Most people budget by asking:

“What can I afford?”

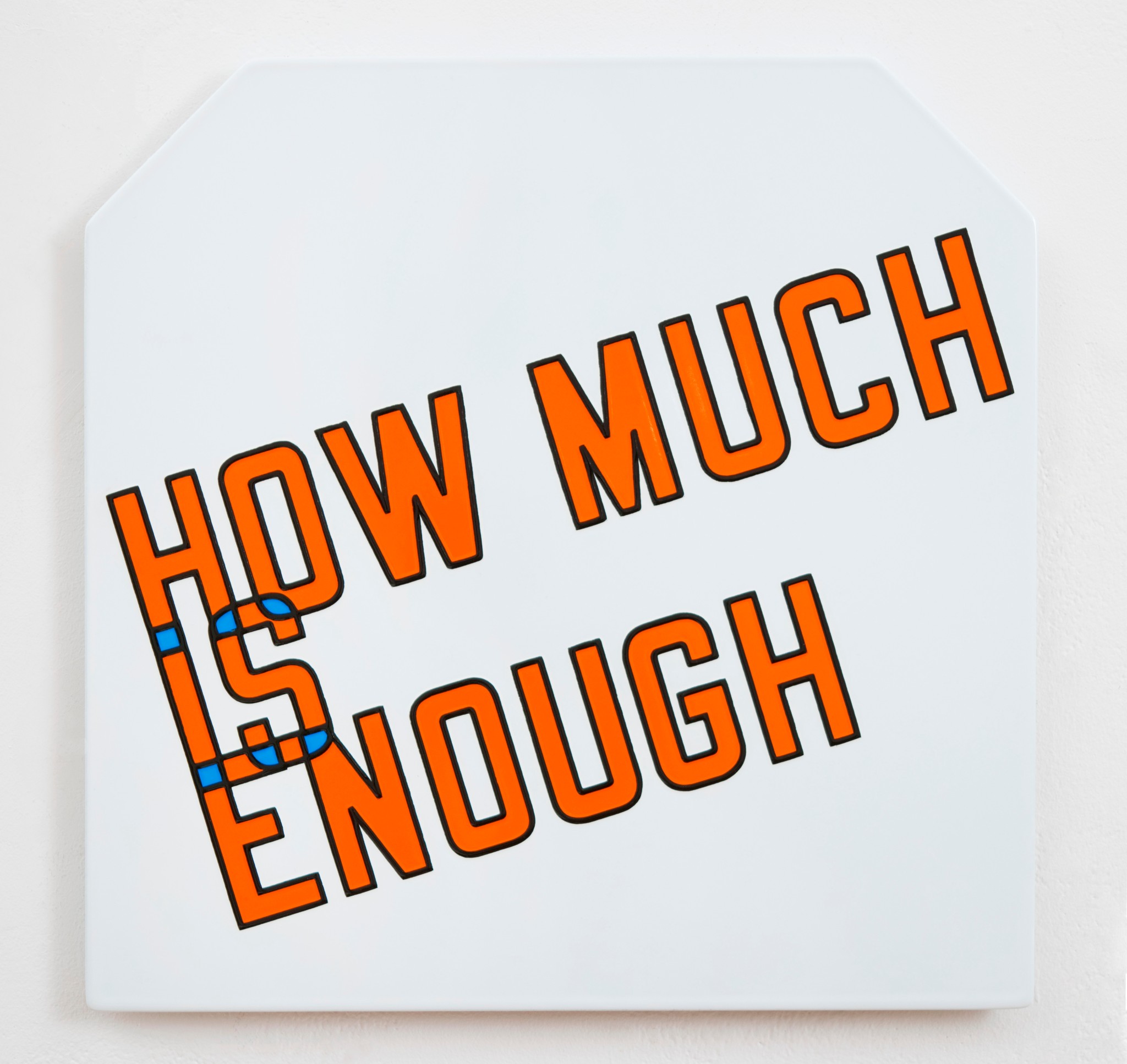

But what if the better question is:

“How much is enough?”

In an age of impulsive buying, status spending, and lifestyle inflation, this simple query brings clarity, control, and calm.

At Vizzve, we believe this is the most powerful question you can ask to reboot your financial life.

🔍 Why We Overspend: The “More” Trap

From online sales to lifestyle envy on social media, we’re taught to believe:

More gadgets = success

Bigger house = security

Fancier vacation = happiness

But when “enough” isn’t defined, expenses balloon. Budgets break.

🧠 The Psychology of “Enough”

The idea of “enough” changes:

A single person might need ₹30,000/month

A family of 4 might need ₹1.5 lakh

A retiree might just need peace and ₹20,000

It’s not about how much you earn.

It’s about knowing when to pause consumption and protect savings.

📝 Budgeting With “Enough” in Mind

Vizzve helps you break this down into 4 key categories:

| Category | Ask This… | Example Value |

|---|---|---|

| 🎯 Essentials | “What’s the minimum I need to survive?” | ₹40,000/month |

| 💼 Responsibilities | “What’s enough to stay debt-free?” | ₹10,000 EMI |

| 🌱 Growth & Goals | “How much to invest for peace of mind?” | ₹8,000 SIP |

| 🌈 Joy & Lifestyle | “What makes life worth living without guilt?” | ₹5,000 outings |

If you know your minimums, your overspending becomes obvious—and fixable.

📲 How Vizzve Helps You Define “Enough”

Budget Tracker auto-categorizes your spending

Goal-Based Planning shows you how close you are to your version of “enough”

Reminders & Limits help you stay disciplined

Emotional nudges in the app ask: “Did you need that 5th coffee this week?”

We’re not here to judge. We’re here to help you ask better questions

💬 Vizzve Explains

“Enough isn’t minimalism. It’s mindful money.”

Defining your “enough” gives you freedom.

Because once your needs are met, the rest is gratitude and growth.

❓ FAQs

Q1: How do I calculate what’s enough for me?

Start with fixed costs (rent, EMIs), then add must-haves (groceries, bills), and finally buffer for savings and joy. Vizzve helps build this visually.

Q2: What if I feel guilty saving too little?

There’s no perfect formula. But asking “What matters most to me?” leads you toward better spending.

Q3: Is “enough” the same as being frugal?

No. “Enough” is custom to your values, not society’s standards.

🧭 Final Thought

You don’t need more money.

You need a better relationship with what you already earn.

Ask yourself today:

“How much is enough for me?”

Vizzve is here to help you live richer—not just spend more.

Published on : 10th July

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed.