The investment or capex cycle refers to the ebb and flow of business investment, infrastructure spending, manufacturing expansion and related activity. When this cycle is near its trough, economies often show signs such as weak private investment, low capacity utilisation, subdued infrastructure spend — but also signals of recovery begin to appear.

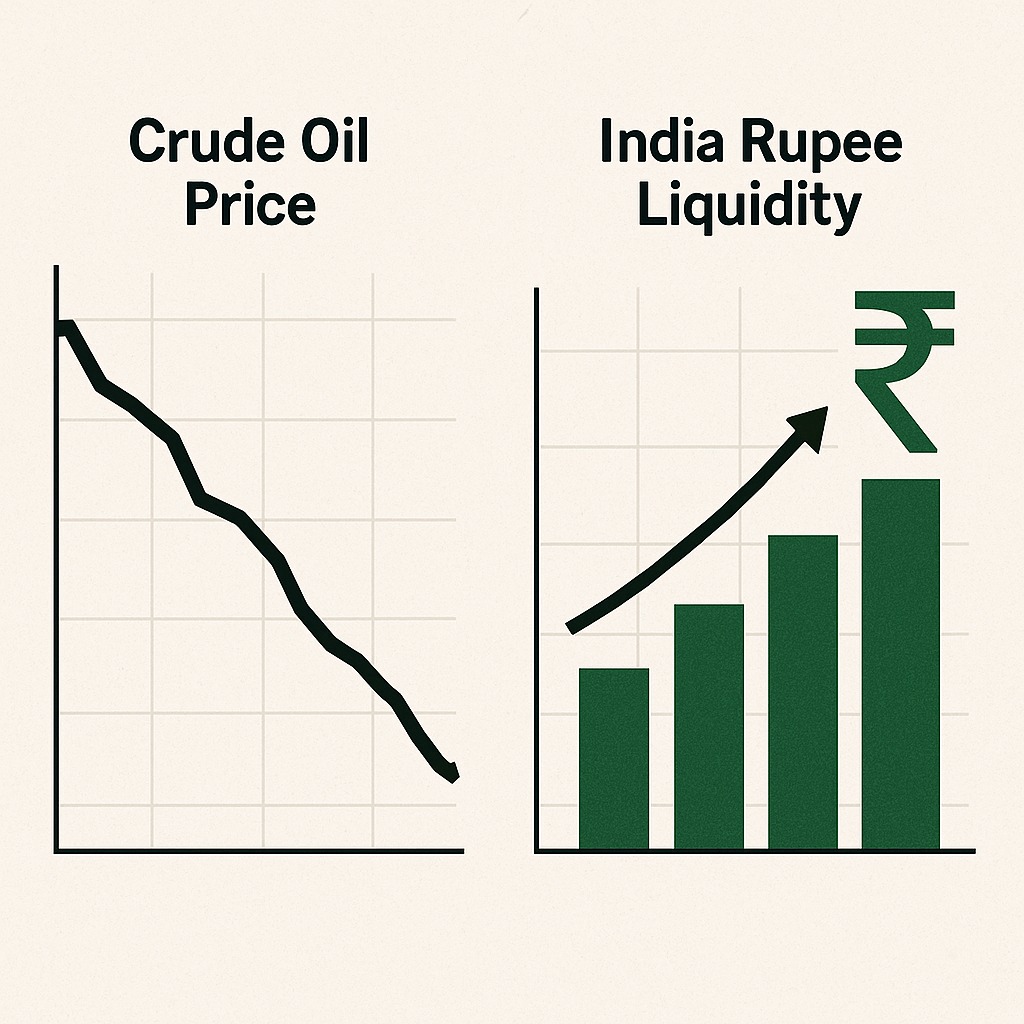

Recent reports suggest that India may be reaching such a turning point — the bottom of the investment cycle — thanks to two key signals: easing crude oil prices and improved liquidity.

1️⃣ Why Crude Oil Prices Matter

India is a large importer of crude oil; high oil prices push up input costs, inflation, current account pressure and thus hurt business confidence and investment. A decline in oil prices therefore removes a major headwind. For example:

A report noted that “decline in crude prices … are all supportive of a pick-up in growth going forward.”

Lower oil should reduce cost pressures, freeing up cash flows for businesses and investment.

Thus, a sustained drop or stabilisation in crude oil is a favourable signal that the investment cycle can recover.

2️⃣ The Role of Liquidity and Interest Rates

Liquidity in the banking system and the interest rate environment are central in enabling investment. When rates are high and liquidity tight, investment tends to get delayed. But recent commentary suggests:

India’s growth cycle may be bottoming out as interest rate and liquidity cycles turn favourable.

With softer inflation pressure (thanks partly to lower oil) the central bank has more room to ease or at least hold rates — which encourages investment.

In short: better liquidity + lower cost of funds = more investment willingness.

3️⃣ What This Implies for the Investment Cycle

Putting these together:

Lower oil prices reduce cost/inflation drag

Improved liquidity/interest rate signals reduce financing costs

Hence, the two signals suggest India’s investment cycle may be bottoming out and we might be entering a phase of renewed investment activity.

This is further supported by reports expecting a medium-term uptrend in investment. Angel One

4️⃣ What’s Still Holding Back Investment

Even if the bottom is near, some headwinds remain:

Global demand remains weak: export/trade uncertainty continues to weigh. The Times of India+1

Private sector capex often takes time to pick up even when conditions turn favourable.

Structural issues like land/acquisition, regulatory delays, high commodity costs might still hamper large investments.

So while the signals are positive, the rebound may not be uniform or immediate.

5️⃣ What Should Stakeholders Watch For

For those tracking investment or financial implications:

Capacity utilisation rates across sectors — an uptick often signals investment pickup.

Capex intentions in company filings and announcements.

Oil price trajectory — if oil remains low/declining, cost incentive stays.

Bank lending growth / corporate credit growth — rising lending to infrastructure/manufacturing suggests investment revival.

Liquidity indicators — such as RBI liquidity injections, repo rate movements, bank lending spreads.

Government infrastructure spend announcements — because infrastructure often leads the investment revival.

Final Thoughts

The combination of easing input costs (oil) and better financing conditions (liquidity/interest) suggests that India may be near the trough of its investment cycle. For businesses, investors and policymakers, this matters — a recovery in the investment cycle can fuel growth, job creation and returns.

But bottoming out doesn’t mean boom overnight — structural issues and global headwinds remain. The rebound is likely to be gradual, sektor-specific and dependent on execution.

In the coming months, as these signals flesh out, India’s investment landscape could shift from “wait & watch” to “invest & build”.

❓ Frequently Asked Questions (FAQ)

1. What does it mean when an investment cycle is “bottoming out”?

It means the trough or lowest point of investment activity has likely been reached — conditions are becoming favourable for investment to rise.

2. Why do crude oil prices influence investment in India?

Because India imports a large amount of crude; high oil prices increase costs (inflation, manufacturing input costs), hurting profitability and investment. Lower oil eases this burden.

3. How does liquidity affect the investment cycle?

Liquidity refers to how much funding is available and how cheap it is. Better liquidity and lower borrowing costs make it easier for businesses to invest and expand.

4. If investment is bottoming out, what sectors will lead?

Infrastructure, manufacturing, renewable energy and sectors linked to government stimulus often lead the recovery.

5. Does a bottoming investment cycle mean the economy will grow faster immediately?

Not necessarily immediately. It improves the conditions for growth, but actual investment takes time to ramp up and may be uneven.

Published on : 11th November

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed