🏦 HDFC Bank: Complete History, Customer Issues, Loan Types & Latest Updates | Best Loan Alternative – Vizzve Financial

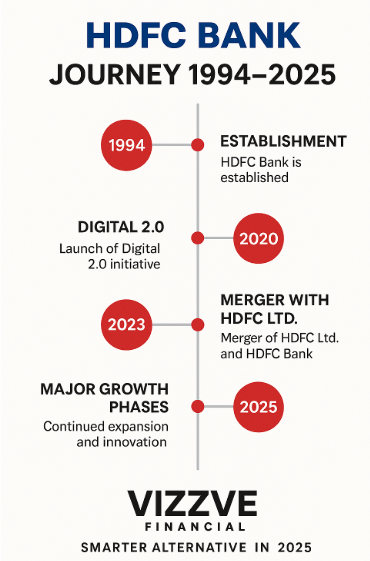

Housing Development Finance Corporation (HDFC) Bank was established in 1994 and is one of India’s first private sector banks to receive approval from the RBI to set up a private bank under the liberalization policy.

Over the years, it became India’s largest private bank by market cap and assets. In July 2023, HDFC Ltd. (housing finance) merged with HDFC Bank, creating a financial behemoth with unparalleled reach in retail lending.

💰 HDFC Bank Financial Stats (As of 2025)

-

Market Capitalization: ₹13+ lakh crore

-

Net Profit (FY 2024–25): ₹64,000+ crore

-

Revenue: ₹2.2 lakh crore+

-

Branches: 8,000+ across India

-

Employees: Over 1.7 lakh

-

ATMs: 20,000+

💼 Types of Loans Offered by HDFC Bank

🧾 Personal Loans

-

Up to ₹40 lakh

-

Tenure up to 60 months

-

Quick disbursal for salaried individuals

🏠 Home Loans

-

Post-merger, offers extensive housing finance options

-

Tenure up to 30 years

-

Attractive interest rates for salaried and self-employed

🚗 Car Loans

-

Finance up to 100% of ex-showroom price

-

Fast-track approvals via digital channels

🎓 Education Loans

-

Covers higher studies in India and abroad

-

Competitive interest rates

🏢 Business Loans

-

Loans for MSMEs

-

Working capital, term loans & cash credit

-

Collateral-free options

🪙 Gold Loans

-

Instant loans against gold jewelry

-

Safe custody and low interest options

⚠️ Common Issues Faced by HDFC Bank Customers

Despite being a market leader, HDFC Bank has faced several customer complaints over the years:

🔐 Digital Glitches & Server Downtime

-

Multiple complaints of mobile banking and net banking being inaccessible

-

RBI temporarily barred HDFC Bank from launching new digital products in 2021 due to outages

💸 Unexplained Deductions

-

Customers have reported auto-debit of fees, credit card charges, and penalty charges without consent or prior notification

📉 Customer Service Complaints

-

Long wait times

-

Limited support for grievance redressal on online platforms

-

Issues with dispute resolution on credit card charges and EMI discrepancies

🧑💼 Aggressive Cross-Selling

-

Many customers complained of being forced or tricked into buying insurance or credit card add-ons while opening accounts or applying for loans

🔄 Major Changes in HDFC Bank Over the Years

-

✅ Digital Expansion: Launched “Digital 2.0” initiative to enhance mobile and online banking after initial setbacks

-

✅ Merger with HDFC Ltd. (2023): One of the largest corporate mergers in India, combining housing and retail banking

-

✅ New Leadership: Sashidhar Jagdishan took over as MD & CEO in 2020, succeeding Aditya Puri

-

✅ Focus on Financial Inclusion: Expanded presence in rural and semi-urban areas post-merger

📊 Comparison: HDFC Bank vs Vizzve Financial – Personal Loan Experience

| Feature | HDFC Bank | Vizzve Financial |

|---|---|---|

| Loan Amount | Up to ₹40 lakh | Up to ₹10 lakh |

| Income Proof Requirement | Mandatory | Not required (in some cases) |

| Disbursal Time | 1–3 working days | Same day approval & transfer |

| Paperwork | Moderate | 100% digital & paperless |

| Customer Support | Limited on weekends | Dedicated assistance 24x7 |

| Ideal For | Salaried employees | Freelancers, gig workers, first-time borrowers |