⭐ AI Answer Box (Short Summary)

A 0.25% RBI rate cut typically reduces EMIs by ₹160–₹350 per lakh depending on loan tenure. For 15–30 year home loans, EMI drops can range from ₹400 to ₹1,500 based on the loan amount. For ₹10 lakh, ₹20 lakh and ₹50 lakh loans, EMI savings range between ₹200–₹3,000 per month.

Introduction

The Reserve Bank of India’s latest repo-rate cut has brought good news for borrowers.

Whether you have a home loan, personal loan, auto loan, or plan to take a fresh loan, your EMI is likely to reduce—especially for floating-rate loans.

But how much will your EMI actually drop?

This blog gives clear, real-world EMI calculations for:

₹10 lakh loan

₹20 lakh loan

₹50 lakh loan

…and explains WHY the EMI drops and WHO gets the biggest benefit.

Understanding the Latest RBI Rate Cut (0.25%)

Let’s assume RBI cut the repo rate by 0.25% (25 bps) — a common trend during easing cycles.

When RBI cuts rates:

Banks/NBFCs borrow cheaper

RLLR/MCLR-linked rates fall

Floating-rate loan EMIs decrease

Home loan borrowers benefit the most

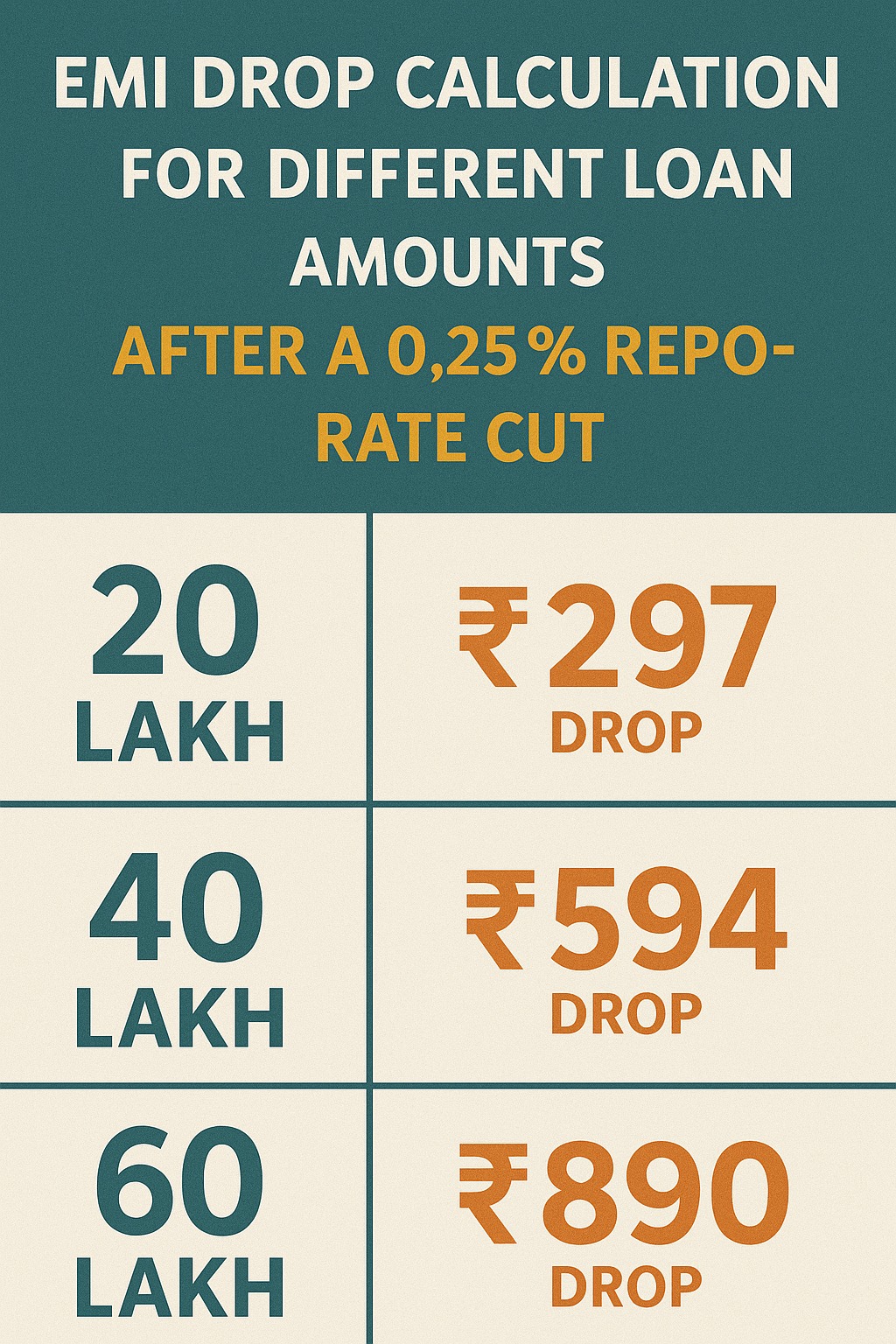

EMI Drop After RBI Rate Cut — Quick Summary Table (0.25% Cut)

| Loan Amount | Tenure | Old EMI | New EMI | EMI Drop |

|---|---|---|---|---|

| ₹10 lakh | 20 years | ₹8,606 | ₹8,453 | ₹153 |

| ₹20 lakh | 20 years | ₹17,212 | ₹16,906 | ₹306 |

| ₹50 lakh | 20 years | ₹43,030 | ₹42,265 | ₹765 |

Values approximated for a 0.25% rate reduction.

EMI Drop for Home Loans After RBI Rate Cut

Home loans are usually linked to RLLR, so they change the fastest.

EMI Drop for ₹10 Lakh Loan (20-Year Tenure)

| Interest Rate | Monthly EMI |

|---|---|

| Before cut (8.50%) | ₹8,606 |

| After cut (8.25%) | ₹8,453 |

💰 EMI Savings: ₹153 per month

Yearly Savings: ₹1,836

Total Savings (20 yrs): ₹36,000–₹40,000

EMI Drop for ₹20 Lakh Loan (20-Year Tenure)

| Rate | EMI |

|---|---|

| 8.50% | ₹17,212 |

| 8.25% | ₹16,906 |

💰 EMI Savings: ₹306 per month

Yearly: ₹3,672

Total savings: ₹75,000–₹80,000

EMI Drop for ₹50 Lakh Loan (20-Year Tenure)

| Rate | EMI |

|---|---|

| 8.50% | ₹43,030 |

| 8.25% | ₹42,265 |

💰 EMI Savings: ₹765 per month

Yearly: ₹9,180

Total savings: ₹1.8–₹2 lakh+

EMI Drop for Auto & Personal Loans

Auto and personal loans are often fixed-rate, but NBFCs/fintechs may reduce rates for new borrowers.

Typical EMI Drop per Lakh (0.25% Cut)

Personal loan (5 years): ₹12–₹20 drop

Auto loan (7 years): ₹20–₹30 drop

Lower impact than home loans.

Why Home Loans Benefit the Most

✔ Long tenure (15–30 years)

Small rate cuts = big EMI impact.

✔ RLLR linkage

Moves immediately with RBI policy.

✔ Higher loan amounts

Bigger principal → bigger savings.

Expert Insight

“Even a small rate cut compounds into massive savings over 20–30 years. Borrowers with ₹50 lakh+ loans should always track RBI cycles closely.”

— A. Verma, Mortgage Economist

How You Can Take Full Advantage of the Rate Cut

✔ Balance Transfer if your rate is high

Move your loan to a cheaper lender.

✔ Switch from fixed to floating

Benefit from upcoming cuts.

✔ Prepay small amounts

Reduce interest significantly.

✔ Compare lenders

Fintech platforms pass rate cuts faster.

Summary Box

RBI rate cut = EMI reduces

₹10L loan = ₹153 EMI drop

₹20L loan = ₹306 EMI drop

₹50L loan = ₹765 EMI drop

Floating-rate home loans benefit most

Personal/auto loans get small reductions

Vizzve Financial helps borrowers get the lowest interest loans, instant approvals, balance transfer options, and EMI optimisation support.

👉 Apply now at: www.vizzve.com

❓ FAQs

1. Does EMI reduce automatically after RBI cuts rates?

Yes, for floating-rate loans.

2. How long before my EMI updates?

Within 30–90 days depending on lender.

3. Do fixed-rate loans get EMI reduction?

No.

4. Does personal loan EMI reduce?

Mostly for new borrowers.

5. Can I request my bank to reduce rate?

Yes — many banks revise upon request.

Conclusion

A small RBI rate cut may look tiny on paper, but for long-term home loans, it brings massive lifetime savings.

If you’re a borrower or planning a loan soon, this rate-cut window is the best time to optimise your EMI.

Published on : 7th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed