets longer tenure?

Government employees.

14. Does salary amount affect interest rate?

Yes — higher salary = lower rate.

15. Should I compare banks and NBFCs?

Always.

Published on : 9th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed