If you’re a homeowner looking to borrow money, two popular options are Home Equity Loans and Home Equity Lines of Credit (HELOCs).

Both let you borrow using your home’s equity — the value of your home minus what you owe on your mortgage.

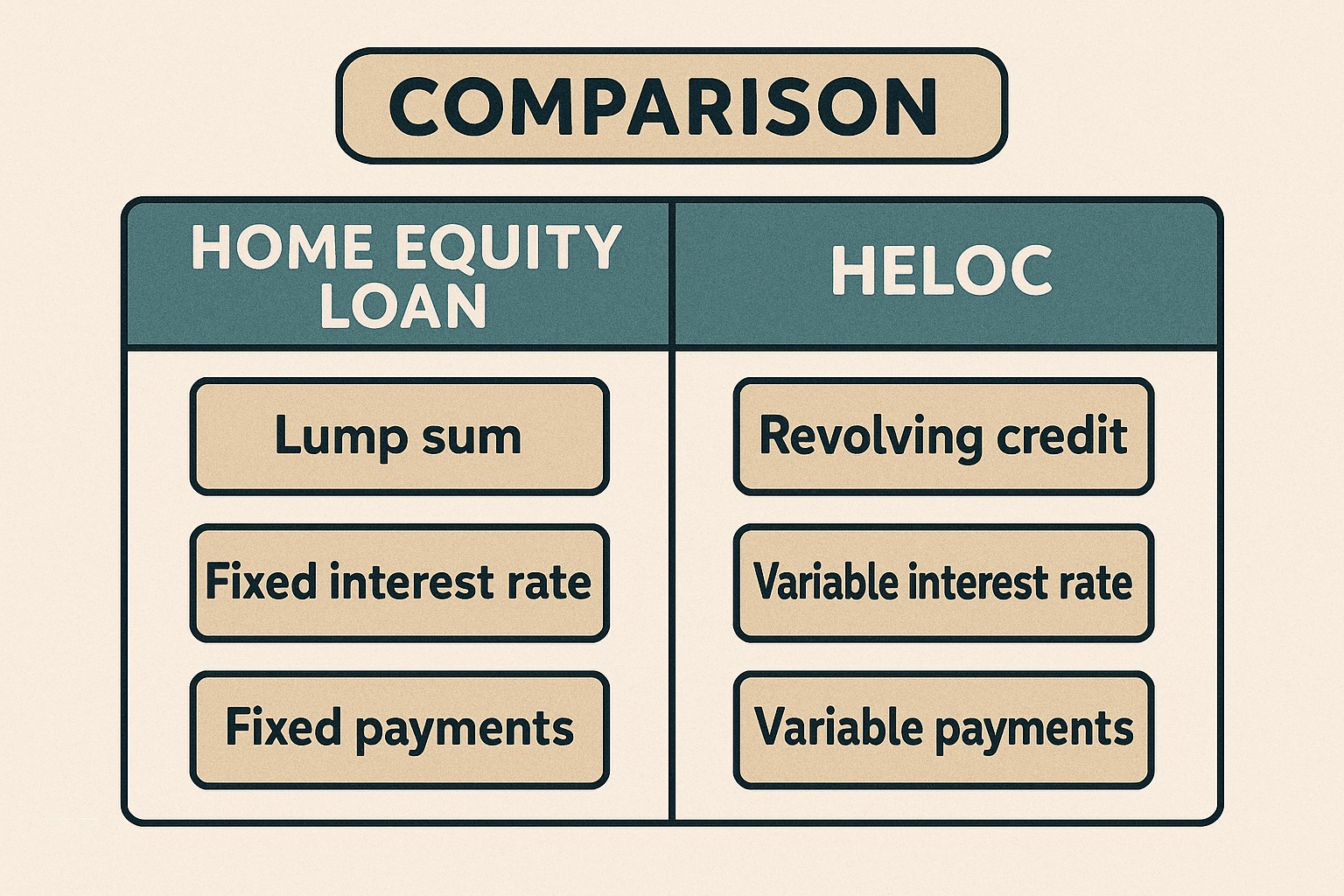

However, they differ significantly in terms of structure, interest, repayment and flexibility.

Here’s a simple, clear guide to help you understand the key differences.

1. What Is a Home Equity Loan?

A home equity loan gives you a lump-sum loan amount upfront.

You then repay it through fixed monthly EMIs over a specified period.

Best For:

One-time big expenses

Predictable repayment

Fixed interest stability

Examples of common uses:

Home renovation

Medical expenses

Paying off high-interest debt

Education costs

2. What Is a HELOC (Home Equity Line of Credit)?

A HELOC works like a credit card, backed by your home’s equity.

You get a revolving credit line and can withdraw funds as needed during the draw period (usually 5–10 years).

You pay interest only on what you use, not the entire limit.

Best For:

Ongoing or unpredictable expenses

Cash flow flexibility

Borrow-as-you-need needs

Examples of uses:

Ongoing home upgrades

Business cash flow

Emergency funds

Education over multiple years

3. Key Differences Between Home Equity Loan vs HELOC

A. Loan Structure

Home Equity Loan: Lump-sum

HELOC: Flexible, withdraw as needed

B. Interest Rate Type

Home Equity Loan: Fixed interest

HELOC: Usually variable interest

C. Repayment

Home Equity Loan: Fixed EMIs

HELOC: Interest-only during draw period; EMIs after

D. Flexibility

Home Equity Loan: Not flexible once taken

HELOC: Highly flexible — borrow when needed

E. Interest Cost

Home Equity Loan: Predictable but may cost more over time

HELOC: Lower initially but may rise due to variable rates

F. Risk

Both are secured by your home — failure to repay may lead to foreclosure.

4. When to Choose a Home Equity Loan

Choose a Home Equity Loan if:

You need one big amount

You prefer predictable EMIs

Interest rate stability matters

Your expenses are planned and fixed

5. When to Choose a HELOC

Choose a HELOC if:

You need ongoing access to funds

Your expenses are uncertain

You want flexibility

You can manage a variable interest rate

6. Pros & Cons Summary

Home Equity Loan

✔ Fixed rate

✔ Predictable repayment

✔ Good for large one-time expenses

✘ Less flexible

✘ Interest on entire amount from day one

HELOC

✔ Highest flexibility

✔ Pay interest only on what you use

✔ Great for long-term projects

✘ Variable interest

✘ Payments can increase later

FAQs

1. Are both options secured by my home?

Yes. Both use your home as collateral.

2. Which is cheaper — home equity loan or HELOC?

HELOCs often start cheaper, but rates can rise. Loans offer stable long-term costs.

3. Can I convert a HELOC to a fixed-rate loan?

Some lenders offer conversion, but not all.

4. Does a HELOC affect my credit score?

Yes. Late payments or high utilisation can harm your score.

5. Which is better for home renovation?

One-time renovation → Home equity loan

Multi-stage renovation → HELOC

Published on : 19th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed