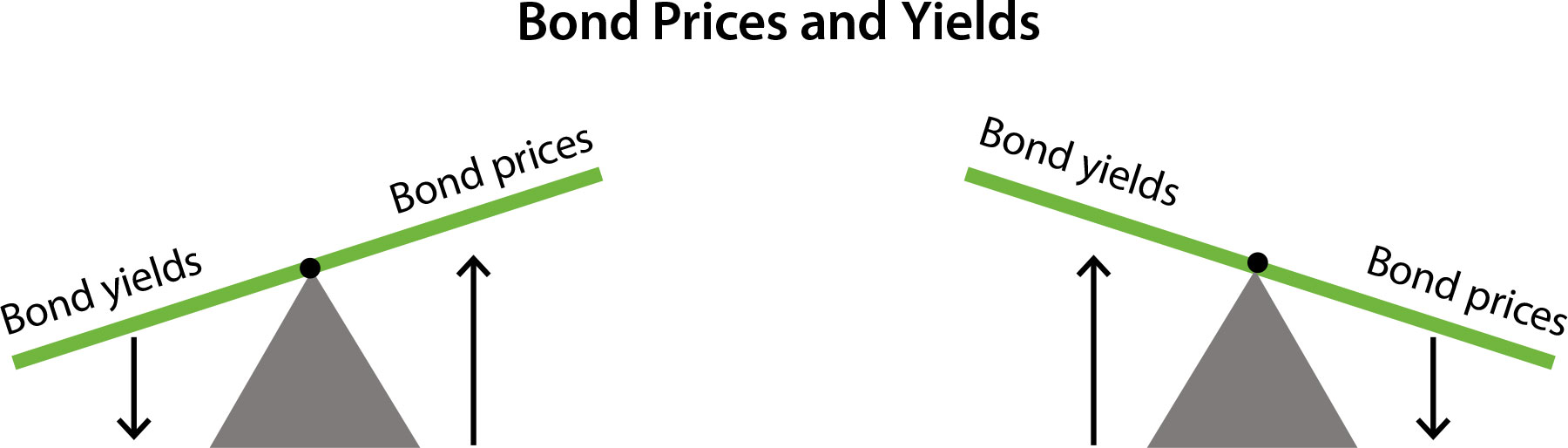

Despite historically low interest rates, borrowing costs in India are rising due to elevated bond yields. This paradox affects government borrowing, corporate debt, and infrastructure financing. Understanding the dynamics behind high yields is essential for investors, companies, and policymakers navigating the debt market.

1. The Bond Yield Paradox

Bond Yields Rising: Government securities and corporate bonds are offering higher yields as investors demand more return for perceived risks and liquidity preference.

Interest Rates Remain Low: The central bank’s policy rates continue to stay accommodative, but bond yields are influenced by market expectations, inflation, and global factors.

Impact on Borrowing: Higher yields increase the cost of issuing new debt, making loans and bonds more expensive for governments and corporations alike.

2. Factors Driving High Bond Yields

Global Interest Rate Pressure: Higher yields in U.S. treasuries and global debt markets create a benchmark for Indian investors, pushing domestic yields up.

Inflation Expectations: Persistent inflation concerns encourage lenders to demand higher returns on long-term debt.

Government Borrowing Needs: Increased fiscal borrowing requirements for infrastructure and social programs elevate supply of bonds, which can raise yields.

Market Sentiment: Risk perception due to geopolitical or macroeconomic uncertainties influences yield curves.

3. Implications for Debt Financing

Corporate Borrowers

Higher Financing Costs: Companies issuing bonds will face higher coupon payments, impacting capital expenditure and expansion plans.

Strategic Debt Planning: Firms may prefer shorter-term debt or floating-rate instruments to manage cost exposure.

Government Borrowing

Budgetary Pressure: Rising yields can increase interest expenses for government borrowing, affecting fiscal space for development projects.

Policy Adjustments: The government may consider reducing borrowing or issuing bonds with longer maturities to stabilize costs.

Investors

Attractive Returns: Higher bond yields make fixed-income investments more appealing.

Risk Management: Investors must evaluate credit risk, interest rate risk, and duration carefully before investing in debt instruments.

Banking Sector

Loan Pricing: Banks may raise lending rates for commercial loans, affecting credit availability for businesses and individuals.

Asset-Liability Management: Rising yields can impact bond portfolios and treasury operations for banks.

4. Strategies to Manage Rising Borrowing Costs

Hedging Interest Rate Risk: Using swaps and derivatives to protect against yield volatility.

Diversifying Debt Sources: Combining domestic bonds, loans, and international borrowings to balance costs.

Shorter Tenures: Issuing short-term debt to reduce exposure to rising long-term yields.

Inflation-Linked Instruments: Issuing bonds indexed to inflation to attract investors while managing cost.

FAQs

Q1: Why are borrowing costs rising despite low central bank rates?

Market bond yields are determined by investor expectations, inflation, and risk perceptions, not just policy rates.

Q2: How does this affect businesses?

Higher yields increase borrowing costs for corporate bonds and loans, which may reduce funds available for expansion.

Q3: What should investors watch for?

Interest rate trends, credit quality, and duration risk are crucial when investing in bonds during high-yield periods.

Q4: Can the government mitigate rising borrowing costs?

Yes, through careful debt issuance strategies, such as longer maturities, staggered borrowing, or inflation-indexed bonds.

Q5: Are rising yields always negative?

Not necessarily—higher yields can provide better returns for investors seeking income, but they increase costs for borrowers.

Published on : 11th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share