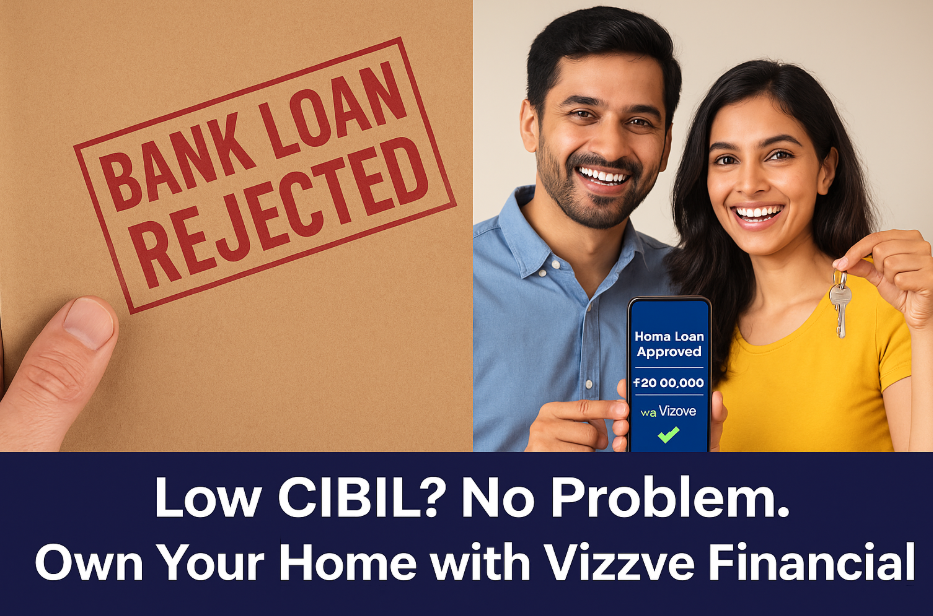

🏠 Home Loan Without CIBIL in 2025 – Is It Possible?

Published by: Vizzve Financial | Updated: May 6, 2025

🏡 Is It Possible to Get a Home Loan Without a CIBIL Score?

Yes, it’s possible in 2025. While traditional banks rely heavily on your CIBIL score to approve home loans, NBFCs (Non-Banking Financial Companies) and financial aggregators like Vizzve Financial offer flexible options—especially for:

-

First-time homebuyers

-

Borrowers with no credit history

-

Low or poor CIBIL score holders

-

Self-employed or informal-income individuals

So, even if your CIBIL is below 650 or not generated yet, you can still get a home loan by applying through the right partners.

💡 Why Banks Reject Home Loans with Low CIBIL

Banks follow strict RBI norms and often deny home loans if:

-

CIBIL score is below 700

-

There are past loan defaults or delays

-

No credit history exists (new-to-credit applicants)

-

Irregular income documentation

But NBFCs and housing finance companies assess alternate data like income cash flow, Aadhaar-linked behavior, and property collateral to approve loans.

✅ How Vizzve Financial Helps You Get a Home Loan Without CIBIL

Vizzve Financial works with 10+ NBFCs and housing finance companies that offer home loans even if your credit profile isn’t perfect.

🔹 Key Benefits:

-

🏠 Loan Amount: ₹5 Lakhs to ₹50 Lakhs

-

📄 Documents: Aadhaar, PAN, income proof (or alternate income like rent/transactions)

-

⏱️ Processing Time: 2–4 working days

-

💯 No CIBIL score required for basic eligibility

-

📱 100% Online Application via www.vizzve.com

👥 Who Can Apply:

-

Salaried individuals (even without Form 16)

-

Self-employed without ITR

-

Homemakers with property co-applicant

-

New-to-credit buyers

-

Low-income group buyers under PMAY scheme

👉 Apply Now: www.vizzve.com

📞 Call: 8449 8449 58

📝 Tips to Improve Approval Chances Without CIBIL

-

Apply with a Co-applicant: Add a family member with a stronger profile.

-

Choose a Property with Clear Title: Approved layouts or RERA-registered flats are more attractive for NBFCs.

-

Opt for a Lower Loan Amount Initially: Get started with a smaller approved amount and top-up later.

-

Show Alternate Income: Use rent slips, business UPI transactions, or even SHG income to support your application.

💬 Real Success Story

“My CIBIL was only 580 due to an old default. I was rejected by 3 banks. Through Vizzve, I got a ₹15 lakh loan approved by an NBFC within 5 days and now live in my own home.”

– Priya Nair, Bengaluru

📌 FAQ – Home Loan Without CIBIL in India (2025)

Q1: Can I really get a home loan with a low or zero CIBIL score?

A: Yes. NBFCs and partners of Vizzve approve loans based on income and property value.

Q2: Is the interest rate higher without a CIBIL score?

A: Slightly higher than banks, but still affordable. Once your repayment is good, you can refinance later.

Q3: What documents are required?

A: Aadhaar, PAN, property papers, and any proof of income (even rental, business cash flow, or alternate income).

Q4: Do I need to visit any office?

A: No. You can apply fully online via www.vizzve.com.