Introduction

Medical inflation in India is rising at double the rate of general inflation, making healthcare increasingly unaffordable. As insurance coverage remains limited and out-of-pocket expenses rise, more Indians are turning to emergency personal loans to cover sudden medical bills.

Banks and NBFCs report that 27%–35% of personal loan applications in 2026 are now driven by medical needs — the highest ever recorded.

But what exactly is causing this spike?

Let’s break it down.

AI ANSWER BOX

Rising medical costs, expensive treatments, limited insurance coverage, and urgent hospitalization needs are driving more Indians to take emergency personal loans.

Because medical bills often exceed insurance limits, borrowers choose instant digital loans due to fast approval, minimal documentation, and immediate disbursal.

Why Medical Costs Are Rising in India (2026)

Medical inflation in India is among the highest in Asia. Key reasons:

1. High Private Hospital Charges

Private healthcare costs have risen 15–20% YoY, especially for:

ICU stays

Surgeries

Diagnostics

Specialist consultations

2. Limited Insurance Coverage

Nearly 65% of Indians either:

Do not have health insurance

OR

Have insufficient coverage (<₹3 lakh)

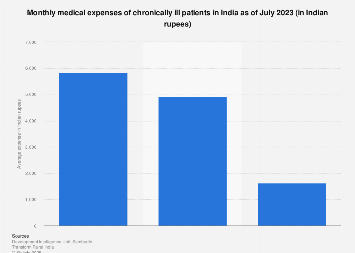

3. Expensive Emergency & Critical Care

Cardiac, cancer, and accident treatments often cost ₹2–15 lakh, far beyond average savings.

4. Rising Cost of Medicines & Diagnostics

Pharmacy prices and lab tests have become 20–40% more expensive.

How Rising Healthcare Costs Are Fueling Emergency Loan Applications

Banks and NBFCs report major growth in medical-related loan demand. Here’s why:

1. Insurance Does Not Cover Full Treatment

Co-payments, room rent limits, exclusions, and non-payable items push patients to take loans.

2. Need for Instant Funds

Medical emergencies demand immediate liquidity, making instant loans the fastest solution.

3. Cashless Claim Rejections

If hospitals deny cashless treatment due to:

policy mismatch

pre-existing conditions

insurer-hospital disputes

Patients have no choice but to borrow.

4. Rising Critical Illness Cases

Lifestyle diseases (diabetes, heart issues) have increased critical care admissions.

What Medical Expenses Are Most Commonly Financed by Loans?

| Medical Need | % Borrowers |

|---|---|

| Emergency surgeries | 29% |

| Accident-related bills | 22% |

| ICU & hospitalization | 18% |

| Medicines & diagnostics | 14% |

| Pregnancy complications | 10% |

| Chronic disease care | 7% |

Emergency Personal Loan vs Medical Loan — Which Is Better?

| Feature | Emergency Personal Loan | Medical Loan |

|---|---|---|

| Approval | Instant | 2–24 hours |

| Maximum Amount | ₹10 lakh | ₹25–40 lakh |

| Interest Rate | 12–24% | 10–18% |

| Processing Fee | ₹1,999–₹5,999 | Medium |

| Insurance Link | Not required | May require medical docs |

| Ideal For | Small–medium emergencies | Major surgeries |

Why Digital Emergency Loans Are Growing Fast

1. 5–15 Minute Approval

Loan apps and NBFCs give instant response.

2. Zero Collateral Required

Unlike gold loans, no asset pledge needed.

3. Fast Disbursal to Hospital

Funds often transferred directly to hospital accounts.

4. 24/7 Availability

Emergency loans can be taken late at night or on holidays.

Challenges Borrowers Face During Medical Emergencies

| Challenge | Why It Happens |

|---|---|

| High interest rates | Due to urgency & unsecured nature |

| Hidden fees | Loan apps add charges |

| Emotional decisions | Borrowers panic & over-borrow |

| Repayment stress | High medical bills + loan EMIs |

Expert Commentary

Medical inflation is now one of India’s biggest financial stress points. Even middle-class families struggle to manage sudden hospitalization costs.

Emergency personal loans bridge the gap when insurance fails or when treatment cannot wait.

However, borrowers must stay cautious — panic-based borrowing often leads to over-commitment and long-term EMI burden.

Planning medical coverage and maintaining emergency savings is crucial.

Key Takeaways

Rising medical costs are pushing more Indians to take emergency personal loans

Insurance coverage is insufficient for most families

Digital loans offer instant cash for hospitalization

Borrowers must compare APR & fees before choosing loan apps

Emergency loans should be used only when necessary

Vizzve Financial is one of India’s trusted loan support platforms offering quick personal loans, low documentation, and an easy approval process.

👉 Apply instantly at www.vizzve.com

FAQs

1. Why are medical costs rising in India?

Due to inflation, expensive private healthcare, and costly diagnostics.

2. Why do people take emergency personal loans for medical bills?

For instant cash during hospitalization.

3. Are emergency loans faster than medical loans?

Yes, personal loans are instant.

4. What is the interest rate for emergency medical loans?

Typically 12–24%.

5. Does insurance cover all medical costs?

No, many expenses are excluded.

6. Can I get a loan if cashless claim is denied?

Yes, emergency loans are common in such cases.

7. Are NBFCs safe for emergency loans?

Yes, if RBI regulated.

8. Are loan apps safe?

Only regulated apps are safe.

9. What is the loan amount for emergency loans?

₹10,000–₹10 lakh depending on profile.

10. How fast can loans be disbursed?

5 minutes–4 hours.

11. Do emergency loans help pay hospital directly?

Yes, some lenders pay hospitals directly.

12. Can I take EMI for surgery?

Yes, some apps offer medical EMIs.

13. Does emergency borrowing hurt credit score?

Not if repaid on time.

14. Is UPI credit used for medical payments?

Yes, for small medical expenses.

15. What is the biggest risk of emergency loans?

High EMIs after recovery.

Published on : 8th December

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed