India is one of the world’s largest recipients of remittances — over $125 billion annually — as millions of Indians working abroad send money back home. But cross-border payments have long been slow, expensive, and dependent on intermediaries.

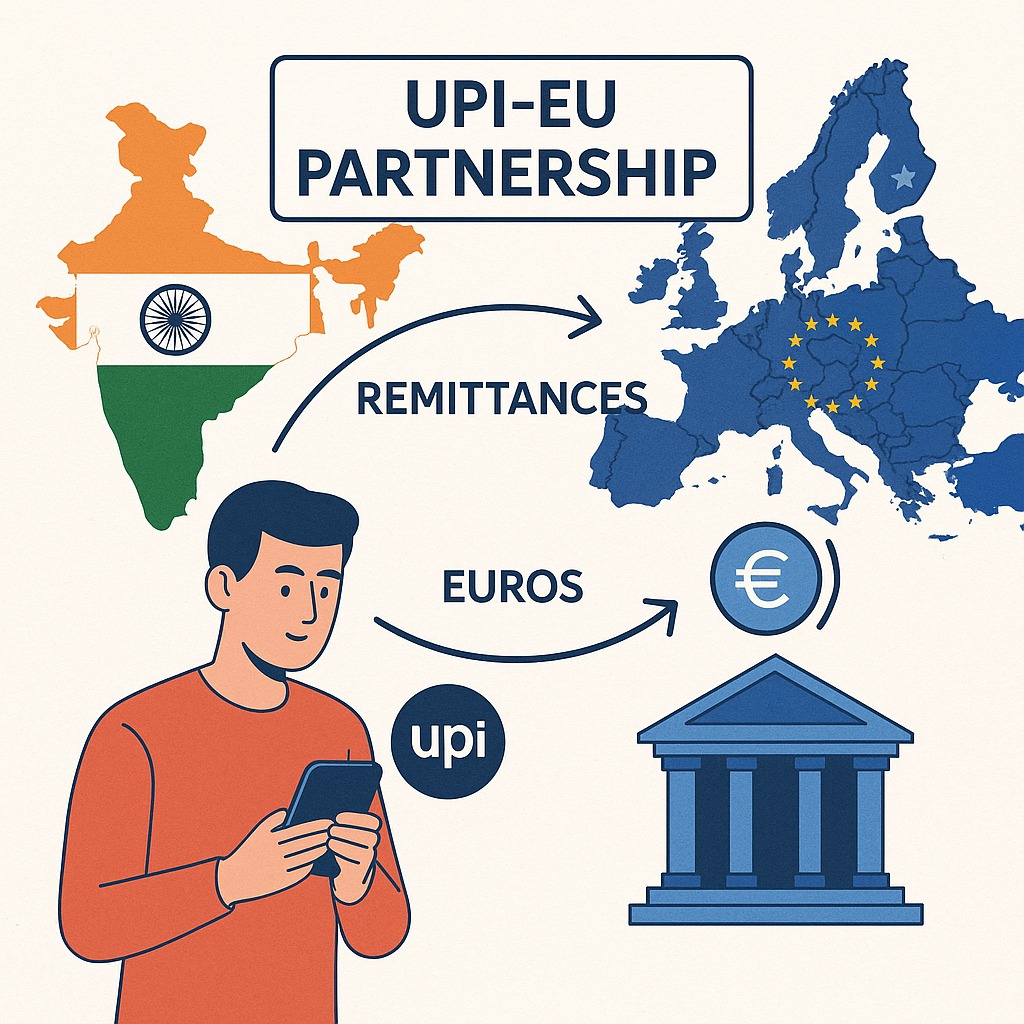

Now, India’s efforts to link its powerful Unified Payments Interface (UPI) with digital payment systems in the European Union may fundamentally reshape global remittance flows.

This partnership represents a shift toward low-cost, instant, and seamless international money transfers, positioning UPI as a global digital payments infrastructure.

1. Lower Remittance Costs — A Major Game-Changer

Traditional remittance channels often charge:

High service fees (3–8%)

Currency conversion charges

Hidden processing deductions

Slow settlement times

UPI–EU linkages can dramatically reduce these costs.

✔ How?

Enables direct account-to-account transfers

Eliminates multiple intermediaries

Uses interoperable, regulated digital payment rails

Reduces transaction fees with transparent pricing

For Indian workers in Europe, this means higher take-home earnings for families back home.

2. Near-Instant Cross-Border Transfers

Most global remittances take:

Hours to days for banking settlement

Longer during weekends or holidays

UPI’s real-time architecture enables:

Instant money movement

24×7 availability

Real-time currency conversion (future-ready)

This is especially helpful for migrant workers sending emergency funds home.

3. UPI as a Global Standard for Low-Cost Digital Payments

With ongoing link-ups in:

Singapore

UAE

France

Nepal

Bhutan

Sri Lanka

And now potential EU integration

UPI is quickly becoming one of the world’s most interoperable digital payment networks.

The EU partnership strengthens India’s position in global fintech diplomacy, setting the stage for:

Multi-currency UPI wallets

Seamless QR-based payments abroad

Merchant acceptance in EU cities

4. Europe Has a Large Indian Diaspora — Big Remittance Potential

Countries with significant Indian populations:

Germany

Netherlands

France

Italy

Belgium

Ireland

Spain

A UPI-compatible system would allow these workers to send money home at a fraction of current costs.

Even a 1% reduction in remittance charges could save Indian workers abroad hundreds of millions annually.

5. Boost to India’s Fintech Exports and Digital Public Infrastructure

The UPI–EU collaboration is more than remittances. It opens doors for:

Indian fintech companies entering EU markets

Cross-border QR integration

API-level payment innovation

Digital identity and KYC collaborations

Joint cybersecurity frameworks

India’s digital public infrastructure (DPI) model becomes a global export product, similar to how UPI expanded through NPCI International.

6. Currency Conversion to Become Cheaper & Transparent

A major pain point today is the hidden forex mark-up.

UPI–EU systems can allow:

Direct currency conversion

Transparent exchange rates

Inter-bank competition for forex rates

Elimination of added mark-ups

Users will know exactly how much their families receive — no surprises.

7. Greater Security and AML Compliance

UPI’s secure, encrypted, multi-factor authentication framework aligns with EU’s:

PSD2 standards

Strong Customer Authentication (SCA)

Anti-money laundering regulations

This ensures safe, compliant cross-border transfers without manual paperwork.

8. Could Reduce Reliance on Traditional Remittance Giants

With UPI entering Europe, users may shift from:

Western Union

MoneyGram

Legacy bank transfers

Forex agents

towards low-cost digital rails.

This could disrupt the global remittance ecosystem.

Conclusion: A New Era of Borderless Digital Payments

India’s digital payments link-up with the EU represents a fintech revolution in motion.

It promises:

Faster remittances

Lower costs

Greater transparency

More digital inclusiveness

Stronger India–EU economic cooperation

As UPI continues to expand globally, India is not just receiving remittances — it is shaping the future architecture of cross-border digital payments.

FAQs

1. How will UPI–EU integration reduce remittance costs?

By enabling direct digital transfers without intermediaries or hidden forex mark-ups.

2. Will transfers be instant?

Yes, UPI-powered systems are designed for real-time settlement.

3. Which European countries could benefit the most?

Germany, France, Italy, Netherlands, Belgium, Ireland, and Spain due to large Indian communities.

4. How does this help India’s fintech industry?

It expands fintech exports, improves digital interoperability, and strengthens India’s global digital influence.

5. Will UPI work at physical stores in the EU?

Future phases may enable UPI QR payments for retail purchases abroad.

6. Is the partnership secure?

UPI aligns with strong EU payments regulations, ensuring safe cross-border transactions.

Published on : 22nd November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed