How the Banking Sector Works in India: A Detailed Overview

The banking sector plays a crucial role in the financial system of any country, and India is no exception. It facilitates the flow of money, offers financial products, and contributes significantly to economic growth. Here's a comprehensive breakdown of how the banking sector works in India:

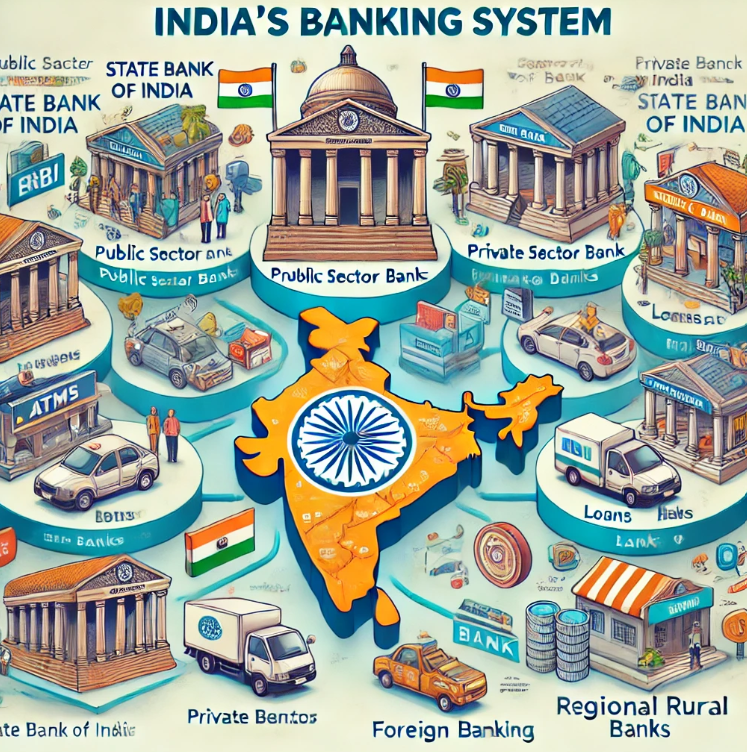

1. Structure of the Indian Banking System

India's banking system consists of two primary segments:

- Public Sector Banks (PSBs): These banks are owned by the government and form the backbone of the banking system in India. Examples include State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda.

- Private Sector Banks: These banks are privately owned, either by individuals or private institutions. Examples include ICICI Bank, HDFC Bank, and Axis Bank.

- Foreign Banks: International banks operating in India, like Citibank and HSBC, are considered foreign banks.

- Cooperative Banks: These banks operate on a smaller, local scale and often focus on specific communities, offering more personalized services.

- Regional Rural Banks (RRBs): These banks were created to focus on the rural economy, providing financial inclusion in less-developed areas.

2. Role of the Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) is the central bank of the country and plays a pivotal role in the functioning of the banking sector. The RBI's key functions include:

- Monetary Policy: The RBI controls inflation, interest rates, and overall liquidity in the economy through tools such as the repo rate and reverse repo rate.

- Regulation and Supervision: It regulates and supervises the banking sector, ensuring that banks adhere to financial and operational standards.

- Currency Issuance: The RBI is responsible for issuing and managing the Indian currency (INR).

- Developmental Role: It works to promote financial inclusion and supports initiatives that drive the growth of banking in rural and underserved areas.

3. Banking Products and Services

Banks offer a wide range of products and services to cater to individuals, businesses, and government needs. Some common offerings include:

- Deposits:

- 1.Savings Accounts: A basic bank account that earns interest on deposited funds.

- 2.Fixed Deposits (FDs): A type of term deposit where customers lock in their money for a specific period at a fixed interest rate.

- 3.Recurring Deposits (RDs): Similar to FDs, but in this case, customers make monthly contributions instead of lump-sum investments.

- Loans and Advances:

- 1.Personal Loans: Unsecured loans offered to individuals for personal use.

- 2.Home Loans: Loans provided to purchase or construct homes.

- 3.Business Loans: Loans aimed at helping businesses expand or meet operational costs.

- 4.Car Loans, Education Loans, etc.

- Other Services:

- 1.ATM/ Debit and Credit Cards: Used for withdrawals, payments, and financial transactions.

- 2.Online Banking: Internet and mobile banking platforms to enable customers to manage their finances remotely.

- 3.Insurance: Many banks also provide insurance products (life and general insurance) through tie-ups with insurance companies.

4. How Banks Make Money

Banks make money in several ways, the most common being:

- 1.Interest Spread: Banks lend money to borrowers at a higher interest rate than what they pay depositors. This difference, or spread, is a key source of profit.

- 2.Fees and Charges: Banks charge fees for account maintenance, ATM withdrawals, processing of loans, and various other services.

- 3.Investments: Banks also invest in government bonds, securities, and other financial products to earn returns.

5. Banking Transactions: The Process

Here’s an overview of how basic banking transactions work:

1.Deposits: Customers deposit money into their accounts (either savings, current, or FD accounts). The bank then uses this deposited money to fund loans and investments.

2.Loans: When customers need loans, banks assess their creditworthiness (through credit scores, income verification, etc.). If approved, the loan is provided, and the bank charges interest on the loan amount.

3.Loan Repayment: Loan repayments are made by the borrower, typically via EMIs (Equated Monthly Installments). A portion of each EMI goes toward the principal amount, while the rest is paid as interest to the bank.

6. Role of Technology in Banking

Modern banking is increasingly dependent on technology. Here’s how:

- Digital Banking: Most banks offer online banking platforms where customers can access account details, transfer funds, and pay bills remotely.

- Mobile Banking: Mobile apps allow customers to perform banking transactions via their smartphones.

- ATMs: Automated Teller Machines (ATMs) provide 24/7 access to cash withdrawals, balance inquiries, and even some banking transactions like bill payments.

- Fintech Innovations: The rise of fintech companies has led to innovations like peer-to-peer lending, digital wallets, and instant loan disbursement, further enhancing the banking experience.

7. Future of Banking in India

With rapid technological advancements and the government's push for financial inclusion, the banking sector in India is evolving. Future trends include:

- 1.Increased Digitalization: With mobile and internet banking becoming more prevalent, banks are expected to offer a wider range of digital services.

- 2.Artificial Intelligence and Blockchain: AI will play a major role in automating processes, detecting fraud, and improving customer service. Blockchain technology may also be utilized to increase transparency and security in transactions.

- 3.Focus on Financial Inclusion: The government and banks are working together to provide banking services to rural and underserved areas, ensuring that more people have access to financial products.

Conclusion

The banking sector in India is a highly dynamic and evolving industry, with banks playing a crucial role in facilitating economic growth, financial inclusion, and technological advancement. With the continued efforts of the government and financial institutions, India's banking sector is well-positioned to meet the needs of an ever-changing global economy.

Most Searched Banks for Home and Personal Loans in India: Compare with Vizzve?

Looking for the best home and personal loan options from the most trusted banks in India? Here's a list of the most searched banks that offer competitive rates and flexible terms. Use Vizzve to compare loan products from these leading institutions and secure the best deal:

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

- Kotak Mahindra Bank

- Bajaj Finserv

- Bank of Baroda

- Punjab National Bank (PNB)

- IDFC FIRST Bank

- IndusInd Bank

- Yes Bank

- Union Bank of India

- Canara Bank

- LIC Housing Finance

- Tata Capital

Why Choose Vizzve?

With Vizzve, you can effortlessly compare home and personal loan options from these top banks, ensuring you get the best interest rates, minimal documentation, and quick approvals. Vizzve provides you with a seamless experience to secure the perfect loan for your needs.

- 1.99% Approval Rate: Enjoy higher chances of loan approval with Vizzve’s streamlined application process.

- 2.Competitive Offers: Get access to exclusive offers and special discounts from leading banks.

- 3.Quick and Easy Comparison: Compare multiple loan products in just a few clicks and make an informed decision.

Compare and Get Offers Now!

Start your loan journey today with Vizzve to make informed financial decisions and unlock the best deals with top banks. Try Vizzve now for a 99% approval rate and experience a hassle-free loan process!

Visit Now: www.vizzve.com

Call: 8449844958