A personal loan calculator is a digital tool that helps borrowers estimate the monthly EMI, total interest, and repayment schedule for a personal loan. Using this calculator before applying for a loan can help you plan your finances better and choose the most suitable loan option.

How Does a Personal Loan Calculator Work?

A personal loan calculator works by using the loan amount, interest rate, and loan tenure to calculate EMIs. Most calculators use the standard EMI formula:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1+r)^n}{(1+r)^n-1}EMI=(1+r)n−1P×r×(1+r)n

Where:

P = Principal loan amount

r = Monthly interest rate

n = Number of monthly installments

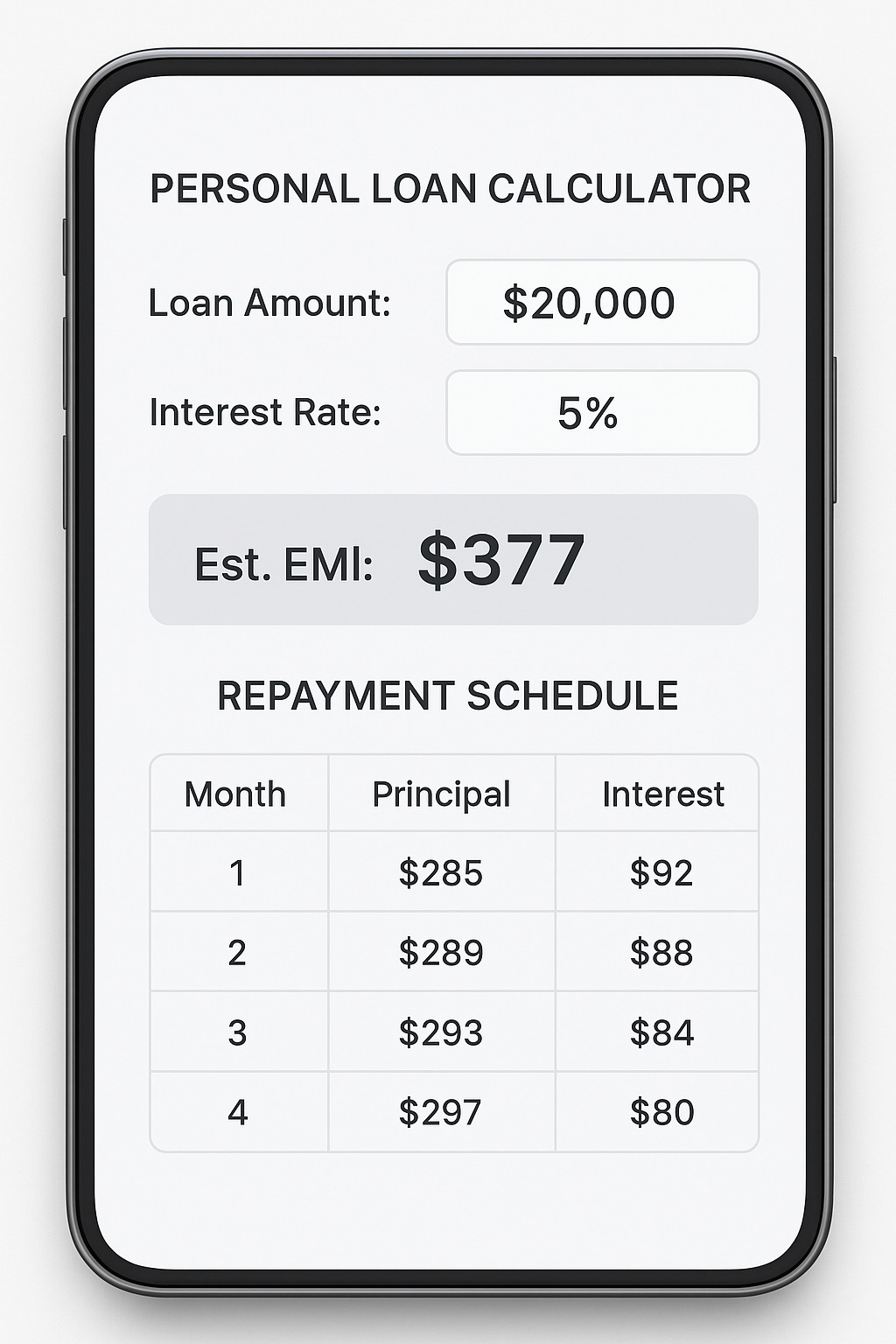

Once you enter the details, the calculator instantly provides:

EMI Amount: Monthly repayment you need to pay.

Total Interest Payable: Total interest over the loan tenure.

Total Payment: Principal + interest over the loan period.

Amortization Schedule: Breakdown of principal and interest for each month.

Why Use a Personal Loan Calculator?

Plan Your Budget: Know how much you need to pay monthly.

Compare Loans: Evaluate different interest rates and tenures before finalizing.

Avoid Over-Borrowing: Borrow only what you can comfortably repay.

Save on Interest: Experiment with shorter tenures to reduce total interest.

Instant Estimation: No paperwork or approvals needed to check EMIs.

Tips for Using a Personal Loan Calculator

Input the exact loan amount and interest rate offered by your bank.

Try different tenures to see how it affects your EMI and total interest.

Factor in processing fees or other charges if the calculator allows.

Use calculators from trusted banks or financial platforms for accuracy.

FAQs

Q1: Is a personal loan calculator accurate?

A1: It gives a close estimate of EMIs and interest. Actual figures may vary slightly due to processing fees or lender-specific rules.

Q2: Can I calculate EMIs for pre-approved loans?

A2: Yes, enter the pre-approved loan amount, interest rate, and tenure to get accurate EMIs.

Q3: Does it charge any fees?

A3: No, personal loan calculators are free tools provided by banks and financial platforms.

Q4: Can it help me choose between multiple lenders?

A4: Absolutely! You can input different interest rates and tenures to compare lenders and pick the best option.

Published on : 4th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share