If you own a house and rent it out, the rental income must be reported under “Income from House Property” in your Income Tax Return (ITR). The calculation is not just about rent received; it involves deductions, municipal taxes, and certain allowances. Here’s a step-by-step guide on how to calculate income from a let-out house property in 2025.

1. Steps to Calculate Income from Let-Out Property

Step 1: Determine Gross Annual Value (GAV)

The higher of:

Actual rent received/receivable, OR

Expected rent (based on municipal valuation or fair rent).

Step 2: Deduct Municipal Taxes Paid

Municipal taxes actually paid by the owner are deducted from GAV.

Step 3: Arrive at Net Annual Value (NAV)

NAV=GAV–MunicipalTaxesNAV = GAV – Municipal TaxesNAV=GAV–MunicipalTaxes

Step 4: Apply Standard Deduction (30% of NAV)

As per Section 24(a), a flat 30% deduction is allowed on NAV (no proof required).

Step 5: Deduct Interest on Home Loan (if any)

Under Section 24(b), interest paid on home loan for let-out property is fully deductible (no ₹2 lakh cap, unlike self-occupied property).

Step 6: Arrive at Income from House Property

Income=NAV–StandardDeduction–InterestonHomeLoanIncome = NAV – Standard Deduction – Interest on Home LoanIncome=NAV–StandardDeduction–InterestonHomeLoan

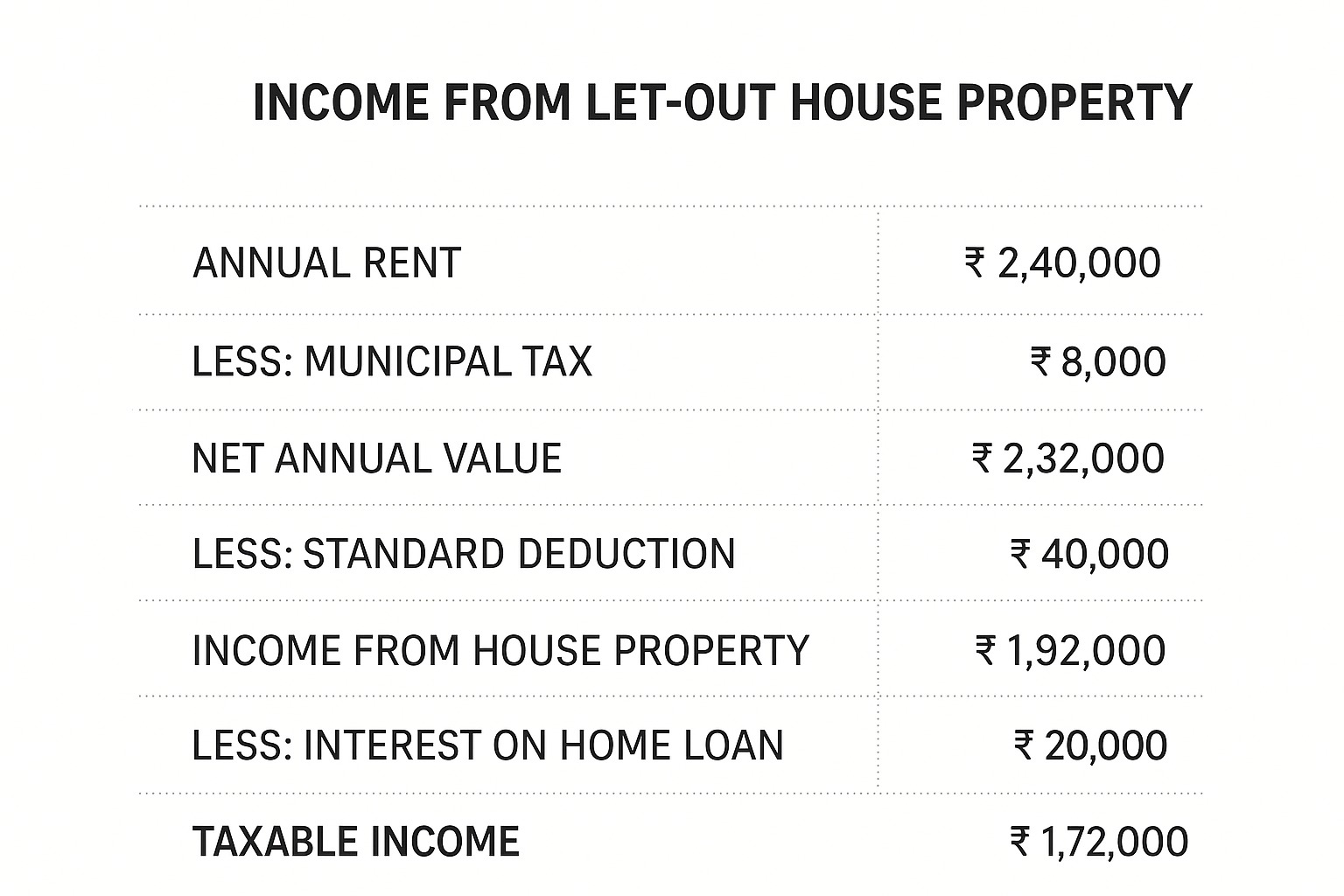

2. Example Calculation

Suppose you rented out a flat in 2025 with these details:

Rent received: ₹30,000/month = ₹3,60,000/year

Expected rent: ₹3,20,000/year

Municipal taxes paid: ₹20,000

Interest on housing loan: ₹1,50,000

Calculation:

GAV = Higher of (₹3,60,000, ₹3,20,000) = ₹3,60,000

Less: Municipal Taxes = ₹20,000

NAV = ₹3,40,000

Less: Standard Deduction (30% of ₹3,40,000) = ₹1,02,000

Less: Interest on Loan = ₹1,50,000

Taxable Income from House Property = ₹88,000

3. Key Deductions Available

Standard Deduction: 30% of NAV.

Interest on Loan: Full deduction for let-out property.

Municipal Taxes: Allowed only if paid during the year.

4. Important Points to Remember

Even if rent is not actually received (but is receivable), it is taxable.

If the property is vacant for some time, vacancy allowance can be claimed.

Co-owners can split income based on ownership share.

Conclusion:

Calculating income from a let-out house property requires understanding of GAV, NAV, deductions, and interest benefits. By using the right method, you can reduce taxable income while ensuring compliance with the Income Tax Act.

FAQ :

Q1: What if I have two properties, both let-out?

Each property is calculated separately under the same method.

Q2: Is there a cap on interest deduction for let-out property?

No, the full interest amount is deductible (unlike self-occupied property).

Q3: Can I claim municipal taxes if unpaid?

No, only actually paid municipal taxes are deductible.

Q4: What if the tenant doesn’t pay rent?

Unrealized rent can be excluded if genuine conditions are met.

Q5: Is TDS applicable on rent income?

Yes, if rent exceeds ₹50,000/month, tenants must deduct TDS @5% under Section 194-IB.

Published on : 4th September

Published by : SMITA

www.vizzve.com || www.vizzveservices.com

Follow us on social media: Facebook || Linkedin || Instagram

🛡 Powered by Vizzve Financial

RBI-Registered Loan Partner | 10 Lakh+ Customers | ₹600 Cr+ Disbursed

https://play.google.com/store/apps/details?id=com.vizzve_micro_seva&pcampaignid=web_share