You want to revamp your kitchen, extend a bedroom, or finally give your home the facelift it deserves. But when it comes to financing a renovation in 2025, you’ve got two choices:

👉 Home Renovation Loan

👉 Personal Loan

So, which loan is better for your needs? Let Vizzve Finance help you compare and choose smartly.

🧾 What Is a Home Renovation Loan?

A home renovation loan is a type of secured loan specifically meant for home improvements. It's typically offered to homeowners who want to renovate their existing property.

✅ Key Features:

Lower interest rates (compared to personal loans)

Based on property ownership

Can be part of your existing home loan

Possible tax benefits under Section 24(b)

💰 What Is a Personal Loan?

A personal loan is an unsecured loan, meaning you don’t need to pledge collateral. You can use it for anything, including home renovations.

✅ Key Features:

Faster disbursal

No collateral required

Shorter tenure (1–5 years)

Slightly higher interest rates (11–24% p.a.)

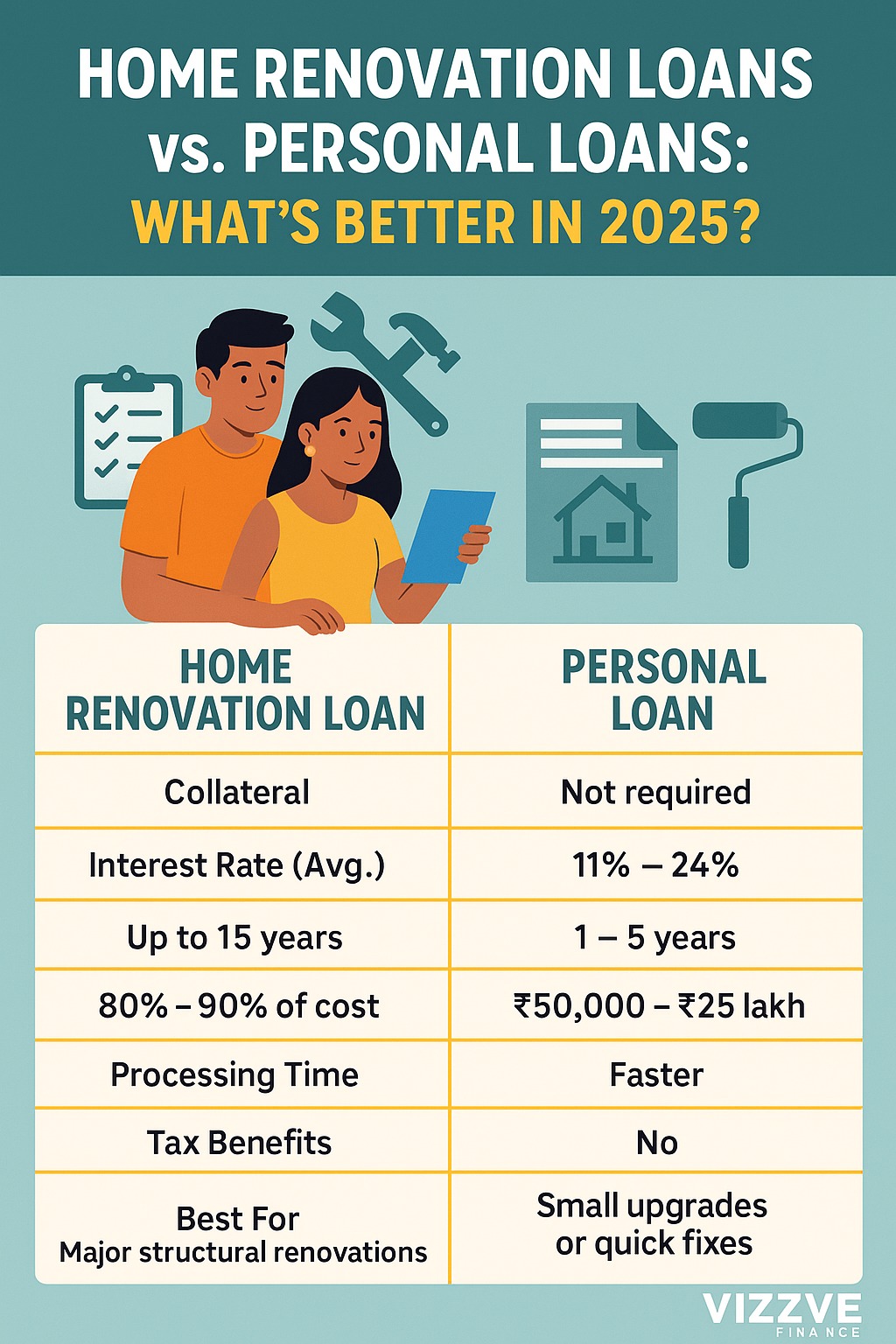

📊 Side-by-Side Comparison: 2025 Edition

| Feature | Home Renovation Loan | Personal Loan |

|---|---|---|

| Collateral | Required (property) | Not required |

| Interest Rate (Avg.) | 8.5% – 11.5% | 11% – 24% |

| Tenure | Up to 15 years | 1 – 5 years |

| Loan Amount | 80% – 90% of cost estimate | ₹50,000 – ₹25 lakh |

| Processing Time | Slower (5–10 days) | Faster (24–72 hours) |

| Tax Benefits | Yes (Sec 24b – ₹30,000 max) | No |

| Best For | Major structural renovations | Small upgrades or quick fixes |

🏠 When Should You Choose a Home Renovation Loan?

✔️ You own the property and have documents

✔️ You’re doing major structural changes (roof, plumbing, flooring)

✔️ You want lower EMIs & longer repayment

✔️ You’re already a home loan customer with the same bank

🚿 When Should You Choose a Personal Loan?

✔️ You need money urgently

✔️ The renovation is small to mid-sized (painting, modular kitchen, furniture)

✔️ You don’t want to risk collateral

✔️ You want flexibility in how you use the funds

📢 Vizzve Insight: Tax Benefit Tip

You can claim up to ₹30,000 in interest deduction under Section 24(b) of the Income Tax Act for home renovation loans—only if linked to your property.

No tax perks on personal loans used for renovation.

🧠 Pro Tips Before Applying

🧾 Get cost estimates from contractors to determine accurate loan amount

🏦 Compare multiple lenders via Vizzve for best rates

🧮 Use Vizzve’s EMI calculator to plan smartly

🔒 Don’t borrow more than you can comfortably repay

❓ FAQs – Home Renovation vs. Personal Loans in India 2025

Q: Can I get a home renovation loan without an existing home loan?

A: Yes, but you'll need to prove ownership of the property.

Q: Which loan is better for ₹2–3 lakh renovation?

A: A personal loan is faster and better suited for smaller renovations.

Q: Will banks ask for renovation proof?

A: Yes. For home renovation loans, you may need to submit invoices or quotes from contractors.

Q: Can I prepay either of these loans?

A: Yes, but check prepayment charges with your lender.

✅ Vizzve Final Word

🏠 If your renovation is large, planned, and property-linked — go for a home renovation loan.

⚡ If it's urgent, quick, and under ₹5–10 lakh — opt for a personal loan.

No matter which one you choose, Vizzve Finance helps you compare rates, simplify paperwork, and stay financially stress-free.

Your dream home makeover starts with a smart loan decision.

Published on : 18th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed.