Microfinance Institutions (MFIs) play a crucial role in providing financial access to underserved populations in India. However, lending money to low-income borrowers comes with its own set of challenges, particularly the risk of over-indebtedness. MFIs build long-term trust by adopting responsible lending practices, ensuring that borrowers benefit without falling into debt traps.

1. Assessing Borrower Repayment Capacity

Responsible lending begins with a thorough evaluation of a borrower’s financial capacity. MFIs:

Assess income sources and household expenses.

Avoid giving loans that exceed repayment capacity.

Use group lending models to ensure collective accountability.

This approach reduces defaults and fosters mutual trust between the MFI and the borrower.

2. Transparent Loan Terms and Interest Rates

Transparency is a cornerstone of trust. MFIs ensure borrowers understand:

Interest rates (minimum, maximum, and average).

Processing fees and other charges.

Repayment schedules and penalties for late payments.

Clear communication prevents misunderstandings and builds confidence in the institution.

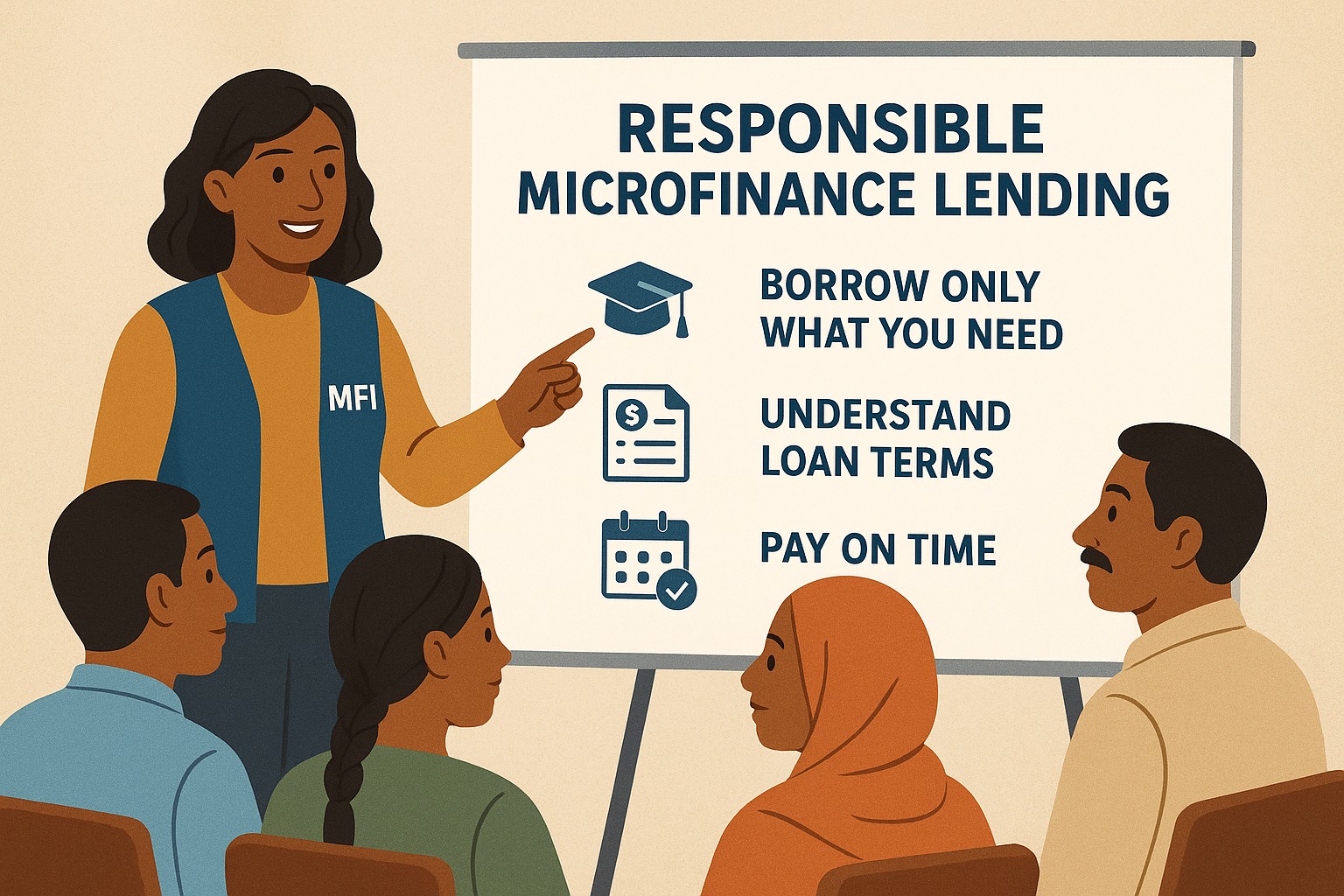

3. Financial Literacy and Education

MFIs don’t just lend money; they empower borrowers with financial knowledge:

Conduct workshops on budgeting and savings.

Explain how timely EMI payments improve creditworthiness.

Teach responsible borrowing practices to avoid debt traps.

Borrowers who understand loans are more likely to repay on time, creating a trustworthy relationship.

4. Avoiding Over-Indebtedness

MFIs adhere to RBI guidelines and internal policies to prevent borrowers from accumulating excessive debt. Responsible lending includes:

Checking existing loan obligations before approval.

Limiting the loan size relative to income.

Offering repayment flexibility in emergencies.

This protects borrowers and enhances the credibility of the MFI.

5. Building Long-Term Relationships

Trust is strengthened when MFIs treat borrowers as partners rather than mere clients. Practices include:

Personalized guidance and support during repayment.

Recognition of timely payments with incentives or lower interest rates.

Open channels for complaints or clarifications.

A borrower who feels valued is more likely to remain loyal and recommend the MFI to others.

6. Ethical Recovery Practices

Responsible MFIs avoid aggressive or unethical collection methods. Instead, they:

Engage in friendly reminders and structured repayment plans.

Offer grace periods during financial hardship.

Use community support mechanisms for collection rather than coercion.

Ethical practices build confidence and reduce the stigma associated with borrowing.

Conclusion

By focusing on responsible lending, transparency, and financial education, MFIs not only minimize risks but also earn the trust of their borrowers. This trust ensures long-term relationships, better repayment rates, and a positive impact on the broader community. Ethical lending practices are the foundation of sustainable microfinance.

❓ FAQs

Q1: What is responsible lending in microfinance?

Responsible lending ensures loans are offered based on a borrower’s repayment capacity, with transparent terms and ethical practices to avoid over-indebtedness.

Q2: How do MFIs educate borrowers?

MFIs conduct workshops, one-on-one guidance, and provide educational materials about budgeting, credit scores, and repayment discipline.

Q3: Can responsible lending improve a borrower’s credit score?

Yes, timely EMI payments reported to credit bureaus help borrowers build a strong credit history.

Q4: How do MFIs prevent borrowers from taking too many loans?

They verify existing obligations, limit loan amounts based on income, and follow RBI guidelines on maximum debt limits.

Q5: Why is trust important between MFIs and borrowers?

Trust leads to better repayment rates, long-term relationships, and a positive reputation, allowing MFIs to serve more communities sustainably.

Published on : 10th October

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share