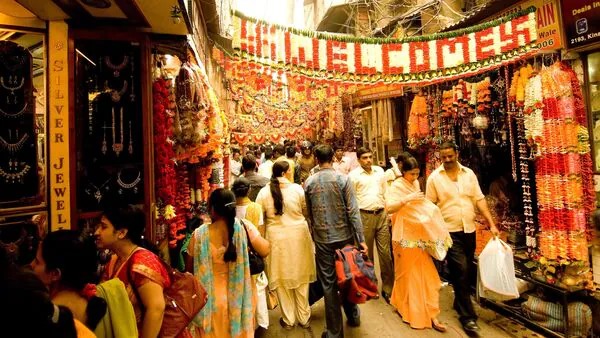

India’s festive season is synonymous with a shopping boom. This year, the excitement is paired with a major tax overhaul—GST 2.0—designed to simplify compliance, rationalize rates, and encourage consumption. But how exactly is this reform shaping consumer behavior during the most lucrative time of the year?

What Is GST 2.0?

GST 2.0 refers to the upgraded version of India’s Goods and Services Tax system with:

Simplified Rate Structure

Faster Refund Mechanisms

Digital Compliance Tools

Reduced Tax Slabs on Key Consumer Goods

Impact on Festive Shopping Trends

1. Lower Prices on Select Goods

Reduced tax slabs mean electronics, appliances, and lifestyle products are more affordable.

2. Rise of E-Commerce & Digital Payments

GST 2.0’s streamlined compliance encourages online sellers to expand offerings and discounts.

3. Higher Consumer Confidence

Transparency in pricing and tax credits makes shoppers feel more secure.

4. Boost to Small & Medium Retailers

Simplified filing lowers entry barriers, allowing local shops to compete with big players.

Behavioral Shifts Among Consumers

Price Sensitivity Drops: With uniform rates, buyers focus more on quality and brand.

Bulk Buying & Pre-Booking: Shoppers plan purchases ahead to lock in lower GST rates.

Preference for Invoice-Based Purchases: For warranty and input tax credit benefits.

Retailers’ Response to GST 2.0

Brands are using the reform as a marketing point, highlighting “GST benefits” in festive promotions. Retail chains are bundling offers, passing tax savings directly to customers.

Long-Term Economic Impact

GST 2.0 aims to formalize more of the retail economy, increasing tax compliance while boosting consumption. The festive boom provides a real-time stress test for this reform.

Conclusion

The synergy of GST 2.0 and the festive shopping boom is more than a seasonal coincidence—it’s a preview of how tax reforms can reshape India’s consumer economy. With greater transparency and affordability, shoppers and retailers alike stand to gain.

FAQs

Q1. What’s the difference between GST and GST 2.0?

GST 2.0 is an upgraded system with simplified rates, digital compliance, and faster refunds compared to the original GST framework.

Q2. How does GST 2.0 affect festive season prices?

Lower tax slabs and streamlined compliance reduce prices for several consumer goods, especially in electronics and lifestyle segments.

Q3. Will small retailers benefit from GST 2.0?

Yes. Simplified filing and fewer tax slabs help small shops compete with larger players during peak shopping seasons.

Q4. How are consumers changing their shopping behavior?

Consumers are bulk-buying, pre-booking, and preferring invoice-based purchases to benefit from lower GST rates.

Q5. Could GST 2.0 boost long-term economic growth?

Yes. By formalizing more of the retail economy and increasing consumer confidence, GST 2.0 can stimulate sustained consumption.

Published on : 24th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share