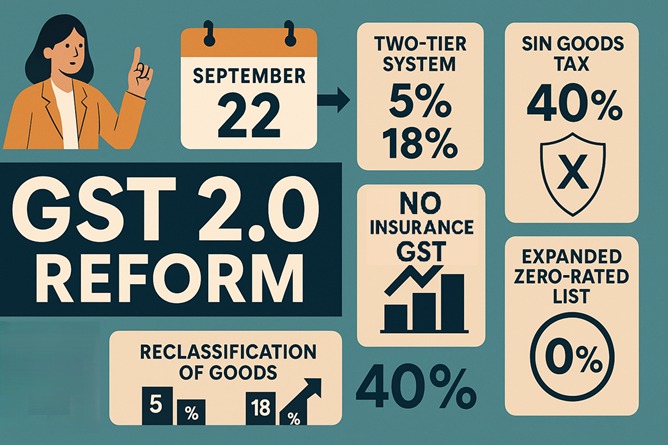

As of September 22, 2025, India has officially rolled out GST 2.0, marking a new era of simplified taxation aimed at boosting consumption and economic growth. The revamped Goods and Services Tax (GST) structure introduces significant rate cuts across various sectors, with notable benefits for the automobile and Fast-Moving Consumer Goods (FMCG) industries.

Automobile Sector: Price Cuts to Drive Demand

The automobile industry stands to gain substantially from the GST 2.0 reforms. Small petrol hybrid cars, previously taxed at 28%, now fall under the 18% GST slab. This reduction is expected to make vehicles more affordable, stimulating demand.

Companies like Maruti Suzuki, Tata Motors, and Hyundai have announced price cuts on models such as Alto, Swift, Brezza, and Fronx, with reductions reaching up to ₹1.29 lakh.

Additionally, auto ancillary companies like Bosch, MRF, and Bajaj Auto are poised to benefit from lower GST rates on auto parts, potentially reducing production costs and increasing profitability.

FMCG Sector: Lower Prices to Boost Consumption

The FMCG sector is set to benefit significantly under GST 2.0. Essential items such as soaps, shampoos, biscuits, butter, and coffee, which were previously taxed at 18%, now attract a reduced GST rate of 5%.

This change is expected to lower product prices, making them more accessible to consumers and stimulating demand. Major FMCG companies like Hindustan Unilever, Procter & Gamble, and Graviss Foods have adjusted their pricing strategies to capitalize on the anticipated surge in consumer spending.

Other Beneficiaries: Cement, Electronics, and More

Beyond automobiles and FMCG, several other sectors are set to benefit from GST 2.0 reforms:

Cement: Reduced costs for construction materials may lower housing prices and stimulate infrastructure development.

Electronics: Consumer electronics, including televisions and air conditioners, now fall under the 18% GST slab, down from 28%, making them more affordable.

Healthcare: Medicines and health insurance premiums have been exempted from GST, reducing healthcare costs.

Consumer Durables: Items like refrigerators, washing machines, and microwaves are now more affordable, boosting sales in the sector.

Economic Impact and Outlook

The implementation of GST 2.0 is expected to contribute approximately ₹2 lakh crore to India’s economy. The reforms aim to stimulate consumption and economic growth, with sectors like automobiles and FMCG poised to lead the charge.

FAQs

Q: What is GST 2.0?

A: GST 2.0 is an upgraded version of India’s Goods and Services Tax system, introduced to simplify tax structures and reduce rates across various sectors.

Q: Which sectors are benefiting from GST 2.0?

A: Key sectors benefiting include automobiles, FMCG, cement, electronics, healthcare, and consumer durables.

Q: How will GST 2.0 impact consumers?

A: Consumers can expect lower prices on a wide range of products, from vehicles to daily essentials, increasing affordability and purchasing power.

Q: When did GST 2.0 come into effect?

A: GST 2.0 was officially implemented on September 22, 2025.

Published on : 22nd September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share